INTRODUCTION

Adoption of fair normative legal acts related to taxes is one of the important strategic directions of the state policy. Income tax paid by individuals plays an important role in the tax system. Income means profit. The source of all taxes is income. In the practice of countries around the world, income is taxed under different names at the stage of formation. The most common form is income tax. The place and role of taxes in the state budget, their significant share in ensuring public expenditures make their classification necessary. The classification of this or that tax allows to determine more precisely the essence and content of that tax. Despite the diversity of taxes and the importance of each of them in the formation of state revenues, personal income tax has a special place among all these taxes.

In 1991 as a result of the collapse of the USSR, former Soviet republics gained independence and all former republics, as well as, the Republic of Azerbaijan gradually began to adopt regulatory legal acts regulating tax relations. The Law of the Republic of Azerbaijan “On income tax from physical persons in the Republic of Azerbaijan” consisting of 18 articles, adopted on June 24, 1992 and entered into force on July 1, 1992, invalidated the former law of the USSR «On income tax of citizens of the USSR, foreign citizens and stateless persons» dated April 23, 1990 (The Law of the Union of Soviet Socialist Republics «On income tax from citizens of the USSR, foreign citizens and stateless persons» of April 23, 1990).

The decision of the Milli Mejlis (Milli Mejlis-Parliament of the Republic of Azerbaijan) on the enactment of the Law of the Republic of Azerbaijan «On the Income Tax from Individuals in the Republic of Azerbaijan» stated that from July1, 1992 single, lonely citizens and small families should not be subjected to taxation in the Republic of Azerbaijan. Taxation of single, lonely citizens and small families in the Republic of Azerbaijan must be terminated.

The first and second parts of Article 1 called «Taxpayers» of the aforementioned Law states: «The income taxpayers in the Republic of Azerbaijan shall be permanent and non-permanent citizens of the Republic of Azerbaijan, foreign citizens and stateless persons».

«The physical person shall be recognized as permanent resident who actually was on the territory of the Republic of Azerbaijan for a total of more than 183 days during any 12-month period ending in a calendar year» (The Law of the Republic of Azerbaijan «On the Income Tax from Individuals in the Republic of Azerbaijan» dated June 24, 1992); Article 6 of the same Law provides for the first time the taxation of monthly income, as well as the taxation of annual gross income. One more innovation was the development of annual gross income statement for taxpayers.

Another feature of the deduction of income tax from physical persons is the inadmissibility of paying this tax by someone other than the taxpayer. That is, the tax is calculated only for personal income of citizens of the Republic of Azerbaijan, both permanent and non-permanent place of residence in the Republic of Azerbaijan, foreign citizens and stateless persons and paid according to this income.

Physical persons’ income tax is a progressive tax, in other words, the tax rate increases as income increases. In accordance with Article 6 entitled «Tax rates» of the Law of the Republic of Azerbaijan «On income tax from physical persons in the Republic of Azerbaijan» the rate of income tax is defined from 12 % to 55 %. There was no tax on the minimum wage and other income of citizens.

The minimum wage was set at 250 manats (2,500 rubles) in the territory of the Republic of Azerbaijan since December 1, 1992 (the national currency of the independent Republic of Azerbaijan - manat was introduced in 1992 and replaced the Soviet ruble at a rate of 10 rubles to 1 manat).

In accordance with the Law dated June 24, 1992, income earned by physical persons outside the Republic of Azerbaijan is included in the taxable income in the Republic of Azerbaijan. In accordance with the legislation of foreign countries, the amount of income tax paid by these physical persons was taken into account whilst taxing in the Republic of Azerbaijan.

According to the rules of transfer of taxes to the budget, the tax calculated from the income of physical persons was transferred directly to the budget from the income of these physical persons. It was not allowed to pay the income tax of physical persons at the expense of enterprises, offices and organizations.

