Introduction

The functioning of each country's financial system, the development of financial segments and the stability of the financial services market in general are important issues. In an era of increasing global threats and continuing global financial difficulties, the attractiveness of the necessary resources for the stability of financial markets and the financing of the country's economy, the efficient provision of investment and innovation activities, encouraging foreign investors and securing economic processes are necessary conditions. Insurance, the main financial market sector, is significant in these processes (Kaigorodova et al., 2018).

Insurance fulfills a very multifunctional and beneficial mission, insures in advance the risks that may arise in economic processes, and in a sense, it acts as a useful financial mechanism and tool in reaching the predicted profitability level and compensating a certain part of the losses arising from the risks formed in the processes related to investments and invested financial resources (Laux & Muermann, 2010). Economic entities and individuals benefiting from insurance can avoid risks by insuring their properties (Gómez & Ponce, 2018). Moreover, insurance has a key role in compensating for the loss of property and business because of natural disasters, new upheavals by climate changes, military conflicts, civil conflicts, droughts, fires, carelessness, and similar losses. Insuring property or activity creates conditions for doing more intensive work in those areas and taking certain risks (Hollman et al., 1993).

There are enough risks involved in entrepreneurial activities in commerce and business, and the higher the risk, the greater the success. This is also the case in life: sometimes a person takes risks to achieve some goal, sells his property and involves it in the cycle of economic activity, that is, invests in some field, or fails to take the necessary measures to protect the property in time, or leaves the property unused, etc. However, in consequence of insuring all these, in a sense, the compensation mechanism of a significant part of the losses is realized through insurance.

The history of insurance in Azerbaijan is quite old. The development of insurance services in Azerbaijan and the perception of insurance as a type of economic activity in general began when it was a part of the Russian Empire (Sh. T. Aliyev, 2018). These processes continued even when it was part of the former USSR. The insurance system in the former USSR was a financial system governed by administrative styles. That is, the multifunctional possibilities of insurance were used only purposefully, in the interests of the former USSR and in the matter of insuring the same territories throughout the country. Compulsory insurances that are promoted and regulated by the state have been considered. The large-scale development of the insurance market was not possible because at that time, Azerbaijan as an independent republic did not have any decision-making authority (Kimball, 1960). All decisions were taken in Moscow, and Azerbaijan was only a subject of an empire and regime controlled from Moscow.

Later, additional opportunities opened up. After the fall of the former USSR, from the beginning of the 1990s, the attributes of independent statehood began to be formed in Azerbaijan. Thus, Azerbaijan has developed its independent state structures and institutional foundations in all areas. The formation of the financial system and the creation of the country's financial institutions also played a significant role. In this way, the processes for the formation of the insurance system, the development of insurance services and the creation of insurance subjects in the market economy in Azerbaijan started.

All this developed as part of the country's financial system. The financial system in Azerbaijan is not so new, and the Ministry of Finance is one of the most experienced ministries. In the period after the restoration of independence, the development of the financial system, the creation of state fiscal management and control functions, the development of financial and credit organizations, the creation of the insurance system and the formation of insurance companies were started.

Thus, since the mid-1990s, private insurance companies, as well as state-owned insurance joint-stock companies, began to operate in Azerbaijan. As a result, certain insurance services segments in the country have been launched and attracted attention as a necessary service in the financial market. But let us admit that these issues have not developed intensively in accordance with world experience. But what are the reasons? Why do serious problems remain in the development of the insurance system in Azerbaijan? There are many questions about this, and certain paradigms and hypotheses of this article are also related to those questions. However, let us note that one of the main reasons why insurance services are not widely developed in the country is mental characteristics. Thus, the trust of the country's population in insurance organizations and insurance services has not yet been fully formed.

Then, improving the insurance system, updating existing mechanisms and applying more effective practical tools are important conditions for the continuous development of the country. It is significant to ensure the availability and attractiveness of insurance services, especially in Azerbaijan, where the financial services market is just developing. Considering the above, the objective of this paper is to analyze the global insurance market, specifically the problems and possible solutions for the development of the insurance system in Azerbaijan.

