Mi SciELO

Servicios Personalizados

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Cooperativismo y Desarrollo

versión On-line ISSN 2310-340X

Coodes vol.10 no.3 Pinar del Río sept.-dic. 2022 Epub 25-Dic-2022

Original article

Procedure for the administration of technical provisions pending liquidation and of risks in progress

1 Empresa de Seguros Nacionales. Unidad Empresarial de Base Pinar del Río. Pinar del Río, Cuba.

2 Universidad de Pinar del Río "Hermanos Saíz Montes de Oca". Pinar del Río, Cuba.

In order to face the risks derived from their activity, insurance entities must have sufficient financial resources to cover outstanding obligations with their clients. The succession and impact of insurance risks in the period 2015-2017 and the high accumulation of claims in short periods of time led to the identification of efficiency reserves in the administration of insurance technical provisions in the Unidad Empresarial de Base Seguros Pinar del Río of the National Insurance Enterprise. The objective is to propose the modification of the administration procedure of the technical provisions of risks in course and provisions pending liquidation. For this purpose, a diagnosis was carried out in the Pinar del Río Base Business Unit during that period, demonstrating that the procedure presented weaknesses in its creation percentages, and unnecessarily immobilized financial resources, which affected the performance and economic efficiency in the short and medium term, these limitations being manifested mainly in times of strong impacts of climatological events and the combination of several risks in agricultural insurance. As a result, an improved procedure was proposed and validated for the 2018-2020 period, achieving superior results in this unit. In addition, a procedure was designed and implemented for electronic indemnities to producers and productive structures in the agricultural sector, improving efficiency and effectiveness in its management: the opening of financial investments derived from the use of temporarily free funds.

Key words: insurance; risks; technical provisions management

Introduction

Throughout history, man has sought a way to respond to his desire for security, designing various mechanisms to protect his life, his property and his family nucleus, which over time have been extended and, in a certain sense, perfected in correlation with the complexity acquired by the interests to be safeguarded.

In the Modern Age, as the third stage in the emergence of insurance, the first ones are maritime insurance; in the 19th century, agricultural insurance, accident insurance and civil liability insurance were born, followed by life insurance; and in the 20th century, new branches of aeronautical insurance and civil liability insurance (del Toro Ríos, 1994).

Today it is undeniable that insurance is an important tool for every businessman who is concerned about the financial protection of his enterprise and that it also provides peace of mind for anyone who, in the event of a loss, has the possibility of having his losses compensated (Aguilar Jurado, 2015; Illescas Ortiz, 2014).

Its legal basis is found in two Decree Laws: No. 177/1997 "On the Regulation of Insurance and its Entities" and No. 263/2009 "On the Insurance Contract", both with the rank of law, as well as resolutions issued by the Ministry of Finance and Prices and by the Superintendence of Insurance of Cuba, which constitute the legal framework that currently supports the insurance activity.

For this reason, all insurance enterprises, in addition to the reserves that are common to all types of entities and which form part of their equity and of the provisions or amounts constituted to meet debts and commitments with third parties, also similar to those of companies in other sectors, must set up specific provisions for their activities, which are the so-called technical provisions. These provisions must be constituted and maintained for an amount sufficient to guarantee, in accordance with prudent and reasonable criteria, all the derivative obligations established in the contracts, as well as to maintain the necessary stability of the insurance enterprise in the face of random or cyclical fluctuations in the loss ratio or in the face of possible special risks (Hernández Barros, 2015).

Based on the above, there is a need for the financial operations of insurance enterprises to establish as a practice the creation of technical provisions to meet obligations with policyholders in the event of claims (Ramírez Estrella, 2016). For the life business, the interaction between technical provisions and the solvency margin can cause perverse effects in cases where high doses of prudence in technical provisions lead to an increase in the solvency margin.

The risk of the assets must be included in the capital requirements. Quantitative restrictions can distort portfolio formation (Albarrán Lozano & Alonso González, 2010).

The Pinar del Río Base Business Unit of the National Insurance Enterprise (Esen), selected for this research and which constitutes the context of the present work, has a procedure for the Administration of Technical Provisions (PDO-06), which establishes how the provisions are to be constituted when executing the services offered by Esen, and which is applicable by all the enterprises´ departments when executing the processes of Arrangement, Policy Follow-up and Claim, defined in the Integrated Management System.