Determining the upper income tax rate to 55% run counter to sound logic, and the existence of such a high tax rate led to the concealment of income by physical persons. The rich experience of developed countries shows that the increase in the income tax of physical persons can be realized, first of all, with these factors - economic development, full employment and the growth of national income, which were not existed in Azerbaijan in 1992.

After June 1993, fundamental reforms were made in all spheres, as well as in the tax system in the Republic of Azerbaijan. In 1995, December, the Law of the Republic of Azerbaijan «On Physical Persons Income Tax» was amended and from April 1, 1996 the maximum income tax rate was reduced by 15 % and was fixed at 40 %.

On July 11, 2000, the Tax Code of the Republic of Azerbaijan was adopted and entered into force on 1 January 2001 (Tax Code of the Republic of Azerbaijan). The previous Law of the Republic of Azerbaijan «On income tax from physial persons in the Republic of Azerbaijan» dated June 24, 1992 lost his force.

General principles of taxation of the income tax of physical persons in the Republic of Azerbaijan are set out in Chapter VIII (Articles 95-102) and Chapter X (Articles 107-152) of the Tax Code of the Republic of Azerbaijan, which came into force on January 1, 2001. Income tax from physical persons covers different sources of income and involves taxation of relevant areas of their activities. According to Article 95 of the Tax Code, taxpayers of income tax are resident and non-resident physical persons.

In the tax law, a resident shall be a physical person or a legal person domiciled in that country. A physical person shall be considered a resident of that country if he or she has lived in the same country for more than 6 months in a calendar year.

The contents of Article 95 of the Tax Code make it clear that citizens of the Republic of Azerbaijan, foreign nationals and stateless persons who receive income from activities in the territory of Azerbaijan shall be payers of the income tax.

In accordance with the principle of equality, citizens of the Republic of Azerbaijan and foreign citizens bear equal tax liability before the state budget of the Republic of Azerbaijan.

According to Article 13.2.3 of the Tax Code, physical persons shall be considered citizens of the Republic of Azerbaijan, foreigners and stateless persons. According to Article 13.2.5.1 of the Tax Code, any physical person who meets one of the following requirements shall be considered a resident:

who actually was on the territory of the Republic of Azerbaijan for a total of more than 182 days in a calendar year;

was in the State service abroad for the Republic of Azerbaijan during the calendar year or within one calendar year;

if physical person’s period of stay on the territory of Azerbaijan Republic and foreign state (in any) does not exceed the period of 182 days this physical person shall be deemed as the resident of the Azerbaijan Republic based on criteria set in following order:

According to the Article 13.2.5.2 of the Tax Code the physical person shall be recognized as non-resident of the Azerbaijan Republic from the last day of his stay on the territory of Azerbaijan Republic during the tax year, until the end of this tax year only if this person is non-resident of Azerbaijan Republic in the following tax year.

According to the Article 13.2.6 of the Tax Code of the Republic of Azerbaijan non-resident physical persons shall be:

persons holding diplomatic or consular status on the territory of Azerbaijan Republic, or family members of such persons;

staff members of international organizations that had passed the appropriate state registration on the territory of Azerbaijan Republic or person on the national service of foreign country in the Azerbaijan Republic, as well as their family members;

person passing from one foreign country to another through the territory of the Republic of Azerbaijan.

Since January 1, 2001, the income tax rate of physical persons has been lowered, and it had been determined that the tax would be deducted from 12 to 35 percent (Article 101 of the Tax Code of the Republic of Azerbaijan).

According to the Law of the Republic of Azerbaijan dated June 19, 2009 «On Amendments and Additions to the Tax Code of the Republic of Azerbaijan», the rate of income tax from physical persons is reduced by 14 % to 30 % from January 1, 2010 and according to the Law of the Republic of Azerbaijan dated December 21, 2012 «On Additions and Amendments to the Tax Code of the Republic of Azerbaijan» the rate of income tax from physical persons is reduced by 14 % to 25 % from January 1, 2013.