Development

The development of the insurance market and the implementation of relevant state regulatory measures and the development of insurance as one of the main segments of the financial market require a complex and systematic approach (Kozarevic et al., 2013). The main goal of state financial regulation in this area is to ensure the maintenance of social and economic stability in society, to develop the national insurance market and take measures to make it more stable and reliable (Fukui, 2012). Furthermore, the importance of insurance services in a market economy is explicit and in such a situation, the strategic importance of insurance activities and insurance services is extremely important.

As previously stated, insurance activity, insurance system in general is one of the new financial aspects of Azerbaijan and the share of this sector in the country's economy is not large. However, in recent years, insurance premiums collected domestically have increased to 1% of the total domestic content. Moreover, interest in the insurance segment, which is the main component of the financial services market, is high. Thus, the number of insurance companies in Azerbaijan is increasing every year. Among the goals of developing the financial services market throughout the country, the development of the insurance market, attracting more investments to our country in this area, and encouraging and stimulating the segments of activity in the market economy due to the expansion of insurance services are in the focus. In independent Azerbaijan, the processes of continuous improvement of insurance legislation and adoption of relevant laws have intensified for the development of the market of insurance products. Strengthening control over insurance operators, explaining the content of insurance in society, regulating insurance services within the framework of legislation, and forming effective mechanisms and tools in this matter are among the important conditions.

In the last 15 years, measures have been taken to improve and regulate insurance sector and strengthen the legal framework in Azerbaijan. On December 25th, 2007, the Law of the Republic of Azerbaijan “On Insurance Activity” was adopted. On June 24th, 2011, another important national law - the law of the Republic of Azerbaijan “On Compulsory Insurance” came into force. The Law of the Republic of Azerbaijan “On Agrarian Insurance” adopted on June 27th, 2019, is quite progressive and stimulating for the purpose of developing entrepreneurship in the agricultural sector and more reliable organization of activities. The “Strategic Roadmap for the development of financial services in the Republic of Azerbaijan”, approved by the Presidential Decree of 6th December 2016, is of foremost importance for the improvement and accessibility of insurance services. In this important document, the insurance activity was emphasized in the context of the financial services market's development. Furthermore, in the “Azerbaijan 2030: National Priorities for Socio-Economic Development” approved by the Decree of the President dated February 2nd, 2021, improvement of insurance activity is characterized as a prominent issue in developing the national economy, in ensuring the interests of human and non-human persons and in protecting their property and health.

A number of related issues should be particularly emphasized: 1) the legislative framework of insurance activity in Azerbaijan has been formed in a certain sense; 2) the conceptual, theoretical-methodological and practical approaches of the insurance activity in the country are mainly determined; 3) interest in insurance services in Azerbaijan is increasing every year; 4) the level of professionalism of the insurance companies operating in Azerbaijan continues to grow relatively, and insurance companies that have managed to operate in the market economy are already being formed; 5) the introduction of more improved forms and approaches of the management and regulation of the country's national insurance services market is a special focus; 6) the role of the insurance system in economic development processes is increasing; 7) national insurance companies, as the most active elements of the financial system, should adapt to the new challenges of the financial services market and expand their high-tech operational mechanisms; 8) due to the digitization of financial services in modern times, the insurance system should be further improved and accessible by using digital mechanisms and adopting high technologies; 9) regulation of insurance premiums and protection of the principle of fairness in this matter are important conditions for increasing the attractiveness of insurance services; 10) to eliminate the difficulties and controversial issues that arise during insurance payments and to strengthen trust in insurance companies, the mechanisms related to the determination and payment of insurance should be reviewed and improved in accordance with the realities of the modern era.

All these show that there are many problems with the development of insurance in the country and additional measures should be taken in this matter. In addition, it is important to develop the national insurance service market in Azerbaijan, to establish stable insurance companies in the market and to ensure the financial stability of insurance operators. The problems of using insurance assets correctly, taking additional measures to increase these assets and adapting the capitalization rates of insurance companies to the requirements of the market economy should also be resolved.