In the period 2013-2017, the procedure referred to technical provisions (PDO-06) was limited in scope, mainly due to the impact of more than one severe weather event in the country (drought, heavy rains, hurricane, pests and diseases), mainly in the agricultural line, which led to a high number of claims on contracted policies, generating great expenditures in indemnities and refunds of premiums, directly affecting the financial structure and the presentation of the insurer's financial statements, which also had an impact on the creation and release of technical provisions and the consolidation of the financial statements on a national scale. Hence, it is presented as an insufficiency that the procedure for the administration of the technical provisions of risks in course and technical provisions pending liquidation existing in the entity are not in correspondence with the current needs.

Therefore, the objective of the research is: to propose the modification of the procedure for the administration of technical provisions for risks in progress and provisions pending liquidation in the Unidad Empresarial de Base Seguros Pinar del Río.

Materials and methods

Theoretical methods:

Historical-logical: To know the generalities of insurance in Cuba. Its main concepts, characteristics and elements. Deepening in the emergence, evolution and essence, from the financial point of view, of the technical provisions of insurance risks in the Cuban enterprise.

Analysis and synthesis: For the critical assessment of the theoretical and contextual framework related to the generalities of insurance in Cuba, particularly in the administration of technical provisions for risks in progress and technical provisions for claims pending settlement and in the current procedures.

Systemic-structural: To support the structure of the procedure on technical provisions for risks in progress and technical provisions for claims pending settlement and their proposed changes so as to contribute to their adequate administration.

Empirical methods were used to obtain the information:

Documentary analysis: To ascertain the fundamental aspects that exist in the bibliography in relation to the dimensions and indicators on the financial management of insurance technical provisions.

Interviews: To diagnose the knowledge and interpretations of technicians and specialists on technical provisions for risks in progress and pending insurance settlement.

Results and discussion

The starting point of the proposal was a diagnosis that made it possible to identify those aspects related to the administration of technical provisions and that prevent an efficient management of them in the Base Business Unit (UEB). This was done under the postulates of Vallejos Díaz (2008), defining the objectives of the diagnosis, the determination of needs, definition of the sources of information, design of formats for the collection of information, analysis and processing of the information obtained and the presentation of the results.

During the period 2015-2017, Esen had the incidence of insurance risks throughout the country, with direct impact mainly to the agricultural sector, associated with an intense drought in 2015 for more than 9 months and later, intense rains, pests and diseases in the late 2015 and first four months of 2016, which led to a negative impact on agricultural production. Pinar del Río agriculture was not exempt from this; tobacco, grain, rice and vegetable production were seriously affected, with the insurance enterprise assuming more than 28500 claims for direct impacts of these risks during that period (Esen, 2015-2019).

Gross Revenues in this period (2015-2017) were valued in thousands of pesos (MP), reaching 299 992.45 MP with a growth in 2017 in relation to 2016 of 8%.

Expenses for the creation of ongoing risks totaled 220161.18 MP, representing 73.3 % in relation to Gross Revenues.

The Agent's Commission reached 25887.27 MP, a value that represents 8.6% of the premium income.

Income from Release of Current Risks in this period amounted to 204798.43 MP, which were released by the avos system, a release method that releases the fraction as the contracted policies expire in term or by the direct impact of insurance risks, since it releases what was provisioned as an expense to meet the obligations contracted with the clients, constituting an income that counteracts and influences the financial situation of the insurance enterprise.

Premium refunds in this period amounted to 21869.44 million pesos, mainly due to the non-seeding of tobacco, rice, grains and vegetables.

Indemnifications totaled 332035.12 MP, negatively impacting the insurance lines of: Tobacco 73 % (242884.92 MP), Rice 10 % (33525.03 MP), Grains 4 % (13788.52 MP), Vegetables 3.7 % (12436.80 MP), Seedbeds 1 % (3429.31 MP), Structures and Coverings 2 % (6686.37 MP) and Temporary Life 3 % (11045.21 MP).

Expenses for the Creation of Technical Provisions for Claims Pending Settlement (PTSPL) amounted to 367800.11 MP. Their behavior is directly proportional to indemnities.

Income from Release of Technical Provisions for Claims Pending Settlement amounted to 457233.25 MP; of which 48942.75 MP were classified as Income from Release of Super Claims and 41336.32 MP were classified as Income from Release of Catastrophic Events, these being released by the Central Office in favor of its subsidiary in Pinar del Río, representing 19.7% of the total.

The other expenses of the insurance activity, associated with the enterprises Intermar and Sepsa for the concept of appraisal, risk analysis and assistance, amounted to 4,550.72 million pesos.

