Introduction

In a globalised world, where the use of technology and the internet is becoming more and more established in economic processes to make them more agile and immediate, mobile banking is becoming stronger day by day, due to the fact that users use less traditional banking to make use of the digital services offered by mobile banking given its immediacy and speed (Geebren et al., 2021); for this reason, it is necessary to investigate and characterise the current panorama on the perception of the use of mobile banking by Colombian consumers, identifying and recognising benefits and opportunities for improvement in organisations belonging to this sector.

According to Zhang et al. (2018) the term "e-banking" is defined as the banking service provided by authorised institutions, through electronic devices operated under the direct management of the bank; hence the importance of providing customers with an agile and careful service, as well as recommending a banking product that fits the needs of the market. The development of technology influences banking products, improvements that have impacted the marketing strategy of each organisation, making banking products available 24 hours a day.

Due to digitalisation, customer expectations have been increasing, causing banks to develop and present innovative products and services to ensure customer satisfaction; as such, technology-based products provide the opportunity to have significant cost advantages, increase profitability and arouse lower risk than traditional banking products. The demand for web-based banking products increased due to decreasing accessibility costs, competitive market structure and the desire to obtain banking products quickly and efficiently. The use of technology means that banking product offerings are just a few clicks away and there is also a great deal of price competition.

In developing economies, financial products are growing faster, hand in hand with rising incomes and improved financial literacy (López-Rodríguez & López-Ordoñez, 2022). Geebren et al. (2021) claim that banks that offer classic banking products (loans, credit cards) and other banking products (insurance, capitalisation bonds) have a higher market power than banks that offer only classic products. Also, some of the banking services and products that a customer can access from the web include mobile banking, bill payment, loan applications and balance monitoring.

Data from the Superintendencia Financiera (2021) show the growing and constant increase in the use of products and services offered by mobile banking in Colombia, as digital transactions accounted for 72% of bank operations and, likewise, digital media accounted for 69% of transactions made in the first half of the year, which shows that more and more users are leaving traditional banking aside to start using the digital services offered by online banking.

Considering the above, this study aims to systematically answer the following questions: What is the evolutionary development of the production of scientific papers associated with mobile banking to date? Who are the most representative authors in mobile banking research globally? Which are the papers that have achieved the greatest impact according to their number of citations? Which journals have the highest production around mobile banking? Which countries lead the scientific production, citation levels and cooperation on the topic of mobile banking? What is the emerging conceptual structure of the scientific production associated with mobile banking? What is the current outlook on the perception of the use of mobile banking by Colombian consumers? The answers to the above questions will allow us to establish lines of research that will benefit the generation of scientific knowledge associated with mobile banking and financial management in the banking sector.

Materials and methods

Development of the bibliometric study

For the development of the bibliometric analysis, the Scopus database was used, which consolidates summaries and citations of documents with high scientific recognition in the different areas and disciplines of knowledge, guaranteed from the rigidity in the selection, review and evaluation of academic documents. It should be noted that bibliometric exercises related to mobile banking have been developed from this database.

The following (TITLE-ABS-KEY ("mobile banking" ) AND TITLE-ABS-KEY ( consumer ) OR TITLE-ABS-KEY ( markets ) ) AND ( EXCLUDE ( DOCTYPE , "ed" ) OR EXCLUDE ( DOCTYPE , "sh" ) ) were used as a search strategy in this database. The period analysed was from 2000 to 2022, due to the consolidation of mobile banking since the beginning of the 21st century.

The different types of documents published were included, except for editorial notes and shorts surveys, thus generating a total of 504 documents. All areas of knowledge are included in the study, with the aim of recognising the theoretical and empirical development of mobile banking in different topics. The quantitative analysis of bibliometrics was carried out in January 2023 using the tools Bibliometrix (The R Project for Statistical Computing) (Aria & Cuccurullo, 2017) and VOSviewer, software that works based on an interface that provides intelligent graphic solutions in scientific research.