From January 1, 2013, the income tax on physical persons in the Republic of Azerbaijan was as following:

Amount of monthly taxable income to 2500 manats shall be at 14 per cent, amount of monthly taxable income over 2500 manats shall be 350 manats +25 % of the amount exceeding 2500 manats.

The annual income from non-business activity shall be taxed at following rates:

Amount of taxable annual income to 30000 manats at 14 per cent, amount of taxable annual income over 30000 manats - 4200 manats + 25 % of the amount exceeding 30000 manats

Taxable income of individuals engaged in business activities without establishing a legal entity is taxed at a rate of 20 percent.

From the subject of taxation established in respect of private notaries by the second paragraph of Article 96.1 of this Code, tax is withheld at a rate of 10 percent (Private notary activity in the Republic of Azerbaijan started in August 2010. At that time only state notary offices were operating).

From January 1, 2019, the income tax of physical persons is subject to the following provisions of Article 101.1-1 of the Tax Code:

Amount of monthly taxable income to 2500 manats shall be at 14 per cent;

Amount of monthly taxable income over 2500 manats shall be 350 manats +25 % of the amount exceeding 2500 manats;

Employment income to be exempted from physical person’s income tax for seven years as from 1 January 2019 for employees of the non-public and non-oil and gas sectors shall be as the following: Monthly Taxable Income Tax Rates Up to 8000 AZN (eight thousand) at 0 %, over 8000 AZN (eight thousand) 14% of the amount exceeding 8000 AZN (eight thousand);

The annual income from non-business activity shall be taxed at 14 per cent.

Taxable income of individuals engaged in business activities without establishing a legal entity shall be taxed at a rate of 20 %.

From the subject of taxation established in respect of private notaries by the second paragraph of Article 96.1 of the Tax Code, tax is withheld at a rate of 10 %.

According to the Article 102.1.6 of the Tax Code of the Republic of Azerbaijan if monthly income, gained in connection with a paid job at the main workplace (where the labor record is maintained) of a physical person is up to 2500 (two thousand five hundred) mantas - 200 (two hundred) manats shall be exempted from income tax and if annual income gained in connection with a paid job at the main workplace (where the labor record is maintained) of a physical person is up to 30000 (thirty thousand) in the amount of 2400 (two thousand four hundred) manats shall be exempted form income tax.

Articles 96-99 of the Tax Code specify the range of objects subject to income tax for residents and non-residents. Thus, the object of taxation on the income of residents is the taxable income, which is the difference between the total income of residents for the tax year and the amount of income deducted by the Tax Code for the same period.

The payment (excluding expenses) for notarial acts carried out by private notary within one month, as well as for services provided in connection with a notarial acts shall be a subject to taxation.

Where there is a tax at the source of payment, the object of taxation is taxable income.

A non-resident taxpayer engaged in activity in the Republic of Azerbaijan through a permanent establishment should be a payer of income tax with regard to taxable income connected with the permanent establishment. Taxable income shall be a difference between gross income generated in a specific period from Azerbaijani sources with regard to the permanent establishment and the amount of expenses with respect to the generation of said income during that period.

A non-resident physical person receiving employment income or income from the transfer of property shall be a payer of income tax with regard to gross income for the calendar year from a source in the Republic of Azerbaijan, reduced by the amount that are attributable to the income for that period, stipulated by the Tax Code.

Income shall cover:

income received as the result of employment;

income from activity which is not connected with employment;

all other kinds of income except for tax-exempt income and gain arising from the revaluation of fixed assets (funds).

Any payments or benefits received by a physical person from employment shall be income received in the form of salaries and wages.

Income from activity that is not connected with employment shall consist of incomes from entrepreneurial and non-entrepreneurial activity:

Income tax from the incomes of physical persons, working under contracts in two or more places, shall be calculated separately from the amount paid by each employer, and paid to the state budget.

