INTRODUCTION

When referring to the term Multi-Agent Systems (MAS), one of the fundamental problems is the interaction between the agents to reach their objectives in the fastest and most efficient way. This is why, when implementing an MAS with negotiated communication and cooperation, one of the main aspects to be taken into account is the selection of a good Trading mechanism, which makes it possible to carry out the interactions between the agents and their cooperation. This mechanism would be the basis for the establishment of concepts such as protocol and Trading Strategy Multi-Agent (ZHANG,2003).

Electronic Trading protocols are mechanisms managed in the theory of Multi-Agent Systems (QUINTERO,1998). They represent the patterns or set of rules that model possible interactions in the system (ODELL,2001). They generally resemble the way humans trade in a competitive market, which makes it possible to use them in the representation and implementation of electronic product or service markets, both in simulated environments and in real environments through the Internet, also known as Electronic Trading E-Business (FIPA,2005).

The quality of the electronic trading process in a Multi-Agent environment is an important element in the benefits obtained by both sellers and buyers. This investigation is aimed at improving the electronic auction process through the use of electronic trading protocols in multi-agent systems. Scientific research methods were used, such as: the systemic method and the empirical method, documentary analysis. The fundamental result of this paper is the determination of the relevance of the use of Multi-Agent Protocols of Electronic Trading through the evaluation of a set of quality metrics, associated to the quality criteria: Rapidness, Efficiency, Scalability and Completeness.

As part of the structure of this paper, the materials and methods used were considered. Specifically, aspects related to electronic trading, electronic trading protocols and quality metrics were evaluated briefly. Likewise, the metrics identified through prototypes were evaluated. In addition, as part of the analysis of the results obtained in the discussion section, important considerations were obtained regarding the performance of the electronic trading protocols. Finally, the conclusions, future work and the main limitations of the research carried out were described.

MATERIALS AND METHODS

In this paper, the following scientific research methods were used:

Theoretical methods

The historical-logical and the dialectic method for the critical study of previous works and to use them as a point of reference and comparison with the results achieved.

Systemic method for analyzing the improvement of the electronic auction process through the use of electronic trading protocols in Multi-Agent Systems.

Analytical-synthetic method, by decomposing the research problem into elements, deepening its study and then synthesizing them in the proposed solution.

Empirical methods

The experimental method, to see the usefulness of the results in the evaluation of the set of Rapidness, Efficiency, Scalability and Completeness metrics.

Documentary analysis: In the review of specialized literature, both academic and business, to obtain the necessary information to carry out the research process.

Comparative analysis: To detect similarities, differences and insufficiencies in the proposed Rapidity, Efficiency, Scalability and Completeness metrics.

The materials used in the research are described below.

Electronic Trading

Electronic Trading includes all interactions between buyers and sellers in all stages: search, purchase and delivery. There are now innovative ways to implement Business-to-Consumer (B2C) with the use of software agents. These types of agents perform on-line comparisons of products more efficiently than those conventionally performed by humans. In this way, they favor competition among the producing companies, while reducing the time and cost of search by the buyers (JAISWAL,2004).

The agents mentioned previously facilitate the connection between potential buyers and sellers. They perform their operations in the electronic market, platform where Buyer and Seller agents can interact with the purpose of buying or selling products at the best possible price. To complete the transaction, the agents, negotiate an acceptable deal for both and then execute the exchange of goods. They use a symbolic language of Trading, through an electronic whiteboard. Trading language includes primitives such as: bidding, buying, selling, dealing, dating, among others (JAISWAL,2004).

Multi-Agent Systems and Distributed Artificial Intelligence

Distributed Artificial Intelligence (DAI) is considered as a subfield of artificial intelligence, focusing on the collective behaviors resulting from cooperation between various entities called agents (OVALLE & MORENO,2007).

There is no agreement on the definition of the term agent, informally, it can be said that a software agent is a computer system capable of performing autonomous actions to achieve its objectives in a given environment (WURMAN,1998). Another conceptualization determines that the software agent is a computer program that acts as an assistant of the user learning gradually of the interaction with the same, and that with the passage of time, is able to anticipate to their needs (JAISWAL,2004). In general, there are many definitions in this respect, one of the most widely used is the one provided by FIPA (Foundation for Intelligent Physical Agents) defined as follows (WURMAN,1998):

"An agent is a software entity encapsulated with its own state, conduct, thread of control and the ability to interact and communicate with other entities (people, other agents or legacy systems)."

Agents acquire a new dimension when grouped together, forming complex systems, which are called MULTI-AGENT SYSTEMS (ANUMBA,2003). A Multi Agent System or Agent Based System (ABS) is characterized by being a system in which there are a number of autonomous agents that inhabit (or share) a common environment and that are seen in the need to interact due to a set of reasons.