Systematic literature review

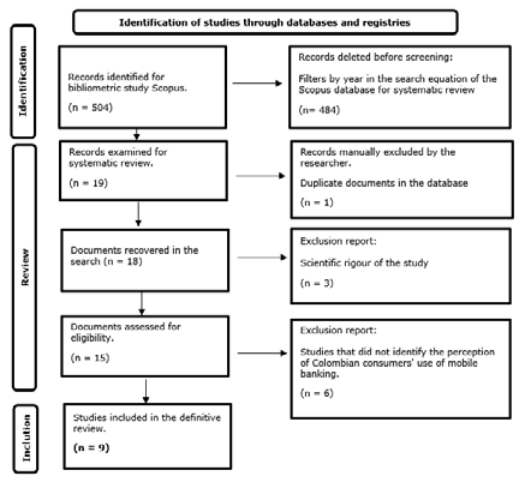

The methodological procedure of the systematic review is based on the PRISMA protocol (Preferred Reporting Items for Systematic reviews and Meta-Analyses). As detailed in Figure 1. This protocol helps to ensure that the systematic review conducted is useful for users and helps the systematic review to capture all the recommended information. The papers selected for the systematic review were obtained in January 2023 from the following Scopus search strategy: (TITLE-ABS-KEY (use AND of AND mobile AND banking ) OR TITLE-ABS-KEY ( banking AND mobile ) AND TITLE-ABS-KEY ( Colombia ) ). Likewise, this review was complemented with a manual search in the Scholar Google database, which finally allowed us to have 11 documents for the development of the systematic review.

The inclusion criteria considered were the following: documents published between 2000 and 2022, and studies that highlighted the perception of the use of mobile banking by Colombian consumers. Exclusion criteria included: duplicate papers in the database, scientific rigor of the study, and studies that did not identify the perception of mobile banking use by Colombian consumers.

Results

Analysis of bibliometric indicators

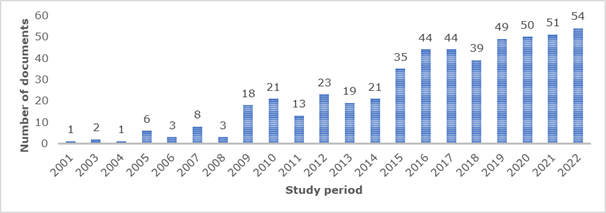

In the bibliometric analysis, 504 documents were recorded for the period from 2000 to 2022. A total of 361 scientific articles, 109 conference proceedings, 4 books and 30 book chapters were identified. A total of 1019 authors were registered in the study, of which 67 produced their publications individually and 952 published collaboratively, obtaining a document per author index of 0.463, an average of 2.16 authors per document, a co-authors per document index of 2.58, and an overall collaboration index of 2.46. It is also relevant to note that the average number of citations per document since its publication is 23.76 and the annual average number of citations per document is 3,102.

Figure 2 shows the number of documents cited in the period studied, which shows an increasing trend in terms of scientific production about perception regarding the use of mobile banking. From 2009 onwards, there was a significant increase, from 3 articles in 2008 to 18 in 2009, and maintaining an upward trend, there was an increase from 21 documents in 2014 to 35 in 2015, and the most significant year during the period was 2022, with 54 documents.

Most representative authors in bibliometrics

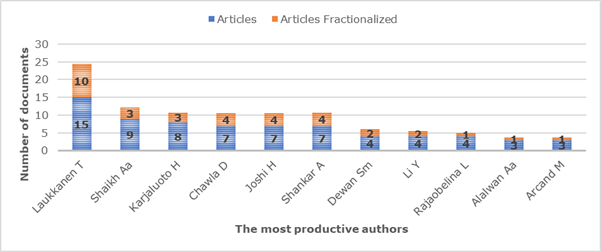

For this research, it is essential to identify the most representative authors who, at a global level, provide knowledge on the perception of the use of mobile banking. In the first instance, there is Tommi Laukkanen, who is characterised by delving into the subject of consumer behaviour, bank marketing and the internet and mobile banking; followed by Aijaz A. Shaikh, who writes about mobile financial services, the collaborative economy and digital consumer behaviour; and finally, Heikki Karjaluoto, a professor of marketing who focuses on analysing this discipline in the online banking scenario. Based on the above, figure 3 shows the most productive authors in terms of the number of publications.

Lotka's law is a description that explains the quantitative relationship that exists between authors and articles on a particular subject in a certain period; this bibliometric law relates authors according to their productivity and has been accepted and accepted by countless data collections. Based on the above, table 1 shows that there are 908 authors with only one published paper, 68 authors with two published papers, 33 authors with three papers, 3 authors with four papers, 3 authors with seven papers, 2 authors with eight papers each, one author with 9 papers and finally one author with 15 published papers.