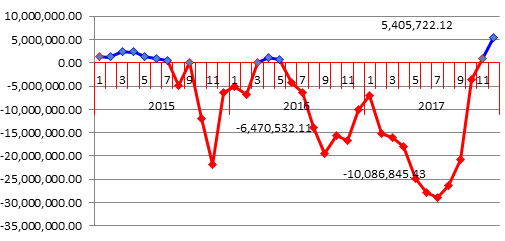

The UEB at the close of the period culminated with a total amount of accumulated losses of Ps. 14,281,354.65, reaffirming that the negative situation of previous years (2015-2016) continued to have its effect in 2017, even though at the close of the 2017 accounting period a favorable result of Ps. 2,276,022.85 is observed, where Indemnity Expenses and Expenses for the Creation of Technical Provisions for Claims Pending Settlement (PTSPL) play an important role.

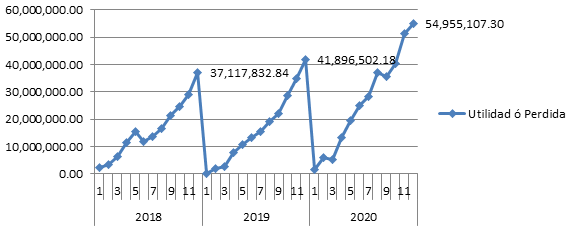

Graph 1 details the behavior by months of the organization's profit, closing in fiscal years 2015 and 2016 in losses.

Analysis of the behavior of the Technical Provisions for Ongoing Risks in the period (2015-2017)

The high volumes of income are concentrated in the last four-month period of each period with values ranging between 9.0 and 23.0 million pesos. This is mainly due to the beginning of the tobacco campaign and the so-called cold season in the various crops, being the tobacco line the one that contributes the most income to UEB together with other lines associated to it, such as: (Seedbeds, Structures and Covers, Existence, among others).

The Expense for the Creation of Provision for Ongoing Risks behaved in a similar way in the period under analysis, with an average of 73% or 73 cents for each peso of gross income, because when the provision is created based on the income obtained by UEB and this income has been high in the last four months, the expense for the creation of ongoing risks grows in the same proportion.

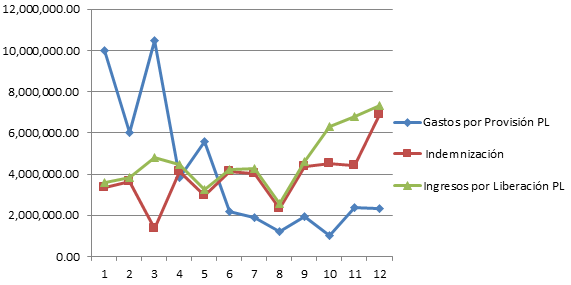

By fiscal year for the period under analysis, the behavior of Indemnities, Creation and release of Technical Provisions for Claims Pending Settlement was as follows:

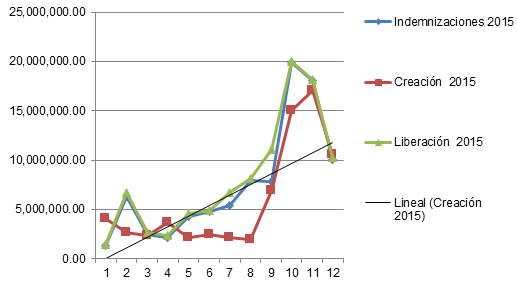

Period 2015

Note that in the last quarter of 2015, according to graph 2, UEB had to disburse heavy amounts related to indemnities between 20 and 10 million pesos and create provision portfolios pending settlement for amounts totaling more than 42 million due to the incidence of rains in the month of December 2015.

Period 2016

In the 2016 fiscal year, the creation of Provision Expenses is mainly located in the months of January and February for amounts over 22 million in January and 8 million in February, created at 100%. Therefore, the largest payments are concentrated between the months of October, November and December, since the entry of payment mandates for each producer to UEB is concentrated and constitutes an essential element at the time of making the adjustment and settlement respectively.

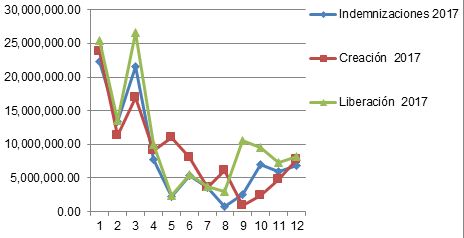

Period 2017

In the first four-month period of 2017, according to graph 3, the insurer continued to cover the obligations with respect to the previous period. Note that the creation until the month of April 2017 covers the differences between what was created in the previous period and the amount of the indemnified and released for this four-month period, having a decreasing behavior until the month of September 2017 where the payment of the 17/17 campaign begins within the same fiscal year. The last quarter of 2017 ended with the values of Indemnification and creation lower than the release of Provisions pending liquidation, which led to a favorable result for UEB, as it closed its fiscal year with a profit.