More measures should be taken to improve the functioning mechanism of the insurance market and to develop a new purpose-oriented insurance strategy, to emphasize the principle of consumer sovereignty in the activities of insurance companies, and to protect the rights and interests of consumers in the insurance market. The insured's interests should be accepted as an objective reality by the insurers, and a healthy competitive environment should be established among them accordingly. It is required that the insurance business should be attractive, insurance companies should show more interest in this field, motivation should be increased, investors should direct more financially resources to insurance activities, and bank-credit organizations should expand their relations with insurance organizations.

Others measures are needed to develop the insurance system in Azerbaijan and to ensure its reintegration into the financial services market in general and to accelerate work in this matter: 1) The main aspects of insurance, financial, economic and investment activities in Azerbaijan should be regulated according to the requirements of the time, the taxation mechanism of insurance companies of the country should be improved and state control mechanisms should be strengthened to encourage them; 2) The country insurance system should be improved and the financial stability of insurance companies should be strengthened based on the impact of globalizing trends in the insurance market; 3) Improvements are needed to develop the insurance market, to set near and long-term goals, to develop the reinsurance market, to strengthen the financial strategies of national insurance companies, to improve the collection strategy and fair use of insurance premiums collected, and to increase insurance services; 4) There is a serious need for new approaches to increase the efficiency of the country's insurance companies and to expand their insurance reserves and authorized capital; 5) Developing the insurance culture of the country's population is of strategic importance, that is, systematic measures should be taken to deal with insurance in any segment of the population, to carry out propaganda activities related to it, to expand advertising activities and to adapt education to the needs of the age; 6) Society and economic institutions should be more informed about the essence and content of insurance services, their importance in the market economy, the advantages of life and non-life insurance, and the principles regarding the usefulness of insurance services; 7) Due to the development of the insurance system in our country, it is possible to strengthen the entrepreneurial activities of real and legal persons and to expand various projects on business issues.

In these processes, insurance is considered a prominent issue and a more necessary mechanism - a financial mechanism. In terms of the economic content and functions of the insurance, a few factors can be distinguished: 1) During the insurance period, the probability of occurrence of events that cause financial and other damages in economic matters is high and insurance service is important in compensating some of them in a certain sense; 2) During insurance, processes take place reflecting the implicit distribution of losses among insurers. In this case, damage may cover only a part of the country's territory and not the entire region. Therefore, insurance services will carry a certain burden in paying these losses, creating additional incentives to ensure the sustainability of economic activity processes and prevent the participants of economic activity from experiencing serious financial losses. The wider the circle of insurance participants, the smaller the share of each insured in the distribution of losses. Thus, a single concentration of funds is achieved, which allows the maximum loss to be paid at the expense of the minimum expenses of each participant; 3) The funds mobilized during the distribution of losses are returned. In other words, the insurance value transferred to the insurance fund of each object has a single purpose and ensures the repayment of the damage in a certain area within a certain period. As a result, the distribution of losses at the expense of insurance is more widespread and certain advantages are obtained in the compensation of losses of the participants of the insurance activity; 4) a key factor is the need for a large area and many objects for the effective territorial distribution of the insurance fund. Therefore, it can be accepted that insurance is a particularly important financial instrument in terms of both its economic content and its functions. What economic content does insurance have in general? In response to this, we can state that insurance is a set of economic relations expressing the damages inflicted to economic subjects within the time and space characteristic of the closed return. It also functions as one of the methods of creating an insurance fund in terms of the economic category and using it in practice. The need to use insurance as an economic category often arises when the mobility of government financial resources is limited.

Insurance also deals with loss of family income and financial losses. In this respect, we can see that the social functions of insurance are quite extensive. Social insurance allows compensating citizens for financial damages and financial assistance due to the loss of the head of the family or damage to health. The essence of insurance is determined based on its functions, and the composition of the essence of insurance depends on its characteristics. Risk and warning functions are among the crucial functions of insurance as the main risk function. These functions are quite characteristic of insurance. Because insurance risk, as a possibility of loss, is related to the main purpose of insurance, namely, to provide financial assistance to economic matters. Through the risk function, financial resources are distributed among insurance participants according to the outcome of random events. Thus, insurance also fulfills the function of a warning, that is, those participating in economic activity are warned of risks and informed that dangers will occur.