Table 1 - Lotka's law

| Documents written | N. of Authors | Proportion of Authors |

|---|---|---|

| 1 | 908 | 0,891 |

| 2 | 68 | 0,067 |

| 3 | 33 | 0,032 |

| 4 | 3 | 0,003 |

| 7 | 3 | 0,003 |

| 8 | 2 | 0,002 |

| 9 | 1 | 0,001 |

| 15 | 1 | 0,001 |

Most important publications in bibliometrics

It is essential to emphasise the most cited documents in the scientific field obtained from the bibliometric corpus. Table 2 lists the documents with the highest number of citations, in which the following stand out: "Author's personal copy Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services" with a total of 596 citations, an article which analyses the risk factors in the use of mobile banking and the factors of acceptance or rejection of mobile banking by consumers. This is followed by "Understanding dynamics between initial trust and usage intentions of mobile banking" with 469 citations, which aims to study the trust that people have in the use of mobile banking and the extent to which they intend or are willing to use this service. Finally, "Predicting consumer intention to use mobile service" with 384 citations, a paper that discusses the extent to which potential consumers may or may not adopt the use of mobile banking despite its availability.

Table 2 - Top 5 most cited documents

| Author | Document | Total Citations |

|---|---|---|

| Luo, et al., (2010). | Author’s personal copy Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services | 596 |

| Kim, et al., (2009). | Understanding dynamics between initial trust and usage intentions of mobile banking. | 469 |

| Wang, et al., (2006). | Predicting consumer intention to use mobile service. | 384 |

| Laforet & Li (2005). | Consumers’ attitudes towards online and mobile banking in China. | 382 |

| Laukkanen (2016). | Consumer adoption versus rejection decisions in seemingly similar service innovations: The case of the Internet and mobile banking. | 239 |

Source: Own elaboration

Most relevant journals from a bibliometric perspective

Table 3 refers to the most relevant journals in the field of study, of which the 10 most significant ones were taken into account, and the International Journal of Bank Marketing with 30 articles, the Journal of Internet Banking and Commerce with 12 papers, followed by the International Journal of Mobile Communications with 10, and finally the journal Developments in Marketing Science: Proceedings of the Academy of Marketing Science with 7 papers.

Table 3 - Top 10 most important journals in the field of study

| Journals | Documents |

|---|---|

| International Journal of Bank Marketing | 30 |

| Journal of Internet Banking and Commerce | 12 |

| International Journal of Mobile Communications | 10 |

| Developments in Marketing Science: Proceedings of the Academy of Marketing Science | 7 |

| Journal of Financial Services Marketing | 6 |

| Journal of Islamic Marketing | 6 |

| Proceedings of the Annual Hawaii International Conference on System Sciences | 6 |

| Journal of Retailing and Consumer Services | 5 |

| Lecture Notes in Networks and Systems | 5 |

| Banks and Bank Systems | 4 |

Source: Own elaboration

Scientific production by country

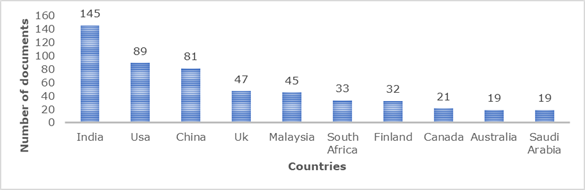

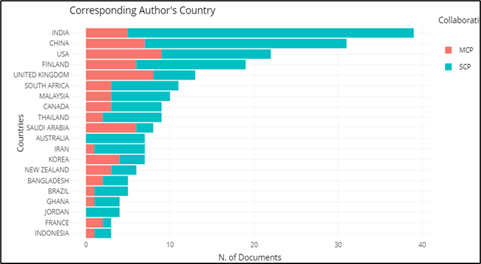

Figure 4 shows that India is the country with the highest number of publications, with a total of 145, followed by the United States with 89 and China with 81 documents; followed by the United Kingdom, Malaysia, South Africa, Finland, Canada, Australia, and Saudi Arabia.

About the total number of citations of documents by country, table 4 shows that Finland is the leader in the ranking of countries with 1,848 documents, followed by Korea with 1,077, these two countries having the highest participation with respect to China, which had a total of 1,028 documents, followed by the United Kingdom with 750 and then India with 706 documents. In terms of average citation, Korea is in first place with an average number of citations of 153.86, followed by Portugal with 136.50, then Turkey with 121.50 and finally Finland with 97.26 citations per respective document.