Apparently, according to the legislation in force in the Republic of Azerbaijan, the lowest tax rate among all taxpayers as a physical person, has been set for private notaries. Thus from 1 January, 2013, the payment (excluding expenses) for notarial acts carried out by private notary within one month, as well as for services provided in connection with notarial acts is subject to taxation at a rate of 10 percent. Taking into consideration that the amount of payment for notarial acts carried out by private notary within one month, as well as for services provided in connection with notarial acts is 50000 (fifty thousand) or more than 50000 (fifty thousand), the amount of taxes paid to the state budget is quite low. For example, for notarial acts, as well as for notary services within a month, a private notary collects 50000 (fifty thousand) manats. After paying only 10 % of this amount, ie 5000 (five thousand) manats as a tax to the state budget, the private notary retains 45000 (forty-five thousand) manats. After deducting all the other expenditures of the notary (employee salaries, utility services and social insurance) from the 45000 (forty-five thousand) manats a large amount of money left for private notary. Thus, the amount of funds spent by a private notary to pay salaries and utility services for 1 (one) month is a maximum is 3000 (three thousand). In addition, according to Article 14.5.3 of the Law of the Republic of Azerbaijan of February 18, 1997 «On social insurance» private notaries pay 25 % of the minimum monthly wage, ie 625 manat as compulsory state social insurance fees (The Law of the Republic of Azerbaijan «On Social Insurance» dated February 18, 1997). Thus,the income of a private notary collected for notarial acts, will be about 41375 (forty-one thousand three hundred seventy five) manats (this amount is equivalent to 24338 USD (twenty-four thousand three hundred thirty eight US dollars). As we can see, the monthly salary of a private notary is quite high in the Republic of Azerbaijan. I would also like to point out that according to the Law of the Republic of Azerbaijan of November 26, 1999 «On Notary» notary activity shall not be considered as entrepreneurial activity. Article 3 (part 5) of the Law «On Notary» envisages: «Notary is prohibited to be engaged in entrepreneur activities and perform other paid works, with exception of scientific, pedagogical and creative actions» (The Law of the Republic of Azerbaijan “On Notary” dated November 26, 1999). Based on the foregoing, it would be advisable to amend Article 101.4 of the Tax Code of the Republic of Azerbaijan as the following “From the subject of taxation established in respect of private notaries by the second paragraph of Article 96.1 of this Code, tax is withheld at a rate of 60 percent”. If suggested amendment takes place in the Article 101.4 of the Tax Code of the Republic of Azerbaijan, the amount of tax paid to the state budget from the money collected by private notaries for the notary actions and notary services within one month, will be significantly increased.

It is also important to note that even if the subject of taxation established in respect of private notaries by the second paragraph of Article 96.1 of the Tax Code, tax is withheld at a rate of 60 percent,the monthly salary of a private notary will be quite high.

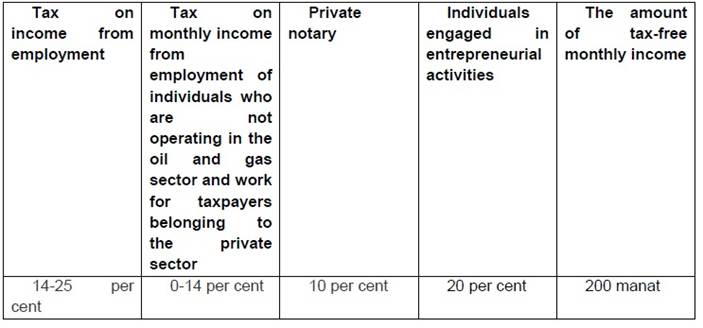

At present, the tax legislation of the Republic of Azerbaijan defines the rates of monthly personal income tax as in the table below.

See the following examples:

Example 1:A private notary working in the notary's office in № in Baku, has collected 50000 (fifty thousand) manats for notary services. After paying 60% of this amount, ie 30000 (thirty thousand) manats as a tax to the state budget, the private notary retains 20000 (twenty thousand) manats. The private notary's employees salary, the amount of payment for utility services es and compulsory state social insurance is 3625 (three thousand six hundred twenty five) manat (3000 manat for employees' salaries and utility services, 625 manat for compulsory state social insurance). After deduction of all expenses, lets calculate the amount of money left: 20000 (twenty thousand) - 3625 (three thousand six hundred twenty five) = 16375 (sixteen thousand three hundred seventy five) manats. Thus, the profit of a private notary within one month (after deducting all costs) will be approximately 16,375 (sixteen thousand three hundred seventy five) manats.