Electronic Trading Protocols

In order to carry out the processes of communication and cooperation between the agents that integrate an MAS, the mechanisms called Multi-Agent Trading Protocols are necessary. They aim to simulate among software agents, processes of acquisition of products or goods as they would be done in a mechanism of real Trading between a group of people. They consider the types of participants allowed, states of Trading, events that lead to the transition of states, and valid actions of participants in particular states (ODELL,2001).

Two of the Trading protocols most known and defined by FIPA (Foundation for Intelligent Physical Agents) are (ARANGO DE BENITO,2009):

FIPA English-Auction: It is an auction method to the rise. In this auction the bidders (buyers) announce how much they are willing to pay for a product, sending, every time, a more attractive price offer, until arriving at a maximum price (maximum limit) that has been established from the beginning and that only The agent (buyer) knows. Once the period of exposure of the auction has ended, the asset is assigned to the one who offered the highest value (CHURCHES,1998).

FIPA Dutch-Auction: This is a low auction method. In this auction the seller (who originates the auction), starts with a high price, having in secret a minimum price (reserve price or minimum cap) for the sale of the product. The initial offer is progressively diminished until a buyer accepts it, at that same moment the Trading is finished (CHURCHES,1998).

Quality Metrics for Electronic Trading Protocols

As part of the research carried out, the analysis of some quality criteria was carried out, allowing the comparison of the two Trading protocols mentioned in the previous section. Four factors were chosen for the definition of quality metrics, which are specified below (BEN-AMEUR,2002):

Rapidness

Rapidness (Ra) is defined as the time it takes for a protocol to reach the end of the Trading. In order to arrive at a formula for the Rapidness of a protocol, certain constant conditions must be taken into account, in the particular case of this work, all the platform and number of agents were taken as constants for the measurement (REAIDYA,2003).

Under these conditions the Rapidness of a protocol is defined as (REAIDYA,2003):

where

#c |

is the number of conversations made during the Trading process. It is carried out by MAS agents (REAIDYA,2003) |

Thrown values must be standardized for understandable results. For this standardization process, two factors are taken into account:

Rmax: Ideal Rapidness expected to achieve Trading. This value will be given with respect to the experimentation performed and will be the largest number of conversations obtained in a successful run (REAIDYA,2003).

Rmin: Lower Rapidness, that is, the least number of conversations that occurred in a race (REAIDYA,2003).

The final equation of the normalized velocity equals (REAIDYA,2003):

Range (Ra): The Rapidness is defined in the range ENT#091;0,1ENT#093;. It represents approximately the number of conversations that were carried out in a second within the Trading process (REAIDYA,2003).

Efficiency

The Efficiency (Ef) metric of a Multi-Agent Trading protocol is defined as the number between ENT#091;0,1ENT#093;, which indicates the value of the Efficiency of the profits obtained by the agents, both sellers and buyers, during The Trading process. 0 is the lowest value of profit or gain and 1 is the maximum value (OVALLE & MORENO,2007).

The formulas to represent Efficiency are:

For sellers

For buyers:

Where:

Pn: It is the real trading price, in which it was possible to sell the good involved (OVALLE & MORENO,2007).

Pr: It is the reserve price or cap fixed by an agent for the object being negotiated. In the case of a seller Prv is the minimum price cap for the sale of the good and in the case of a buyer Prc will be the maximum price offerable for the purchase of the product.

Pi: Is the initial offerable base price, by a buyer. It is important to note that depending on the trading protocol used this initial price varies, so for a British Auction this price is low while in the Dutch Auction this price is very high (OVALLE & MORENO,2007).

Range: The Efficiency value is within the range ENT#091;0, 1ENT#093;.

Completeness

The Completeness (Co) of a protocol is the ability to find a solution to the process of electronic Trading. It must be verified whether the good or product that was wanted in the Trading was obtained or the expected merchandise was sold after the transaction finished. For the measurement of this factor a maximum auction time should be set and it must be verified whether the Trading was completed or not (PASTRANA,2006).

Range: Take only two values (PASTRANA,2006):

1: If the complete Trading process was completed within the maximum time for the auction.

0: If the Trading process was not carried out in the set time.

Scalability

The Scalability metric allows us to determine how MAS performance changes when its size increases or decreases, taking into account the number of agents. The measurement of this criterion is done in each of the protocols, increasing the number of agents within the MAS and taking into account in each case, Completeness, Rapidness and Effectiveness. If these values degrade disproportionately as the size of the system increases, then, it can be said that the protocol has poor Scalability (PASTRANA,2006).

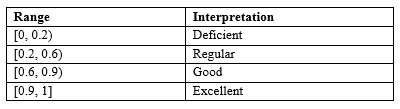

Range: The range for the Scalability metric is in the range ENT#091;0, 1ENT#093;. Four linguistic values will be used to identify the performance of the MAS, with respect to this metric, in a specific protocol (PASTRANA,2006). The linguistic values are set out in Table 1.