Table 4 - Top 10 countries with the highest level of citations in the field of study

| Country | Total citations | Average article citations |

|---|---|---|

| Finland | 1848 | 97,26 |

| Korea | 1077 | 153,86 |

| China | 1028 | 33,16 |

| United Kingdom | 750 | 57,69 |

| India | 706 | 18,10 |

| Usa | 398 | 18,09 |

| Malaysia | 293 | 29,30 |

| Iran | 273 | 39,00 |

| Portugal | 273 | 136,50 |

| New Zealand | 272 | 45,33 |

Source: Own elaboration

Figure 5 lists the countries with the most production, whether the authors of the documents are from the same country or, on the contrary, they are a collaboration of different nations. SCP are publications where the authors belong to a single country, while MCP are documents where at least one of the interacting authors is from a different country. As can be seen in figure 3, the country with the highest number of outputs is India, followed by China, the United States, Finland, and the United Kingdom, being the five most productive countries. It is also relevant to know with whom these countries cooperate, as this provides a more global view: The United States, the United Kingdom, China, Arabia Saudi, and India are the countries with the highest number of cooperations.

Main institutions supporting research in the field of study.

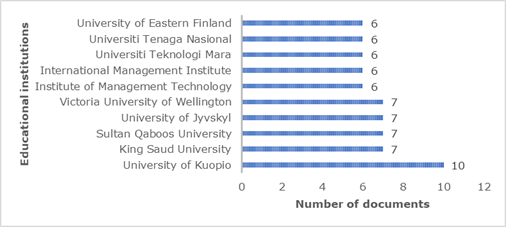

The role that educational institutions have in the scientific research environment has a notable contribution and because of this, in figure 6 they are detailed, where the 10 educational institutions with the most participation were taken as a reference and a total of 111 documents were considered. In first place, the University of Kuopio stands out with 10 articles, then King Saud University and in third, fourth and fifth place, with a total of 7 documents each, are: Sultan Qaboos University, University of Jyvskyl and Victoria University of Wellington, respectively.

Conceptual structure and thematic evolution

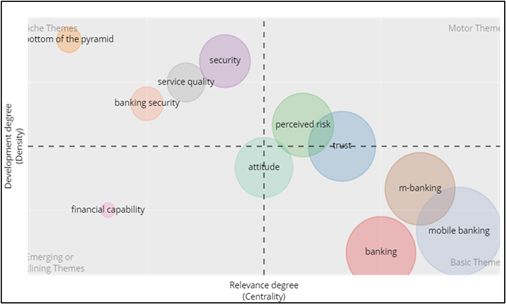

Based on the analysis of the thematic map shown in figure 7, the quadrants of the Cartesian plane show four moments of transformation and evolution of the themes considered. Once the diagram has been analysed, it is established that the driving theme is perceived risk, being the most important and consolidated theme in the research, while the topics: mobile banking, trust and attitude are in a central trend, as a basic theme in this period; followed by security, quality of service and banking security as isolated themes and finally the theme of financial capacity, which is shown as an emerging issue or theme, as it is possible that it tends to dissipate.