Example 2: A private notary operating at ASAN Service Center № …… in Baku has collected over 70000 (seventy thousand) manats for notary services. After paying 60 percent of this amount, that is 42000 (forty two thousand) manats as a tax to the state budget, the private notary retains 28000 (twenty eight thousand) manats. The private notary's employees salary, the amount of payment for utility services es and compulsory state social insurance is 3625 (three thousand six hundred twenty five) manats. Let’s calculate the amount of money left to the private notary after deducting all costs: 28000 (twenty eight thousand) - 3625 (three thousand six hundred twenty five) = 24375 (twenty four thousand three hundred seventy five). Thus, the profit of a private notary within one month (after deducting all costs) will be approximately twenty-four thousand three hundred seventy-five manats (It is equal to 14338 US Dollars (fourteen thousand three hundred thirty-eight US dollars).

One can see that even if the tax for a private notary is established at the rate of 60 (sixty) percent of the taxable item specified in the second paragraph of Article 96.1 of the Tax Code is to be applied, the monthly salary of a private notary will be quite high.

Let's look at examples of income tax payments from other physical persons.

Example 1: A physical person working in the State Committee for Urban Planning and Architecture of the Republic of Azerbaijan earns 850 manat. According to Article 102.1.6 of the Tax Code, since 200 manat is exempted from income tax, the income tax will be 650x14 per cent = 91 manat.

Example 2: The enterprise has provided 80 (eighty) manats worth of food to each employee on the occasion of the holiday. In this case 80 (eighty) manat should be taken into account in the gross income of each employee and must be subject to income tax.

Example 3: An enterprise purchased at is own expense a train ticket in the amount of 180 manat for an employee’s vacation abroad and paid an income tax at its cost. In this case, the employee's gross income includes not only the cost of the train ticket but also the amount of income tax paid by the enterprise.

Example 4: In May 2019, the company paid for its employee 1200 manat annual tuition fee to the institution of higher education. The monthly salary of the employee is 700 manat. According to Article 102.1.3.1 of the Tax Code, up to 1000 manat of the subsidy to pay for education during the calendar year is exempted from income tax.

Thus, the taxable monthly income of an employee in May is 700-200 (according to article 102.1.6 of the Tax Code, if the individual's monthly income from any paid job at the principal place of employment is 2500 manat, 200 manat is exempted from income tax) + (1200-1000) = 700 manat. That is, the employee in May will pay 14 percent of the 700 manat, i.e. - 84 manat.

Example 5: In August 2019, the company transferred 2400 manat to the bank account of hospital in Ankara for treatment of its employee in the Republic of Turkey (at the exchange rate of 2400 Azerbaijani manat to Turkish liras set by the Central Bank of the Republic of Azerbaijan). The monthly salary of an employee is 800 manat. According to Article 102.1.3.1 of the Tax Code, to cover treatment costs abroad during the calendar year, part of the financial aid up to 2000 manat is exempted from income tax. This means that the taxable monthly income of an employee in August will be 600 (200 manats is exempted from income tax) + (2400-2000) = 1000 manat. That is, the employee will pay in August 140 manat-14% of the 1,000 manat

Example 6. The physical person let his apartment in Baku to the citizen of Russia for 6,000 (six thousand) manats for 1 year. In this case, an annual income of the physical person gained in the amount of 6,000 manat from rent is considered to be income from non-entrepreneurial activity and physical person has to pay income tax of 6,000x14 per cent=840 (eight hundred forty) manat.