Even before our era, there were various manifestations of insurance activity. In the 12th century, the first insurance associations related to maritime transport were formed in Iceland. In the 13th century, there were certain approaches to the distribution of damages in the system of socio-economic relations between people. In the 14th century, the organization of insurance activity took place. Thus, mutual agreements were made regarding the distribution of damages arising from maritime transport and insurance services were established. The contract signed in Genoa, Italy in 1347 can be indicated as the oldest insurance policy. With the gradual expansion of the development of maritime transport in the 14th-18th centuries, the use of peril insurance contracts increased. Since the second half of the 18th century, risk insurance activities have expanded in Western European countries due to the development of industry and shipping. In the 18th and 19th centuries, insurance activities became more popular due to the development of various industries in the USA and Western Europe. Thus, there was a property insurance service in London (England) and Hamburg (Germany). Since the 20th century, the formation and development of the insurance system has taken a wider scale. Processes regarding insurance services have been accelerated, and insurance service delivery mechanisms have been established in life, industry, and other fields of activity. According to Samuelson and Nordhaus (2010), any activity can reduce uncertainty and risk and increase economic well-being. Subjects using insurance services operate in a more secure manner if they are insured when they create additional economic value and take risks related to it.

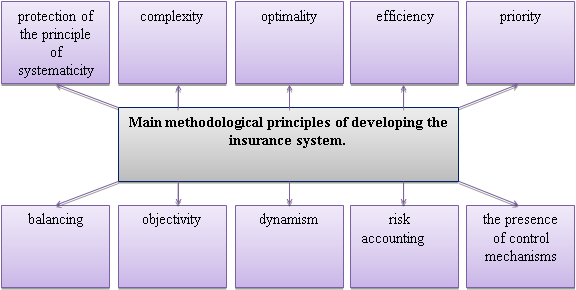

Since the second half of the 20th century, insurance services have been widespread in various sectors of the economy. However, as previously stated, the insurance system in the USSR, including Azerbaijan, consisted of centrally managed and compulsory insurance types. However, adapted to modern times, for the development of the insurance system a set of methodological principles should be considered. These are indicated in Figure 1.

In this methodological approach of the insurance system, concreteness, and optimality of the rules of use of the applied mechanisms are important. In addition, the institutional development of the insurance system, the optimal determination of the control system's functions, and the improvement of economic and legal mechanisms are required. Another set of methodological approaches to improving the insurance system can be attributed to 1) adapting the state insurance policy to global challenges; 2) developing and implementing insurance market support mechanisms by the state; 3) taking measures to improve the legal framework of the insurance system; 4) diversifying the insurance portfolio structure and 5) ensuring the effectiveness of the insurance market control system.

In world experience, insurance activity is one of the main aspects of the state's economic policy and provides a comprehensive approach to risks in various fields and the effectiveness of insurance in risk determination and management processes is great (Fung et al., 2018). The development of the insurance system is also important in terms of expanding the structure of the state's financial services market at a time when global risks and threats are increasing (Hui & Xin, 2017). The role of insurance activity is significant in the activities of state and private enterprises, in strengthening the economic security of the country, in preventing risky situations and in allocating losses (Christiansen et al., 2016). In-depth examination of the development features of the insurance system and the development and implementation of new mechanisms are considered principal issues (Weiss, 1991). On the other hand, one of the important conditions is to see the risks of the insurance market objectively and to define the management mechanisms (Eikenhout, 2015).

The functionality and efficiency of the insurance system is quite high in several economically developed countries, including the USA, Japan, England, Germany, France, and Italy. The insurance services market in these countries is widely developed (US Treasury, 2014). Problems related to the development of the insurance system in the United States are evaluated seriously by federal structures and adequate measures are taken (Lencsis, 1997). In 2019, the growth rate in insurance payments was 1.3% in the USA, 2.3% in Canada, 1.0% in Japan and 0.6% in Germany. There was no growth rate in 2020 due to the negative impact of the Covid-19 coronavirus pandemic, but it is possible to predict that the dynamics of insurance services will be more intense in post-pandemic conditions. The strategic importance of insurance and its contribution to economic development processes are more in demand. In 2021, 5.8% of the global GDP was formed because of insurance activity, and the increase in insurance payments was 3.3% or 6.9 trillion US dollars.