Proposed Modification to the Technical Provision for Ongoing Risks (PTRC)

In the commercial area of the UEBs, the provision will be managed by product and currency, and in the accounting area it will be recorded by line of business and currency. For the creation, release and recording of the Technical Provision for Ongoing Risks, the following procedure shall be followed:

Management based on the 12 avos method

Creation: It is created for each product based on the gross monthly premiums received by currency and type of insurance, to which the agent's commission, security surcharge and the surcharge for catastrophic risks specific to each product will be deducted.

This is the responsibility of the specialists in the commercial areas:

Notify the Accounting and Finance area of the creation and release of the provision by insurance line and currency.

Print the creation and release report for the month and reconcile it with the reports printed by the accounting area, leaving evidence of such reconciliation and recording the signatures on both documents.

Send to the Operations Management the requested information according to the established schedule.

This would be the initial provision, which will decrease over time.

PRC = PB x (1 - B) x (1 - CA - RS - RC)

Where:

PRC: Current Risk Premium

CA: Agents' Commission, reflected in the technical basis for mediation payment.

RC: Surcharge for catastrophic risks established in the technical base

RS: Safety surcharge derived from the Safety Margin established in the technical basis.

B: Bonus established in the technical basis

Once the Current Risk Premium has been determined, it will constitute the balance of the provision at the beginning of the policy term, i.e., the amount that will be created by the policy. The remaining balance of the provision can be calculated by means of the following expression:

PTRC = PRC * % Discount

% Discount = * 100 T t

T: Total length of time the policy will be in force (measured in days or months)

t: Time elapsed since contracting (measured the same as T)

The result of this operation is what remains as a balance in the provision and, therefore, constitutes a reference for the determination of the amount to be released. The information with the amount to be created will be sent to Accounting and Finance together with the income, by currency and insurance line.

Release: At the end of each month, the corresponding avos will be released from the provision, based on the fact that the first month only one avo will be deducted and the following months two avos will be deducted until the end of the term; the remaining avo will be released the following month after the end of the term.

In the case of travel insurance, the provisioned amount shall be released in full one month after its creation for Travel in, and three months after its creation for Travel out. This information shall be sent monthly to the accounting area by insurance line and currency.

Regardless of the administration method used to ensure that the creation and release operations are carried out correctly and to leave a record at the end of the month, the technical area will take the month's income by product and currency to which the established percentage was applied as appropriate and, with this information, the amount of creation of the provision, release of the month's provision and balance of the resulting provision by insurance line and currency is filled in. This model is the one that allows the reconciliation with Accounting and Finance and the accounting area will deliver to the technical area for such reconciliation the accounts of Creation, Release of the month and the balance of the Provision. Both areas will keep signed copies of these documents as proof of the reconciliation.

This provision is fully released when:

Validity expires

Policy cancellations occur

Total losses

All Travel Insurance policies, a month Travel in and three months Travel out

At the end of the month, the information on this provision will be sent to the Operations Department, which will analyze it and send any errors detected by e-mail.

Even though there are two methods for the creation and release of Ongoing Risks, the proposal to the organization's management would be aimed at homogenizing the use of the 12 avos method in all its subsidiaries, since this allows it to obtain a fraction (Avo) in the release of the provision as it advances in the maturity of the contracted policies. This can have a periodicity in its income while the release in the integral percentages is made at the end of the policy term. Today, of the 17 UEBs, ten use the integral percentage method.

When creating the technical provision for current risk, the gross premium paid is reduced by the percentages established in the technical basis of each product regarding agents' commission, security surcharge and surcharge for catastrophic events.

When surcharges for catastrophic events are analyzed, this is done on the basis of the different classes of insurance, establishing the same surcharge for different lines of insurance within the same class. In the case of agricultural insurance, not all lines of insurance are exposed to catastrophic events at the same intensity, so it would be prudent to open the study by lines in order to differentiate the surcharge for each one, providing more veracity and accuracy.

These analyses should be carried out periodically and not remain static, as they would be far from reality, since catastrophic events do not occur every year, and the accident rate also varies in the different lines, which would influence the percentage to be created.