Evaluation of Quality Metrics for Multi-Agent Protocols of Electronic Trading through a prototype

Identification and Description of Actors

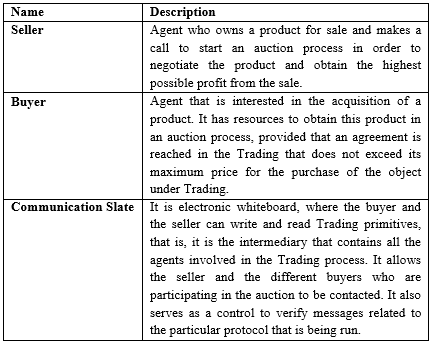

Three fundamental actors are involved in the electronic Trading process, which are listed in Table 2.

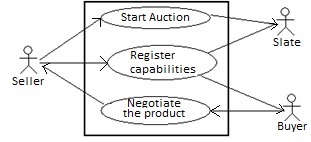

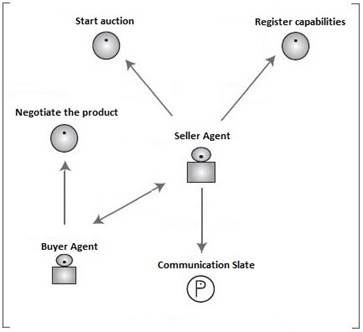

Identification and Description of Use Cases

There are three use cases that make up the auction process of a product. They are considered in the prototypes implemented as basis for the identification of agents and their interaction context (See Figure 1, Figure 2) (ZHANG,2003).

Implementation of the Prototype

The results of the prototypes taken into account to calculate the value of the metrics belong to a master's thesis (Example 1) and a paper from the National University of Colombia (Example 2). Both simulate a process of English Auction and another one for the Dutch Auction. The prototypes were implemented with the JADE (Java Agent Development Framework) platform, which provides development and execution environments for the realization and maintenance of MAS (BEER,1999). The development environment consists of a series of libraries in Java that separate the software agent from the platform on which it is to be executed. The execution environment enables agents to be activated and facilitate communication between them. In addition, JADE complies with FIPA specifications for the interoperability of MAS platforms at the architecture and message level (FIPA ACL) Foundation for Intelligent Physical Agents Agent Communication Language (BEER,1999).

Evaluation of Quality Metrics

As part of the evaluation process, the metrics mentioned above were calculated in each of the implemented prototypes. Some of the results are shown below.

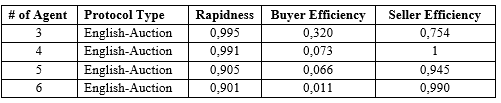

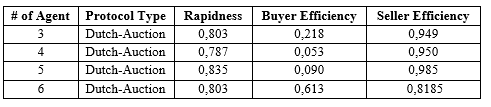

It is important to note that Scalability is measured by the progressive increase in the number of agents, in order to determine the behavior of the system in terms of Rapidness and Efficiency. For the validation of the quality metrics discussed above, a maximum number of six agents was considered, since simulation was required for that quantity. Table 3 shows some results from the experiment (FIPA,2005).

Given the obtained values it is possible to extract the consolidated ones, taking as base the run of the MAS with a MASller number of agents, in this case three agents. The maximum reduction of Rapidness and Efficiency of both the buyer and the seller was measured. Subsequently a numerical value was taken for the Scalability of the two protocols, with the purpose of performing a linguistic interpretation of the results obtained (FIPA,2005). Table 3, Table 4 and Table 5 correspond to the prototype of Example 1. While Table 6, Table 7 and Table 8 are associated with the prototype of Example 2.

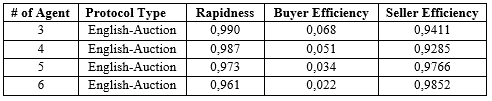

Table 3 Results from the measurement of the parameters Rapidness and Efficiency given an increase in the agents of the MAS. English-Auction Example 1

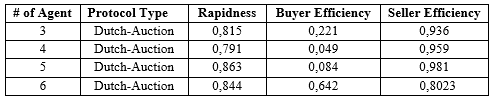

Table 4 Results from the measurement of the parameters Rapidness and Efficiency given an increase in the agents of the MAS. Dutch-Auction Example 1

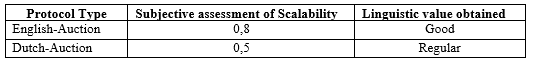

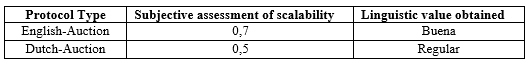

Table 5 summarizes the Scalability results for the two protocols implemented after analyzing the data shown in Table 3 and Table 4.