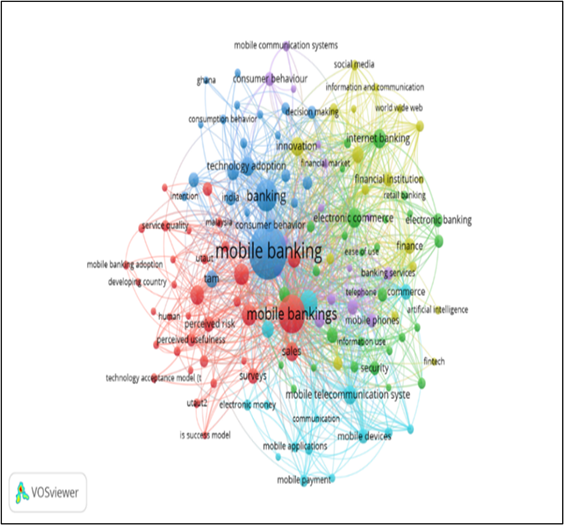

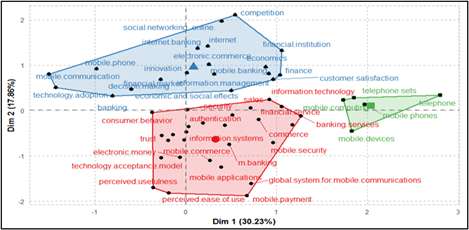

Figure 8 shows five clusters; first, there is the blue cluster, which refers to the driving themes of the analysis, including banking, mobile banking, technology adoption, consumer behaviour and e-money; then there is the red cluster, which points to the basic themes, such as perceived risk, technology model acceptance, mobile banking adoption, perceived usefulness and service quality; then there is the purple cluster, which refers to the isolated themes, such as: phones, mobile phones, banking services and banking services. Then, the green cluster is evident, which exposes emerging themes, such as internet banking, e-commerce, e-banking and use of information; and finally, the yellow cluster is observed and its key words are information and communication, social networks, innovation, finance and financial institution.

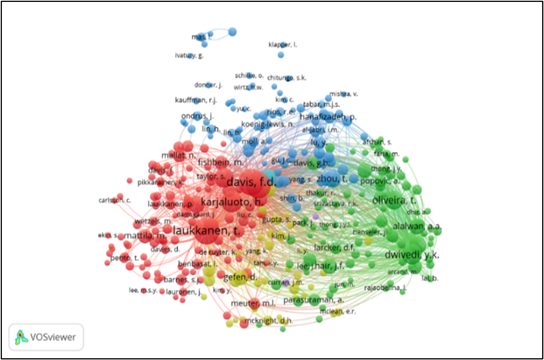

Figure 9 shows the connections and co-citation links between each two authors and the colour of the nodes specifies the group to which each author was linked given their thematic similarity. In the co-citation analysis of most cited authors, where clusters of separate nodes are shown, the first is red headed by Laukkanen, followed by other authors such as Karjaluoto, Davis, Fishbein and Barnes; in second place are the blue-coloured nodes headed by Zhou, Shin and Lu. Then there is green, with Oliveira, Dwivedi, Larcker and Alalwan; and finally, there is the smallest in yellow, with authors such as Gefen, Gupta and Yang.

Figure 10 shows three relevant clusters of the study, with respect to the first study theme, the green cluster shows research based on mobile computing, handsets, phones, and mobile devices; the next blue cluster shows studies on e-commerce, innovation, internet, mobile banking, mobile phones, technology adoption and financial institutions. In the red cluster, topics such as mobile commerce, information systems, consumer behaviour, trust, mobile applications, authentication, e-money, and technology acceptance model are presented. All the above clusters mark important lines of research relevant to address studies associated with mobile banking in the financial management scenario.

Qualitative systematic review

Among the objectives of the empirical studies identified after conducting the systematic literature review are to analyse the financial inclusion of mobile banking and its potential, as well as to understand the vulnerability of users' data; however, it was identified that there is a predominant objective, which is to recognise and determine the factors that affect the use and acceptance of mobile banking, as well as to examine the determinants that make consumers want to use or not use mobile banking services. These objectives are important for researchers, because from this it is possible to know and identify the barriers to use faced by mobile banking and, likewise, the actors in the banking sector can take actions to increase its use, improve the service and, in the same way, attract new customers.

The methodologies most used by researchers identified from the review include questionnaire administration, correlation analysis of variables, interviews, semiotic analysis, constant comparative method, partial least squares (PLS) techniques, descriptive statistics and probabilistic models, LOGIT type, socio-economic profile analysis, econometric analysis, logistic regression models, literature review and descriptive statistical analysis. In addition, probabilistic exercise, microdata analysis and direct testing or demonstration are frequently used. Based on the results analysed in each of the investigations, it is possible to determine and characterise the current panorama on the perception of the use of mobile banking by Colombian consumers, in which it is evident that the use of mobile banking is fundamentally motivated by the ease of use, trust and usefulness that users perceive; it is also important to highlight that there is a high probability of use in the population that has constant access to the internet, as well as in people with higher incomes and with university education. Similarly, it was observed that resistance to mobile banking use is strong among inexperienced users and that the conditions that facilitate use are highly significant in intentionality.

