Introduction

Grain farming is one of the main subsectors of agriculture. This situation of grain in the agri-food sector is due to its consumable properties. Cereal products satisfy 45% of the daily energy requirement of the human body. The produced fodder grain is used in feed for the livestock industry.

The average increase in world cereal production by 2028 compared to 2018 should be about 14% (Organization for Economic Cooperation and Development -Food and Agricultural Organization, 2019).

At the present stage, the grain market operational model has shifted from import to export. The export orientation created the impetus for the growth of grain production.

These processes were also caused by a decrease in the production and consumption of livestock products, due to a decrease in the solvent demand of the population and the inability to compete with cheaper food imports (Yarkova & Pryanishnikov, 2018; Khairullina, 2019; Khairullina & Yarkova, 2019; Yarkova, 2019; Yarkova & Khairullina, 2019).

Thus, in connection with the rapid growth of Russian grain supplies to international markets and the limitation of grain consumption for feed purposes within the country, a priority was given to a reference to the needs of the world market.

There is an unambiguous opinion among Russian scientists about increasing grain production in the context of an export-oriented strategy.

Krylatykh & Belova (2018), have considered grain production in Russia from the standpoint of export growth, as the main stimulus for increasing production. They noted that ignoring economic laws and the pursuit of leadership in world grain exports can negatively affect the structure of agricultural production and lead to its deformation. In addition, Russian grain producers have accumulated serious technological problems associated with seeds, protection from pests and diseases, and soil depletion (Altukhov, 2017).

Ksenofontov, et al. (2017), also believe that export and consumption in animal husbandry are the main factors in the development of the Russian grain market. The key factor that retain the development of this sector in the future is the limited capacity of domestic and foreign sales markets. An increase in the share of export-oriented grain will increase the dependence of the domestic market on fluctuations in the world grain market.

Issues of state regulation of the grain market in the context of food security in Russia have been actively studied. It is noted that the functioning of the Russian grain market is associated with the growth of vertically integrated companies in this sector. This allows maintaining some stability of production and reducing price risks (Ksenofontov, Polzikov & Urus, 2019).

However, it should be noted that integration also leads to monopolization of markets and contributes to growing price. In addition, the concentration of the largest proportion of grain production among vertically integrated companies can be considered in different ways. On the one hand, this allows implementing a single technological chain butthe use of internal transfer prices can distort the market mechanism.

Altukhov (2017), notes that the competitiveness of Russian grain is mainly associated with the use of natural advantages and prices. At the same time, innovative and investment factors in increasing grain export potential lack sufficient attention.

Constraining factors are the influence of international grain trading, the increased presence of large foreign grain traders in domestic and especially in foreign grain trade; infrastructure restrictions, underdeveloped logistics infrastructure, irrational structure of the territorial distribution of elevator and port facilities in the country; the presence of internal and external risks, the low quality of the produced grain, the production of hard, strong and valuable wheat varieties is not stimulated.

Among the positive factors affecting the production of cereals, the following are noted: the country's high land supply, the presence of significant breeding-genetic, energy, water and labor resources, a significant number of large grain-producing farms in the regions and their link to large transport interstate highways.

The distribution of grain crops in Russia covers 557 climatic agriculture zones. Therefore, the problem of rational distribution of production also plays a key role in increasing the efficiency of grain production. A low share of high-quality wheat production remains, which negatively affects the quality of baking and other types of products of the grain-product subcomplex. This limits the markets for these products. It should be noted that the share of class four grain in the gross yield of soft wheat in the Russian Federation is 59%, class five grain - 24% (Altukhov, 2018).

To increase the efficiency of grain production, Nechaev & Bondarenko (2017), propose the creation of an intercountry agro-industrial cluster for deep processing of grain on the basis of a public-private partnership. This will make it possible to produce the following high-tech grain products: high-protein feed additives, fodder yeast, corn and wheat gluten, modified starches, glucose-fructose syrups, sugar substitutes, crystalline glucose, and organic and amino acids.

Studies of other countries, for example, China, Zhou (2010), explore the processes of integration and the formation of the national grain market. A study by Mattos & Fryza (2014), regarding Canadian farmers' pricing policies confirms the presence of a disposition effect in marketing decisions. Farmers tend to sell grain when contract prices are higher than their base price, and wait longer to sell when they are lower than their base price. Hobbs & Young (2000), notes that closer vertical coordination of supply chains is becoming the dominant feature in the agri-food sectors of many countries.