In Table 1, indicators of the world's top 10 countries in terms of the total amount of income from life and non-life insurance premiums in 2020 are indicated.

Table 1 - World's top 10 countries in terms of the total amount of income from life and non-life insurance premiums (2020), in million US dollars.

| № | Countries | Life insurance | Non-life insurance | Total | Compared to 2019, + increase; - decrease | Special share in the world total |

|---|---|---|---|---|---|---|

| 1 | USA | 632,687 | 1,897,883 | 2,530,570 | 1.8% | 40.3% |

| 2 | China | 347,545 | 308,330 | 655,874 | 6.2 | 10.4 |

| 3 | Japan | 294,497 | 120,308 | 414,805 | -3.0 | 6.6 |

| 4 | Great Britain | 238,890 | 99,430 | 338,321 | -7.1 | 5.4 |

| 5 | Germany | 106,571 | 151,995 | 258,566 | 3.8 | 4.1 |

| 6 | France | 136,611 | 94,736 | 231,347 | -11.2 | 3.7 |

| 7 | South Korea | 106,143 | 87,565 | 193,709 | 8.2 | 3.1 |

| 8 | Italy | 118,612 | 43,361 | 161,973 | -3.5 | 2.6 |

| 9 | Canada | 58,234 | 85,234 | 143,468 | 6.4 | 2.3 |

| 10 | Taiwan (China) | 91,155 | 22,150 | 113,304 | -3.8 | 1.8 |

Source. https://www.iii.org/publications/insurance-handbook/economic-and-financial-data/world-insurance-marketplace

In the “Strategic Roadmap for the Development of Financial Services in the Republic of Azerbaijan” approved by the Decree of the President of the Azerbaijan Republic of December, increasing the role of insurance companies in the Azerbaijan financial services market and related priority tasks are specified (I. Aliyev, 2016a). Moreover, the issue of regulation and development of the insurance system was particularly emphasized in the “Strategic Roadmap for the National Economy and Main Sectors of the Economy” approved by the Decree of the President of the country dated December 6th, 2016 (Aliyev, 2016b). In this context, the existence of favorable conditions for the development of the insurance system and the intensification of the activities of insurance companies in Azerbaijan is noticeable. Improving the insurance system and forming a more efficient portfolio of insurance services are among the main tasks of the modern era. If we look at the role of insurance in the financial services market and in terms of systemic transformation, measures should be taken to strengthen the financial situation of insurance companies and their management mechanisms should be improved (Alakbarov et al., 2020).

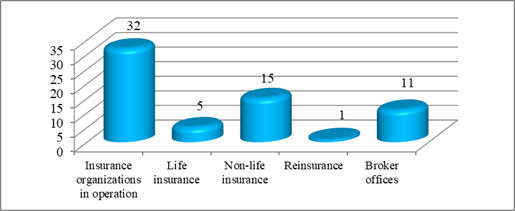

As a result of measures to develop the insurance system in Azerbaijan, the dynamism of the insurance market in the country has been strengthened and the efficiency of the activities of insurance companies has been increased (Ibrahimov, 2018). The following data is a prove of that. As of January 1st, 2021, 18 out of 34 insurance organizations in Azerbaijan are subjects of non-life insurance activity (see Figure 2).

Fig. 2 - Number of insurance companies in Azerbaijan, as of January 1st, 2021. (Compiled by the author based on data of the SSCRA - https://www.stat.gov.az/source/finance/az/bul/Sigorta_2021_illik.pdf)

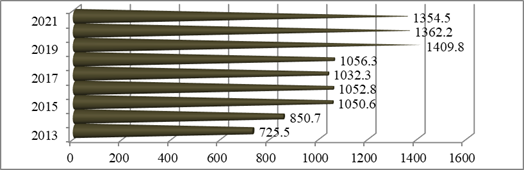

Total assets of insurance companies operating in Azerbaijan are indicated in Figure 3. Its total assets at the end of 2021 were 1354.5 million Azerbaijani manats, or 796.8 million US dollars.