Proposed Modification to the Technical Provision for Claims Pending Settlement (PTSPL)

The purpose of this provision is to have a scheme to meet liabilities arising from occurred disasters and to avoid financial risks due to the lack of a provisioning system, by declaring profits while having obligations for these disasters. The proposed changes seek a more accurate accounting reflection of the insurer's situation; similar work was carried out by Paule Vianez et al. (2020).

For the constitution and recording of this provision, the following procedure shall be followed:

Claim per customer

Appraisal (Certified Third Parties, Drones, Mixed Groups)

Receipt of Minutes by clients and municipalities

Application of creation percentages according to intensity and impact of risk

Recording of the provision pending liquidation

Creation of compensation files with sufficient and enlightening burdens of proof

Adjustment and settlement procesa

Accounting for compensation and income from release of the provision pending settlement

The criteria for the creation of this provision will depend on the type of insurance being processed, as long as they do not refer to accidents that occurred in previous fiscal years, since such amount must already be created as Pending Accidents to be Declared. By insurance branches, it is as follows:

General Insurance: It will be created with the value reflected in the Inspection and Appraisal Record form, which is part of the claims file.

Personal Insurance: Death Coverage: To be created with the value of the Sum Insured; funeral expenses: to be created with a fixed amount of 1000.00 pesos, as well as Disability (Temporary and Permanent) and Pharmaceutical Expenses: To be created with the resulting value at the time of the loss adjustment.

Agricultural Insurance: The proposed creation of this provision will be subject to the intensity and impact on the policies in force during the period of the loss: the categories will be determined as follows:

Table 1 Percentage of creation according to intensity and risk

| Risk intensity | % creation PTSPL |

|---|---|

| Slight | 100 |

| Severe | 60 |

| Very Severe | 40 |

| Catastrophic | 20 |

Source: Own elaboration

In adverse climatic and/or phytosanitary situations, affecting a large portfolio of policyholders (classified as Severe, Very Severe or Catastrophic), there are considerable amounts of losses and the operational and financial capacity of UEB is exceeded. The director of this entity, after analysis and approval of his Direction Board, may create amounts at or below 60%, as previously defined in the procedure. Taking into consideration the characteristics of the policy (Yield or Investment). This provision will be created according to the valuation of the technical board, taking into account the intensity and magnitude of the damages; it will be made from the amount reflected in the Inspection and Appraisal report, since in this way the amounts reflected are closer to reality, giving the insurer more time to make the pertinent analyses and gather all the information.

It is also recommended the use of relative indexes according to the impact of the risks and loss triangles in times of disasters or a significant increase in claims for a given event, since their response would be much more expeditious, initially covering up to 40% of the losses in the yield policies, depending on the impact and to the extent that the collection of quality and sufficient information to settle their obligations progresses. The remaining amount will be created at the time of the loss adjustment.

In the following months, to the extent that the aforementioned situations improve and after analysis by its Board of Directors, UEB must adjust these creations until it reaches the established minimum of 60%.

In no case may the UEB that presents accumulated creations of less than 60% obtain an actual profit greater than that planned for each month.

Payments for third party services related to the claim process will also be part of this provision and the corresponding provision will be created when such services are requested and will be released upon payment, i.e., upon receipt and posting of the invoice.

If the computer system does not process the administration of provisions, the main specialist will deliver this information digitally to the Accounting and Finance area, by municipality, insured and currency, each time there is a movement, which will be reconciled in writing with accounting at the end of the month. Whenever there is an adjustment, reference shall be made in the field referring to the claim number and the adjustment that gave rise to it. In all cases, if prior to the date of adjustment of the loss it is known that the loss will be less than that created, the appropriate amount shall be released.

Release: It will be made once the indemnity payment has been made. When the insured party, for reasons beyond his/her control, does not comply with the obligation to deliver to UEB the proofs required in each of the policies within the terms established, the provision created shall be released, which shall be recreated when all the documents are provided and released when the payments are made, leaving written evidence duly signed by the director of UEB of this procedure.

The same shall apply when the indemnity is not collected and is returned to UEB. In all cases, there must be a written record of the reconciliation between the technical area and accounting. Periodically the UEB's Management area will inform the Accounting area of the movement of this provision.

Preparation of claim files

Receipt of notices of loss and appraisal reports

Receipt of the burden of proof

Preparation of files

Loss adjustment

Preparation of the Indemnity Claim

Delivery of checks and release of liability

Receipt of relays of responsibility

The claim files will be ready for adjustment when all the requested information containing the notices, appraisal reports and requested proofs are submitted, with UEB counting 30 days for settlement.