It is observed that mobile banking currently faces different barriers, and although access in the urban population is high, consumers feel that they can only make use of it in a low percentage (15%), with respect to the transactions they perform daily (Arango-Arango, 2017). Another barrier is the evidence that the population shows minimal percentages of financial product ownership, and finally, the security-related risks to which mobile banking consumers are subject. Table 5 below lists the objectives, methods and different results associated with Colombian consumers' perceptions of mobile banking use, based on the 11 papers selected for the systematic literature review.

Table 5 - Qualitative systematic review matrix.

| Author | Objective | Method | Perception of Colombian consumers' use of mobile banking |

|---|---|---|---|

| Bermeo-Giraldo et al. (2021). | To recognise the factors that influence the use and acceptance of mobile banking among consumers in Medellín, Colombia. | Data collection through 220 self-administered questionnaires, confirmatory factor analysis to determine the correlation between the variables and the proposed constructs. | The use of mobile banking is mainly motivated by the ease of use and the confidence and usefulness perceived by users. A strong correlation was found between perceived trust and security, as well as perceived usefulness and intentionality of use. |

| Van Klyton et al. (2021). | To analyse the simultaneous processes of co-creation and co-destruction of value that exist in the use of a mobile banking application in a rural area of Colombia. | Qualitative and ethnographic approach, based on empirical data obtained from 34 semi-structured interviews. | It is identified that the simultaneous expressions of joint creation and destruction of value that exist in the layers of the ecosystem diminished the value proposition of digital money. Likewise, negative interactions impacted on the perception of value. |

| Tavera-Mesías et al. (2021). | To identify the precedents for low-income urban users' intention to use mobile payment applications. | Quantitative approach from surveys of a sample of 397 people, who were both current and potential mobile banking users and measured using a Likert scale. The study used partial least squares (PLS) techniques. | Perceived usefulness and perceived ease of use were found to be the main antecedents, resistance was strongest in inexperienced users, while perceived risk had less influence. Facilitating conditions for mobile payment use were significant in explaining intention to use and served as antecedents of resistance to use this service. |

| Baños & Quintero (2016). | To examine the factors that are determinants in the acceptance and use of mobile banking in Colombia. | Quantitative approach applying the DANE Quality of Life Survey - 2015. Analysis of descriptive statistics and development of a probabilistic LOGIT-type model. | Although there are regional differences in the use and adoption of mobile banking, in general terms there is a high probability of use in the population that has constant access and use of the internet, as well as in people with higher incomes and university education. |

| Arango-Arango (2017). | To recognise the determining circumstances when consumers accept, access, and use electronic payments in Colombia. | Analysis of two surveys, one aimed at consumers and the other at merchants. Using two-sided market theory and controlling for the socio-economic profile of the population | Even though access to electronic payments in the urban population is high, consumers feel that they can only make use of it in 15% of their daily transactions. It is concluded that if the acceptance of electronic payments were to increase by 10%, users would also increase their use of electronic payments and the use of electronic payments in Colombia would increase. |

| Celis & Quitian (2016). | To determine the factors affecting financial access and inclusion in Colombia in 2014. | Econometric analysis, logistic regression model, literature review and descriptive statistical analysis of the survey: Colombia-Global Financial Inclusion (Global Findex) Database 2014, of the World Bank. | It is evident that the population shows minimal percentages of ownership of basic financial products and for this reason it was estimated that this is due to financial exclusion based on barriers of demand (income, educational level) and supply (cost of services, variety, and number of financial institutions). |

| Gómez-González et al. (2016). | Expand knowledge about the use of cash and credit and debit cards in Colombia, highlighting the factors that make the use of cash persist in the country. | Probabilistic exercise on the Banca de las Oportunidades Demand Study (2015). | The use of cash in Colombia has increased in recent years, a behaviour that is in line with what is happening in other economies in the region, and one of the main reasons or factors for this behaviour is the ease of use and access, as anyone can access it and the speed with which small transactions can be made. Although the use of credit cards has been increasing, they are not widely used when making transactions, as users must pay interest for the transaction and there are no payment facilities. |

| Fernández de Lis et al. (2014). | Two objectives are presented: the first is to analyse the regulation of financial inclusion of mobile banking in Colombia; and the second is to identify the potential of mobile banking in terms of financial inclusion. | Microdata analysis for Colombia from the World Bank's Global Financial Inclusion Survey for 144 countries (Global Findex). | The private sector and governments have shown a regulatory effort aimed at developing mobile banking and increasing financial coverage, developing initiatives to encourage financial inclusion, so that people can increasingly gain access to these services. The relevance of strategies to reduce transaction costs has been highlighted, based on mobile phone coverage and regulatory changes, which have gradually allowed the country to have easier access to financial services. |