For the purpose of improvement of the banking sector’s activity in the Republic of Azerbaijan, contributing to the social protection policy of the country to keep the income of citizens at their disposal and for the purpose of forming of interests in citizens to place deposits in banks Article 102.1.22 of the Tax Code, as amended by the Law of the Republic of Azerbaijan dated January 19, 2016 «On Amendments to the Tax Code of the Republic of Azerbaijan» is included in the following edition:

Annual interest income paid on deposits of physical persons by the local bank and a branch of a foreign bank operating in the Republic of Azerbaijan, divident paid by emitent for investment securities, discounts and interest income shall be exempted from income tax for a period of 3 (three) years as from February 1, 2016.

By the Law of the Republic of Azerbaijan dated December 16, 2016 «On Amendments to the Tax Code of the Republic of Azerbaijan» in Article 102.1.22 of the Tax Code the word «3 (three)» is substituted with the word «7 (seven)».

It is possible that a physical person may be a resident of the Republic of Azerbaijan, as well as a resident of any foreign country. If there is a Convention between that State and the Republic of Azerbaijan concerning the elimination of double taxation and the prevention of tax evasion, the provisions of this Convention shall prevail.

Because, in accordance with Article 151 of the Constitution of the Republic of Azerbaijan, if there is a contradiction between the normative legal acts of the Republic of Azerbaijan (except for the Constitution of the Republic of Azerbaijan and acts adopted by referendum) and international treaties to which the Republic of Azerbaijan is a party, these international treaties shall be applied (Constitution of the Republic of Azerbaijan).

Article 2.5 of the Tax Code of the Republic of Azerbaijan states: Should any international treaty to which the Republic of Azerbaijan is a party provide for regulations that differ from those contained in this Code and legislative acts established on taxes, the provisions of said international treaties shall govern.

Article 2.6 of the Tax Code of the Republic of Azerbaijan states: If international treaty with the intention of avoiding double taxation to which Azerbaijan Republic is the party applied by any person, who is not the resident of the state that entered into such treaty for the purpose of obtaining tax privileges, provisions of article 2.5 of this Code shall not be applied for the purposes of tax privileges to the resident of the state that is the party to such treaty.

The Resolution of the Board of the Ministry of Taxes of the Republic of Azerbaijan No. 1717050000009300 dated June 12, 2017 approved «Rules for the Administration of International Agreements on the Avoidance of Double Taxation Between the Republic of Azerbaijan and Other Countries» (The Resolution of the Board of the Ministry of Taxes of the Republic of Azerbaijan No. 1717050000009300 dated June 12, 2017).

For example, paragraphs a, b, c, and d of the Second Part of the Article 4 of the Convention «On Avoidance of Double Taxation and the Prevention of Fiscal Evasion between the Government of the Republic of Azerbaijan and the Government of Canada» signed on September 7, 2004, and entered into force on 23 January 2006 (this Convention is effective as of January 1, 2007) states:

A person shall be deemed to be a resident only of the State in which he has a permanent home. If he has a permanent home available to him in both States, he shall be deemed to be a resident only of the State with which his personal and economic relations are closer (center of vital interests); if he has no permanent home in either of the States, or he or she does not have a permanent home in any of the States, he shall be deemed to be a resident only of the State in which he is resident; if he has an habitual abode in both States or in neither of them, he shall be deemed to be a resident only of the State of which he is a national; if the individual is a national of both Contracting States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement (The law of the Republic of Azerbaijan of December 30, 2005 On Ratification of the Protocol and Convention “On Avoidance of Double Taxation and the Prevention of Fiscal Evasion between the Government of the Republic of Azerbaijan and the Government of Canada”).

The same rule is highlighted in the second part of the Article 4 of the Convention «Avoidance of Double taxation and prevention of fiscal evasion with respect to taxes on income and capital gains between the Government of the Republic of Azerbaijan and the Government of the United Kingdom of Great Britain and Northern Ireland», which is consisted of 29 articles, signed on February 23, 1994, and entered into force on 29 September 1995.