Burdens are the documents provided by the insured to prove the occurrence of the loss, for example:

Harvest settlements

Affidavit

Plant health certifications

Estimate of quintals and sticks for putting tobacco leaves

Demolition authorization letters

Certification from the Ministry of Science, Technology and Environment (Citma)

Seeding certification

Others according to risk behavior

Other complementary actions to improve the quality and efficiency of insurance.

To begin the consultation process in May

Yield certifications will be requested from the enterprises when deemed necessary (mandatory when yields are higher than 1.57 t/ha in sun tobacco and 1.47 t/ha in covered tobacco).

Submit insurance applications to the bank branch in the first ten days of July.

It is the legal agent's responsibility to ensure that producers have insurance protection when planting and to avoid unnecessary premium refunds.

Review in October of all agreements and request the necessary endorsements.

UEB's new review of the concertation in November and December

Actions aimed at facilitating the appraisal procedure linked to third party services (Sepsa, Intermar and Citma)

Verify if the person making the claim is the same as the insured.

Check if the necessary information is available to carry out the inspection according to the type of insurance and its modality.

Verify the date of occurrence of the accident.

Verify if the loss corresponds to the risk for which it is claimed or if there is the concurrence of any other risk.

Identification of the damaged property: Essential elements for a correct appraisal: date of sowing, variety, crop regime and sowing distance, area actually sown, regardless of the area declared as insured. If necessary, the entire area should be measured. It is advisable to make a sketch of the total area, specifying the shape of the area and its location with respect to the cardinal points. Check whether the lost or damaged animals correspond to those insured.

If a difference is detected between the actual number of animals and the number appearing on the policy, the corresponding recommendation for a proposed endorsement will be reflected in the inspection report.

Identification of the disaster: It is necessary to make it clear which is the risk responsible for the damage, which must be one of the risks covered by the policy in question. If this is not the case, the client's representative in the territory should be informed of this situation in order to confirm the client's interest in carrying out the inspection.

Justification of the disaster: This consists of providing information to demonstrate the magnitude of the loss. It is very important to specify the date or period of occurrence of the loss, which must correspond to the date of the loss. In this regard, it is necessary to collect data that support the incidence of the loss and its comparison with the last 3-5 years. In cases where the official cannot identify a pest or disease that is attacking a certain plantation or when there are discrepancies with the inspected party as to the identification of the same, the latter will be asked to present the Plant Health Certificate. In the case of Livestock Goods, the Veterinary Certificate of the death or slaughter of each animal will always be requested, which must contain the identification of the animal or category, sex, date of the loss, cause of the loss, stamp of the Livestock Registry, complete name and signature of the veterinarian. In the affectations to patrimonial goods.

When deemed necessary, certifications from the local Civil Defense or National Revolutionary Police Unit will be requested.

Measurement of the affected area: In the case of Agricultural Properties, when the affectation is partial, it is necessary to proceed to measure the affected area. In the event that due to its extension it is not possible to carry out the measurement, plans, maps or cadastral information in possession of the insured or of the entity or enterprise to which it is subordinated shall be used, indicating in the documentation the source of the data. The general sketch of the area shall indicate the area that has been affected.

Sampling: Depending on the size and shape of the affected area, samples will be taken.

Compliance with the agreed cycles of 10 days from the notice of loss and five working days to deliver and dispatch the appraisal reports to UEB.

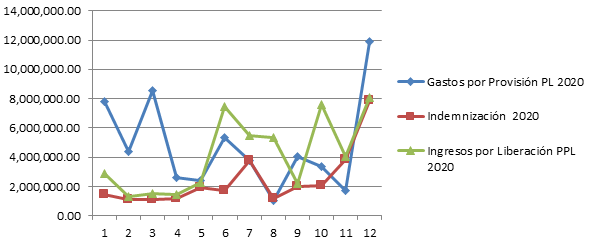

If the comparison of the two three-year periods is analyzed, it can be pointed out that there are common points in these, referring to the periods of higher income, where the last four-month period is the most relevant, in addition, the release of risks in progress has a more stable behavior in the period 2018-2020, due to the lower occurrence, frequency and impact of insurance risks, as well as in the stability, in the processing of income. The notable differences in the first quarter are found in the revenues from Release Risks in Course, since during 2016 and 2017 it was necessary to advance the release to cover the operational losses of the insurer.