Materials and methods

The object of the study is grain producers of various organizational and legal forms: agricultural organizations, farms, households. The study is based on data from Russia from 2010 to 2018. Monographic, abstract-logical, dialectic and balance methods were used to study the prospects for grain production.

Results

In 2017, Russia harvested a record grain crop of 134.1 million tons, which is more than the historical maximum of 127 million tons in 1978. Thus, in 2017-2018 Russia exported a record 53 million tons of grain, ranking second in the world after the United States.

An analysis of the food balance of grain indicates that the gross yield in weight after refinement has increased on average by 1.6 times. The growth of industrial consumption amounted to 13.1%, and export - by 2.4 times.

During the study period, the share of production consumption in relation to resources decreased from 15.1 to 11.6%. Thus, agricultural companies to a greater extent export products of lower processing, bypassing deep processing (Table 1).

Considering the primary production link, it should be noted that 65% of grain production is accounted for by agricultural organizations and 33.8% by peasant (farmer) enterprises, whose share of participation has grown significantly in recent years.

The dominant position in gross revenues is traditionally held by wheat, as the main export product.

Table 1- Grain resources (without processed products), millions tons.

| Indicators | 3 years average | ||

|---|---|---|---|

| 2010-2012 | 2013-2015 | 2016-2018 | |

| Stocks at the beginning of the year | 60.1 | 52.0 | 77.6 |

| Production (gross weight in weight after refinement) | 75.4 | 100.8 | 123.2 |

| Import | 0.8 | 1,1 | 0.7 |

| Total resources | 136.2 | 153.8 | 201.4 |

| Production consumption | 20.6 | 20.6 | 23.3 |

| including: | |||

| for seeds | 10.3 | 10.7 | 11.1 |

| feed for livestock and poultry | 10.3 | 9.9 | 12.2 |

| Processed for flour, cereals, animal feed and other purposes | 45.0 | 46.3 | 52.6 |

| Losses | 1.0 | 1.1 | 1.3 |

| Export | 18.2 | 26.6 | 44.0 |

| Personal consumption (consumption fund) | 0.1 | 0.1 | 0.1 |

| Reserves at the end of the reporting period | 51.3 | 59.1 | 80.2 |

Source: Rosstat. Federal State Statistics Service (2019).

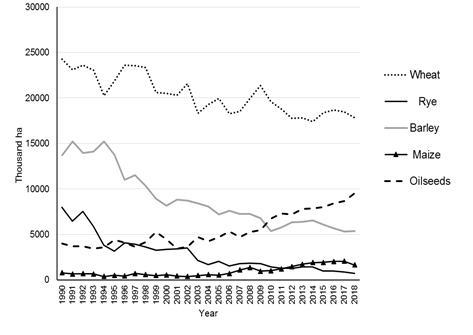

Gross yields of corn, oilseeds, and barley have significantly increased by 3.7, by 2.6 and by 2 times, respectively (Table 2).

Table 2- Gross harvest of crops in the Russian Federation.

| Culture | Year | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Wheat | 41555 | 56293 | 37767 | 52140 | 59713 | 61811 | 73346 | 86003 | 72136 |

| Rye | 1635 | 2971 | 2133 | 3361 | 3283 | 2088 | 2548 | 2549 | 1916 |

| Barley | 8354 | 16935 | 13949 | 15387 | 20377 | 17499 | 17967 | 20629 | 16992 |

| Corn | 3068 | 6937 | 8187 | 11606 | 11290 | 13138 | 15282 | 13208 | 11419 |

| Seeds and oilseeds | 7463 | 12234 | 10574 | 13150 | 12870 | 13854 | 16271 | 16497 | 19525 |

Source: Rosstat. Federal State Statistics Service (2019).

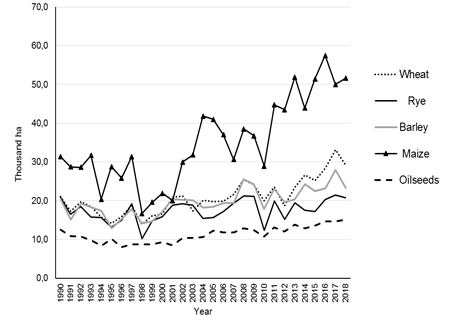

The results obtained are more associated with a certain intensification of production in terms of the reduction in the sown area of grain crops. Over the past ten years, sown areas for wheat decreased by 11%, for rye - 61%, for barley - 26% (Fig. 1).