It is important to note that by September 1, 2019 the Republic of Azerbaijan has signed international agreements with 55 states about avoidance of double taxation and prevention of fiscal evasion with respect to taxes on income and capital gains. Article 127 (Foreign Tax Credit) of the Tax Code of the Republic of Azerbaijan states: «Amounts of income tax or profit tax of resident enterprise paid outside the Republic of Azerbaijan from the incomes of not Azerbaijani source shall be credited upon the payment of tax in the Republic of Azerbaijan». The amounts of the credit stipulated in Article 127.1 of this Code shall not exceed the amount of tax charged on that income or profit in the Republic of Azerbaijan at the rates in effect in the Republic of Azerbaijan.

For example, a physical person who is a resident of Azerbaijan is engaged in entrepreneurial activity in a country with an income tax rate of 18 %. This physical person received an income of 25000 (twenty five thousand) manat from his activities in that country in the current year. In the country where he is engaged in business the amount of income tax payable is 4500 (four thousand five hundred) manats (25000 x 18 per cent = 4,500). In this case, let us determine the amount of tax to be taken into account when paying taxes in Azerbaijan.

According to the Tax Code of the Republic of Azerbaijan, the amount of income tax payable from this amount is 5000 (five thousand) manats (25000 x 20% = 5000). In this case the physical person may reduce the amount of tax paid abroad by submitting a document confirming the tax levy abroad. And the amount of the tax payable would be 500 (five hundred) manats (5,000 - 4,500 = 500).

CONCLUSIONS

The Law of the Republic of Azerbaijan of June 24, 1992 «On income tax from individuals in the Republic of Azerbaijan» is of particular interest in the legal acts adopted after the Republic of Azerbaijan gained independence. This Law determines higher rate of income tax up to 55 percent that run counter to sound logic and the existence of such a high tax rate resulted in the concealment of income by physical persons. The rich experience of developed countries shows that the increase in the income tax of individuals can be realized, first of all, with these factors - economic development, full employment and the growth of national income, which were not existed in Azerbaijan in 1992.

After the return of national leader Heydar Aliyev to power in 1993, the tax legislation was amended, and the maximum income tax rate was set at 40 % from April 1, 1996, and by 35 % as of January 1, 2001.

On the initiative of Ilham Aliyev, the worthy successor of the national leader Heydar Aliyev, changes had been made to the Tax Code of the Republic of Azerbaijan and the maximum level of income tax on individuals were reduced by 30 % from January 1, 2010 and by 25 % from January 1, 2013

According to the legislation in force in the Republic of Azerbaijan, the lowest tax rate among all taxpayers, as a physical person, has been established for private notaries.

Thus, starting from January 1, 2013, the tax is charged at a rate of 10 (ten) % (excluding costs) for notary actions carried out by a private notary within one month. We believe it would be advisable to amend Article 101.4 of the Tax Code of the Republic of Azerbaijan as the following: «From the subject of taxation established in respect of private notaries by the second paragraph of Article 96.1 of this Code, tax is withheld at a rate of 60 (sixty) %».

In our opinion, as the rate of income tax on other individuals is slightly higher, it would be expedient to reduce the rate of income tax on other individuals, except for private notaries. For this purpose, we propose to amend Article 101.1 of the Tax Code of the Republic of Azerbaijan and issue the following wording: «If the amount of monthly income from employment is up to 2,500 (two thousand five hundred) manats, individuals are taxed at a rate of 10 (ten) percent. If the amount of monthly income from employment of individuals is more than 2,500 (two thousand five hundred) manats, 250 (two hundred and fifty) + 20 (twenty) percent of the amount exceeding 2,500 manat is taxed».

Personal income tax is one of the sources of budget revenues in our country and in many foreign countries. Therefore, tax legislation in any country cannot be developed comprehensively and dynamically without accepting the benefits of advanced scientific experience and achievements in the field of personal income tax. In addition, comparative law is of great importance for legal science, especially for national law. Because via comparative law, it is studied how these or other legal problems are solved in different countries, the positive and negative aspects of legal practice in different countries are assessed.