Note during the first four-month period the release of the risks in progress according to the expiration of the policies subscribed in relation to the previous year, being the last four-month period the one with the highest monthly income due to the incidence of the Tobacco and cold campaigns in relation to miscellaneous crops. There is stability in the renewal of policies and new subscriptions in 2018 and 2019. In 2020, there is a contraction related to the effects on the agriculture sector related to inputs and energy carriers aimed at the Tobacco and Cold Campaign, which affects the sowing of more than 12,000 ha (Esen, 2015-2019).

In order to counteract the effects derived from the affectations, emphasis was placed on the quality of risk analyses and underwriting by the Legal Agents, as well as greater supervision by the assistant Brigade Chiefs and Territorial Sales Representative; follow-up visits increased by 25%, reaching 3,500, as well as the materialization of new underwriting directed at miscellaneous crops in the actual conditions of the producers, which avoids underinsurance and super insurance.

The creation percentages applied on average, 75%, are adjusted and cover without difficulty the administration operations of the insurer for each of the types of services it markets. In addition to a greater presence in the media, promoting and training on the advantages of insurance.

Premium refunds in this period amounted to 4772.48 MP, mainly as a result of the non-planting of the Tobacco and Rice lines, respectively.

Indemnifications totaled 109484.57 MP, negatively impacting the insurance lines of: Tobacco 17 %, Rice 16 %, Temporary Life 15.2 %, Grains 8 %, Vegetables 5.8 %, Seedbeds 1 %, Structures and Covers 3 %.

Total expenses for the Creation of Technical Provisions for Claims Pending Settlement amounted to 165323.43 MP. The risks that had the greatest impact in that period were intense rains with 90%, associated with tropical storms; the other incidences are framed in pests, diseases and strong winds. Similar studies were carried out by Ramírez Estrella (2016) in the calculation of the provision of outstanding claims.

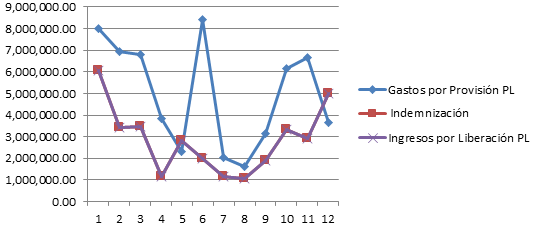

The following graphs reflect the behavior by year:

It can be seen in graphs 4, 5 and 6 that there is a prevalence of disasters in the first quarter of each year associated with heavy rainfall events, which generated claims in the agricultural sector, mainly affecting tobacco, rice, grains and vegetables. During this period, a little more than 7500 claims were generated in the agricultural sector alone. The creation of provisions pending liquidation was recorded at between 40% and 60%, depending on the intensity and damage caused.

The modification was partially validated within the framework of the effects and impact of the risks associated with tropical storms "Alberto", "Laura" and "Eta", with the recording in the financial statements of expenses for creation in the provision pending liquidation of more accurate loss estimates, based on the appraisals made by the Third Parties and not on the claim issued by the producers. During the adjustment and liquidation process, it was also noted that expenses were reduced, there is a better financial balance and the balance sheet reflects a more accurate economic reality, with no major deviations with respect to the rest of the indicators, and only the financing necessary to cover short and medium-term obligations is retained.

Income from the Release of Technical Provisions for Claims Pending Settlement amounted to 146541.22 million pesos, and no income was released in this period for claims deviation or catastrophes.

A key factor aimed at efficiency and effectiveness in the claims, adjustment and settlement process is the performance of third parties and the actions implemented at Intermar, Sepsa and Citma, which provide the insurer with more accurate information, with more realistic estimates.

In addition, an electronic compensation procedure was implemented in the organization for agricultural producers grouped in Credit and Service Cooperatives (CCS), Agricultural Production Cooperatives (CPA) and Basic Units of Cooperative Production (UBPC), which is transversal, obtaining the following results:

Of the total indemnities in the period 2017-2019, 109.8 million pesos are indemnified, using the new procedure, which constitutes 67.7% of the indemnified amount (162.7 million pesos) in 1507 accounting transactions.

During this period, 12750 producers associated with 216 CCSs, 20 UBPCs, 35 CPAs, 8 municipal agricultural enterprises and 2 state agricultural enterprises benefited.

On average, indemnity payments are reduced by 20 days after the completion of the indemnity file (30 days expected), which has an impact on the insurer's efficiency.

Decrease of 90 % in expired checks in the hands of customers for compensation.

Increased work productivity, substantial savings in time spent moving, reconciliation and presentation to the bank by clients.

Savings in office material and energy carriers.

Improved decision making on the disposition and control of financial resources.

Improved traceability and chain of control to final destination.