Fig. 3 - Total assets of insurance companies operating in Azerbaijan (2013-2021), in million manats (Compiled by the author based on data of the SSCRA - https://www.stat.gov.az/source/finance/az/bul/Sigorta_2021_illik.pdf).

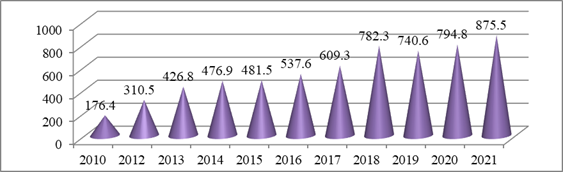

The total amount of receipts from insurance premiums under insurance contracts in Azerbaijan in 2021 was 875.5 million Azerbaijani manats or 515 million US dollars (see Figure 4).

Fig. 4 - Total amount of receipts from insurance premiums under insurance contracts in Azerbaijan (2010-2021), in million manats (Compiled by the author based on data of the SSCRA - https://www.stat.gov.az/source/finance/az/bul/Sigorta_2021_illik.pdf)

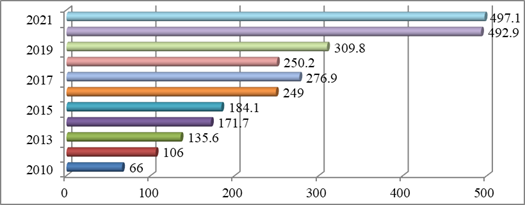

In Figure 5, the total amount of insurance payments in Azerbaijan in 2010-2021 is indicated. This amount was 497.1 million Azerbaijani manats or 292.4 million US dollars in 2021.

Fig. 5 - Total amount of insurance payments in Azerbaijan (2010-2021), in million manats (Compiled by the author based on data of the SSCRA - https://www.stat.gov.az/source/finance/az/bul/Sigorta_2021_illik.pdf).

In Table 2, the analysis of the main indicators of insurance companies operating in Azerbaijan is indicated. Based on data in the table, in 2018-2020, 4 insurance companies - “Ateshgah” Insurance Company OJSC, “Ateshgah Life” Insurance Company OJSC, “Pasha Life Insurance” OJSC and “Pasha Insurance” OJSC in insurance premiums and insurance payments across the country are correspondingly high.

Table 2 - Insurance premiums and insurance payments for insurance companies operating in Azerbaijan, in thousand manats.

| 2018 | 2019 | 2020 | ||||

| Insurance company | Insurance Premiums | Insurance Payments | Insurance Premiums | Insurance Payments | Insurance Premiums | Insurance Payments |

| “A-Group Insurance Company” OJSC | 13 170 | 8 064 | 15 125 | 8 538 | 17 054 | 8 475 |

| “AtaInsurance” OJSC | 22 438 | 10 610 | 18 094 | 14 628 | 13 889 | 8 710 |

| “Ateshgah Life” Insurance Company OJSC | 60 107 | 14 720 | 39 087 | 19 131 | 41 498 | 55 971 |

| “Ateshgah” Insurance Company OJSC | 36 806 | 20 022 | 36 884 | 18 986 | 25 358 | 14 306 |

| Azerbaijan State Insurance Commercial Company - AzerInsurance | 43 389 | 14 689 | 49 067 | 16 240 | 49 122 | 33 351 |

| “Azerbaijan Industrial Insurance” OJSC | 8 139 | 2 863 | 5 632 | 2 019 | 9 042 | 2 136 |

| “AzInsurance” OJSC | 20 030 | 8 096 | 15 289 | 4 812 | 15 913 | 5 952 |

| “Baku Insurance” OJSC | 1 024 | 197 | 1 140 | 239 | 2 062 | 371 |

| “Gunay Insurance” OJSC | 5 837 | 3 328 | 7 222 | 1 894 | 9 045 | 2 443 |

| “Silk Way Insurance” OJSC | 17 003 | 1 717 | 18 495 | 19 931 | 17 320 | 2 590 |

| “Mega Insurance” OJSC | 25 769 | 3 648 | 21 815 | 5 030 | 28 615 | 4 861 |

| "NakhchivanInsurance" OJSC | 263 | 3 | 546 | 2 | 1 671 | 49 |

| “Pasha Life Insurance” OJSC | 264 988 | 71 045 | 212 559 | 99 505 | 242 632 | 222 977 |