Table 6 Results from the measurement of the parameters Rapidness and Efficiency given an increase in the MAS agents. English-Auction Example2

Table 7 Results from the measurement of the parameters Rapidness and Efficiency given an increase in the MAS agents. Dutch-Auction Example2

Table 8 summarizes the Scalability results for the two protocols implemented after analyzing the data shown in Table 6 and Table 7.

In the simple prototypes with which the tests were run all Trading processes were carried out completely, the value thrown for the two prototypes was 1 (FIPA,2005).

DISCUSSION

As a result of the application and evaluation of the quality metrics specified to the Multi-Agent protocols of electronic Trading, important considerations regarding the performance of the same were obtained. These considerations constitute a useful basis for the selection of any of them if it is desired to carry out the electronic auction of tangible products.

Taking into account the results obtained in the execution and comparison of the electronic Trading protocols implemented, the following can be concluded in terms of Efficiency and Rapidness:

For the definition of the Efficiency metric, it is necessary to separate the measure under two points of view in an auction process, the seller's approach and that of the buyers (CHURCHES,1998).

The Rapidness evaluation process on the implemented prototypes offered evidence that the English Auction protocol has a high degree of Rapidness with respect to the Dutch (CHURCHES,1998).

Comparing the English and Dutch Auctions, it is possible to observe that the Rapidness of the English is better than the Dutch, because as the price of the product increases, in the English Auction, there is less permanence of active agents. This is due to the fact that agents are retiring when the Trading has reached levels higher than their maximum price. Therefore, there is less message exchange, which implies greater Rapidness in the process. The Dutch take longer, because all the agents remain active in the Trading until the process is completed (BARTOLINI,2004).

The Scalability of English Auction is better than Dutch Auction, because the number of agents increases as the price increases, the permanence of agents decreases and therefore the exchange of messages is less, which implies greater Rapidness in the process. The Dutch Auction is very degraded, because all the agents remain active in the Trading until the process is finished, which does not happen in the English, where the agents are retiring when not being able to offer a price superior to the limit established for them (WURMAN,1998).

The Scalability of the Dutch Auction is valued as Regular because there is more exchange of messages between the buying agents and the agent slate. In addition, a greater permanence of buying agents is observed in the Trading process and the delay of the same is increased to obtain the sale price, since they wish to achieve the greatest utility (WURMAN,1998).

In terms of Completeness, the English and Dutch Auction protocols, under the appropriate conditions, implemented in this work, were complete (WURMAN,1998).

CONCLUSIONS

Multi-Agent trading systems are a very effective alternative to take into account in those environments in which it is necessary to choose a trading algorithm or strategy, depending on certain circumstances.

In general, the Dutch auction is more beneficial to sellers than the English one, because it registers the highest profits. This is due to the fact that the protocol starts with a high price and decides quickly who delivers the product. On the other hand, the English auction is more beneficial for buyers than for sellers, because the protocol starts with a low price and is slowly rising according to buyers' offers. This allows them to "control" the trading process to obtain better profits (BARTOLINI, 2004)

In terms of Rapidness, the English auction is better than the Dutch auction, because there is less message exchange. The Scalability of the English auction is better than the Dutch auction, because the number of agents increases as the price increases. Likewise, both protocols, English and Dutch auction were completed.

The metrics described in this paper are applicable to any electronic trading environment. In general, the evaluation of the proposed metrics was successful, since it allowed determining which protocol is most beneficial when it comes to electronically auctioning tangible products.

Important Limitations of the experimentation carried out and future work

Make more significant variations in the number of agents to re-measure the behavior of the relevant parameters, in order to corroborate if these protocols have a good scalability.

Include the use of other quality criteria and develop new metrics to characterize Multi-Agent Trading protocols.

In the measurement of the Scalability metric, establish a not so subjective form of evaluation, in which a greater number of parameters associated to the different protocols are considered. Definition of a way to relate the parameters, so that more objective numerical values can be taken.

In the implementation of prototypes, the possibility of conducting successive auctions with product groups is proposed, to simulate the behavior of much more realistic auctions. This allows the Trading of several products at the same time, with the same protocol, in order to analyze new behaviors in the current protocols or in new protocols implemented.

With respect to the Multi-Agent Trading protocols, it is proposed to expand the number of those used in the research. Among the mechanisms to be considered would be the so-called "Double Auctions" (PASTRANA,2006), which allow auction processes between multiple buyers and multiple sellers to negotiate a product.

As future work It is proposed the incorporation of the quality metrics as part of the interoperability indicators to be defined in the project: Interoperability scheme, enabling basis for the computerization of society.

Validate the proposal of interoperability indicators in a specific environment that is integrated as part of the interoperability platform created (aicros enterprise).