Improved management of credit and interest repayment by banking institutions in relation to their customers.

UEB at the close of the 2018-2020 period culminated with a total amount of accumulated profit of 136637.17 MP; graph 7 shows the profit behavior by months in the 2018-2020 period.

Another element to highlight was that, since there was a better estimate in the loss portfolio, it favorably influenced the timely decision making to finance these, since only the necessary monetary resource was immobilized, allocating the temporarily free funds to the financial yield in quarterly installments at the current interest rate approved by the Central Bank of Cuba. This generated from 2019-2020 income amounting to 971.20 MP with fixed-term funds amounting to 60000.00 MP.

The administration of technical provisions is a pillar for the optimum performance of insurance companies; it is based on the need to accrue the typical income and expenses of these, charging to each fiscal year or period those that really correspond to them, with an efficient management and administration of risks, promoting the use of information techniques and technologies for their processing, which provides substantial improvements in the estimation and prediction of these, improving decision making and the efficiency of the processes in the key result areas of the organization.

The realization of the diagnosis to ascertain the problem, based on the application of instruments and consultation of primary and secondary sources in the period 2015-2017, made it possible to know the situation presented by UEB Pinar del Río in relation to the administration of technical insurance provisions, taking into account the existing procedure and demonstrating the need to propose modifications to it.

The proposed modification to procedure PDO-06 on the management of technical provisions ratifies the need for changes, which will enable a more efficient management of these provisions, improving the estimation, recording and presentation in the financial statements, timely improvement in financial decision-making, together with complementary actions in the key results processes, leading to greater efficiency and effectiveness in the organization.

Referencias bibliográficas

Aguilar Jurado, M. Á. (2015). Métodos para la estimación de Provisiones Técnicas de Seguros de No Vida. Universidad de Granada. [ Links ]

Albarrán Lozano, I., & Alonso González, P. (2010). Métodos estocásticos de la estimación de las provisiones técnicas en el marco de Solvencia II. Fundación MAPFRE. https://app.mapfre.com/ccm/content/documentos/fundacion/cs-seguro/libros/Metodos_estocasticos_de_estimacion_de_las_provisiones_tecnicas_en_el_marco_de_Solvencia_II.pdf [ Links ]

Consejo de Estado de la República de Cuba. (1997). Decreto-Ley No. 177 Sobre el Ordenamiento del Seguro y sus Entidades. http://www.esicuba.cu/index.php/legislacion-nacional/seguro-en-cuba/decreto-ley-no-177 [ Links ]

del Toro Ríos, J. C. (1994). Curso Básico de Seguros. Asociación Argentina de Productores Asesores de Seguros. [ Links ]

Esen. (2015-2019). Informes estadísticos y registros contables del período 2015-2019 de Pinar del Río. Empresa de Seguros Nacionales. [ Links ]

Hernández Barros, R. (2015). Los riesgos de las entidades aseguradoras en el marco del Enterprise Risk Management (ERM) y el control interno. Innovar, 25(1Spe), 61-70. https://doi.org/10.15446/innovar.v25n1Spe.53194 [ Links ]

Illescas Ortiz, R. (2014). Principios fundamentales del Contrato de Seguro. Revista Española de Seguros, (157), 7-20. https://dialnet.unirioja.es/servlet/articulo?codigo=4728779 [ Links ]

Ministerio de Finanzas y Precios. (2009). Decreto Ley No. 263 Del Contrato de Seguro. http://www.esicuba.cu/index.php/legislacion-nacional/seguro-en-cuba/decreto-ley-no-263 [ Links ]

Paule Vianez, J., Coca Pérez, J. L., & Granado Sánchez, M. (2020). Análisis comparativo de metodologías para la cuantificación de provisiones técnicas en entidades aseguradoras. Adaptación a Solvencia II. Revista Mexicana de Economía y Finanzas, 15(3), 313-329. https://doi.org/10.21919/remef.v15i3.377 [ Links ]

Ramírez Estrella, M. A. (2016). Método global de cálculo de la provisión de siniestros pendientes, a partir de la utilización de la información histórica completa e incompleta de una compañía de seguros. Escuela Superior Politécnica del Litoral. [ Links ]

Vallejos Díaz, Y. A. (2008). Forma de hacer un diagnóstico en la investigación científica. Perspectiva holística. Teoría y praxis investigativa, 3(2), 11-22. https://dialnet.unirioja.es/servlet/articulo?codigo=3700944 [ Links ]

Received: January 19, 2022; Accepted: December 15, 2022

texto en

texto en