| “Pasha Insurance” OJSC | 128 007 | 49 520 | 150 177 | 52 798 | 163 453 | 71 452 |

| “Gala Hayat” Insurance Company” OJSC | 15 897 | 12 349 | 14 861 | 6 262 | 15 942 | 4 052 |

| “Gala Insurance” OJSC | 16 557 | 1 963 | 26 787 | 3 270 | 32 838 | 3 361 |

| “Revan Insurance” OJSC | 1 759 | 316 | 3 185 | 477 | 1 078 | 332 |

| “Xalg Hayat” Insurance Company OJSC | - | - | 977 | - | 3 672 | - |

| “Xalg Insurance” OJSC | 14 496 | 3 810 | 28 340 | 16 016 | 31 182 | 17 608 |

| “Agrarian Insurance Fund” OJSC | - | - | - | - | 18 | - |

| Insurance companies whose licenses revoked | 32 275 | 13 373 | 15 896 | 11 756 | 7 229 | 6 156 |

| “Amrah Insurance” OJSC | 744 | 104 | 861 | 202 | 1 982 | 877 |

| “AXA MBASK” Insurance Company OJSC | 18 601 | 9 563 | 975 | 6 101 | 5 | 628 |

| “Standard Insurance” OJSC | 12 931 | 3 707 | 14 060 | 5 453 | 5 242 | 4 651 |

| FINAL | 727 954 | 240 333 | 681 177 | 301 537 | 728 634 | 465 153 |

Source. Compiled based on data of the Central Bank of the Republic of Azerbaijan - https://www.cbar.az/page-189/insurance

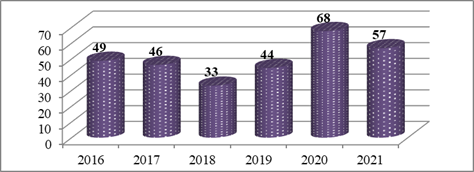

In Figure 6, the special weight of insurance payments in total insurance premiums for insurance companies operating in Azerbaijan in the years 2016-2021 is indicated. At the end of 2021, this indicator was 57%. More surprisingly, at the height of the Covid-19 pandemic - in 2020, this indicator was 68%.

Fig. 6 - Special weight of insurance payments in the total of insurance premiums for insurance companies operating in Azerbaijan in 2016-2021, as percent (Compiled by the author based on data of the SSCRA. https://www.stat.gov.az/source/finance/az/bul/Sigorta_2021_illik.pdf).

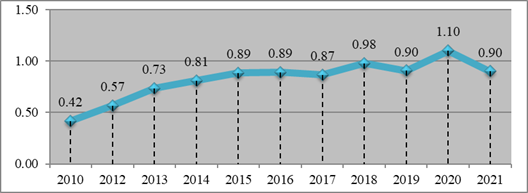

In Figure 7, the share of income from gross insurance premiums in the gross domestic product in Azerbaijan for 2010-2021 is indicated. This indicator was 0.42% in 2010, 0.89% in 2015, 1.1% in 2020 and 0.9% in 2021.

Fig. 7 - Share of income from gross insurance premiums in gross domestic product in Azerbaijan for 2010-2021, as percent (Compiled by the author based on data of the SSCRA - https://www.stat.gov.az/source/finance/az/bul/Sigorta_2021_illik.pdf).

In Table 3, the analysis of the volume of insurance payments per capita in Azerbaijan is indicated. This indicator increased from 19.61 Azerbaijani manats to 86.52 Azerbaijani manats during the analysis period. This indicates the dynamism of interest in insurance services.