| Imbachí (2016). | Identify the most important aspects of the proposal that Colombia wants to make to UNCITRAL on the factors that concern the parties involved in e-commerce, in terms of mobile commerce and payments through mobile devices. | Study and interpretation of the proposal made by the Delegation of Colombia to the member countries of the United Nations Commission on International Trade Law (UNCITRAL). | The study to be presented is important for e-commerce, given that in this way the economic and digital divide is reduced, as well as the importance of unifying and harmonising digital commerce for the benefit of the Colombian population. |

Discussion and conclusions

From the point of view of different authors who refer to mobile banking, the importance of mobile banking lies in the rapid and uninterrupted access to information and the speed of response in transactions. It also highlights that internet banking aims to serve a large mass, focusing on the diversification of banking products, solving problems of security and banking efficiency (López-Rodríguez & Neme-Chaves, 2021). Users can perform more agile, convenient, and accurate transactions, highlighting that, the relevance of electronic banking products and e-banking is increasing day by day, offering banks advantages such as low risk, high profitability and low cost (Monroy-Perdomo et al., 2022).

Over time, digitisation has allowed experiencing paperless banking and technological expansion has been one of the main forces stimulating the growth of the banking sector (López-Rodríguez & Espinosa-Rodríguez, 2021); however, internet banking and the consumption of such products have a security risk. Some of these perceived risks associated with purchasing a banking product, specifically in online services, are security and privacy (López-Rodríguez et al., 2022).

It is evident that, since 2009, there has been a substantial growth in scientific production about mobile banking, where India is the country with the highest number of publications, followed by the United States and China; after these, the participation of the United Kingdom, Malaysia, South Africa, Finland, Canada, Australia, and Saudi Arabia can be observed. Among the most representative authors are Tommi Laukkanen, Professor of Marketing at the University of Eastern Finland, followed by Aijaz A. Shaikh, postdoctoral researcher at the University of Jyväskylä, Finland; and finally, Heikki Karjaluoto, Professor of Marketing at the University of Jyväskylä.

It is pertinent to note that the topic of perception of mobile banking use shows a certain level of scarcity in the scientific literature, as from the qualitative systematic review, only 11 solid and concrete documents were obtained, after the inclusion and exclusion criteria were applied.

In the systematic review, it became evident that among the most representative objectives of the research, the most important are to analyse the financial inclusion of mobile banking and to understand its potential, as well as to understand data vulnerability; however, it was identified that there is a predominant objective, which is to recognise and determine the factors that affect the use and acceptance of mobile banking, as well as to examine the determinants that make consumers want to use or not to use mobile banking services.

After the execution of the qualitative systematic review and based on the results analysed in each of the investigations, it is possible to determine and characterise the current panorama on the perception of the use of mobile banking by Colombian consumers, within which it is evident that the use of mobile banking is fundamentally motivated by the ease of use, trust, and usefulness that users perceive. It is also important to highlight that there is a high probability of use among the population that has constant access to and use of the internet, as well as among people with higher incomes and university education. Resistance to using mobile banking was found to be strong among inexperienced users, and facilitating conditions for use were found to be highly significant in intentionality.

Mobile banking currently faces different barriers, because although access in the urban population is high, according to Arango-Arango (2017) consumers feel that they can only use it for 15% of their daily transactions; another barrier is the evidence that the population shows minimal percentages of financial product ownership; and finally, the security-related risks to which mobile banking consumers are subject.

Among the research proposals and recommendations that emerge from this bibliometric analysis and systematic review of the literature are to investigate and gather in-depth information on the factors that determine whether mobile banking users decide to use these services or, on the contrary, refrain from using them; additionally, it is suggested to investigate the factors that most influence or affect consumers in terms of risks and security in mobile banking. Following this analysis and exploration, it is necessary to propose how providers of mobile banking products can mitigate or address the factors that diminish their use.

One of the main limitations of the study was the fact that only documents located in the Scopus database were taken into account, which prevented the review of relevant research results associated with the perception of mobile banking use not registered in this database; for this reason, it is recommended that for future developments of bibliometric analysis and systematic reviews, the review of documents in other databases such as Web of Science and Dimensions should be carried out.