Table 3 - Dynamics of per capita insurance payments in Azerbaijan (2010-2020)

| Years | Population - total, in thousands | Income from insurance premiums, in million manats | Volume of insurance payments per person, in manat |

|---|---|---|---|

| 2010 | 8997,6 | 176,4 | 19,61 |

| 2012 | 9235,1 | 310,5 | 33,62 |

| 2013 | 9356,5 | 426,8 | 45,62 |

| 2014 | 9477,1 | 476,9 | 50,32 |

| 2015 | 9593,0 | 481,5 | 50,19 |

| 2016 | 9705,6 | 537,6 | 55,39 |

| 2017 | 9810,0 | 609,3 | 62,11 |

| 2018 | 9898,1 | 782,3 | 79,04 |

| 2019 | 9981,5 | 740,6 | 74,20 |

| 2020 | 10067,1 | 794,8 | 78,95 |

| 2021 | 10119,1 | 875,5 | 86,52 |

Source: Compiled by the author based on data of the SSCRA -https://www.stat.gov.az/source/finance/az/bul/Sigorta_2021_illik.pdf

The analysis of the insurance system in Azerbaijan results in the fact that there is a serious need to strengthen the activities of insurance companies and intensify the market of insurance services in general. Therefore, a few issues should be seriously considered and evaluated to improve the insurance system in the Republic of Azerbaijan and to take additional measures related to insurance:

First, regulating state insurance policy under global challenges and implementing new mechanisms are necessary. The state should take measures to strengthen and stimulate public-private sector cooperation in developing the insurance market and ensuring the availability of insurance services. State support mechanisms related to the development of the national insurance market should be developed and applied, and motivational measures should be implemented. The financial stability problems of insurance companies in the country should be seriously studied and measures should be taken to strengthen the financial stability of insurance companies.

In Azerbaijan, monopolies in various fields of the economy should be prevented and a healthy competitive environment should be created in the market of insurance services, and the functioning of the relevant legislation should be ensured. It is important to develop and implement insurance services at world standards and to determine the principles and criteria for this sector. Reshaping the portfolio of insurance services in Azerbaijan and ensuring their advocacy, adapting the structure of insurance services to the requirements of the modern era, and ensuring their availability, and monitoring the compliance with the financial situation of the population and subjects of economic activity are also important.

In terms of improving the insurance system in Azerbaijan and adapting the activities of insurance companies to international standards, we could not cover all the problematic issues and therefore continuing to study the issue is necessary. We believe that our research will continue to intensify the development of the financial services market and to organize insurance activities more efficiently in Azerbaijan, an independent young state.

Conclusions

In a situation where global risks increase and global threats intensify in the world financial market, it is important to develop insurance, which is one of the main sectors of the financial market, and to improve insurance mechanisms. Thus, there is a serious need to develop and implement more stable mechanisms of the insurance system in Azerbaijan. The independent insurance system is just beginning to form in the country and the financial services market is quite sensitive. Considering these factors, additional measures should be taken to expand, develop and improve the implementation mechanisms of insurance services in the country and to use the multifunctional features of insurance services effectively.

Insurance serves as an important financial instrument in Azerbaijan in protecting against risks and threats that arise in developing and increasing the stability of the financial services market, strengthening the activity of financial market participants, forming a healthy competitive environment in this market. However, due to the modern problems and current deficiencies of the financial services market in Azerbaijan, there is a serious need to take measures to organize insurance services. In this sense, the operation of insurance services in Azerbaijan, compliance with insurance legislation, provision of effective mechanisms and enforcement tools for the payment of insurance services, compliance with the principle of protection of fairness in insurance payments are among the main reasons for the low ratings of insurance companies.

For the improvement of this market, it is necessary to make reforms in various areas of the economy, but as well to effectively use the possible opportunities in various areas of the country's economy and take additional actions to attract investments. Moreover, pre-insurance of risks, losses, damages, and the possibility of compensating a certain part of the indemnities through the insurance mechanism, that is, through the insurance mechanism, should be evaluated objectively and provided based on contracts in accordance with the law. In the post-pandemic period, the need to actively use insurance in increasing the dynamism of the financial services market, restoring territories freed from occupation, taking large-scale socio-economic development measures, making investments, inviting foreign investors to territories freed from occupation, and implementing such large-scale works came to fore once again. Then, considering the main drivers of the post-pandemic period and the development assumptions in Azerbaijan, wide use of insurance service and insurance mechanisms in stable development rate of productive economic sectors in the near future, in making a large-scale investment on issues and priority activity areas to achieve the goals of promising economic sectors and in the management of risks arising during the implementation of the innovation project, is the demand of the time.