Corn and oilseed sown areas increased by 1.2 and 1.8 times, respectively.

In the structure of the total sown area, wheat accounts for 33.2%, barley - 10%, corn - 3%, and oilseeds - 18%.

Source: Rosstat. Federal State Statistics Service (2019)

Fig. 1 Sown area of crops (agricultural organizations of Russia).

In 2018, the highest yield growth (in weight after refinement) was noted for corn - 48.1 c/ha. Wheat yield amounted to 29.1 c/ha (Fig. 2).

The leading regions for wheat production are traditionally the south of Russia - Rostov region, Krasnodar Territory, Stavropol Territory, which are the main points of possible growth in export potential.

In 2018, the profitability level from the sale of grain and leguminous crops (including rice and corn for grain) excluding subsidies amounted to 25.5%, which is 6.9% more than in 2017.

In the short term, one should expect a moderate increase in cereal production.

Meanwhile, to assess the competitiveness of grain production, budgetary support for products should be taken into account.

The analysis of this parameter was carried out using the OECD indicator - Producer Percentage Single Commodity Transfers (producer % SCT) (Table 3).

Table 3 Leading regions for the production of grain for 2018, thousand centers.

| № | Region | Wheat | Region | Rye | Region | Barley |

|---|---|---|---|---|---|---|

| 1 | Rostov region | 93354.3 | Republic of Bashkortostan | 3451.4 | Republic of Tatarstan | 10078.8 |

| 2 | Krasnodar region | 89721.5 | Republic of Tatarstan | 2892.0 | Kursk region | 9374.9 |

| 3 | Stavropol region | 71563.8 | Orenburg region | 1984.8 | Voronezh region | 9255.1 |

| 4 | Altai region | 30543.0 | Saratov region | 1178.7 | Tambov Region | 8527.9 |

| 5 | Volgograd region | 30442.7 | Kirov region | 1145.1 | Krasnodar region | 8430.6 |

| 6 | Voronezh region | 27231.9 | Bryansk region | 1023.9 | Lipetsk region | 7854.4 |

| 7 | Kursk region | 24174.6 | Udmurt republic | 752.6 | Republic of Bashkortostan | 7443.6 |

| 8 | Omsk region | 22547.5 | Altai region | 643.9 | Stavropol region | 7181.6 |

| 9 | Saratov region | 22314.3 | Volgograd region | 583.1 | Rostov region | 6759.5 |

| 10 | Oryol Region | 19744.5 | Kurgan region | 457.3 | Oryol Region | 6492.2 |

| 11 | Belgorod region | 18988.8 | Nizhny Novgorod Region | 432.4 | Omsk region | 6163.5 |

| 12 | Republic of Tatarstan | 18593.4 | Voronezh region | 373.9 | Chelyabinsk region | 4893.2 |

| 13 | Tambov Region | 18542.6 | Ulyanovsk region | 344.9 | Belgorod region | 4628.1 |

| 14 | Lipetsk region | 18153.9 | Samara Region | 334.6 | Altai region | 4258.9 |

| 15 | Novosibirsk region | 16549.5 | Kemerovo region | 331.1 | Ryazan Oblast | 4041.2 |

Source: Rosstat. Federal State Statistics Service (2019).

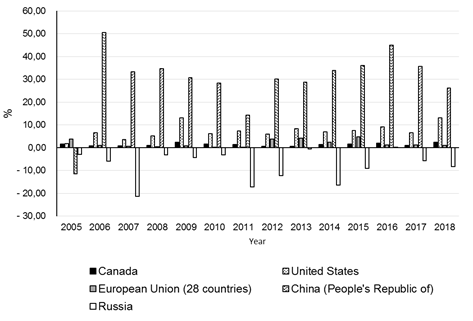

The greatest support to wheat producers is provided by China - 26.1% and the USA - 13.2%. These countries significantly increased this indicator for the study period. In Russia, SCT is still negative (Fig. 3).

Given the importance and need for the development of grain farming for Russia, it is necessary to identify a solution to the following problems:

lack of a state strategy and program to support the development of grain farming, taking into account the territorial and zonal distribution of production;

underdevelopment of transport and logistics support for commodity flows of wheat grain;

deficit of investments;

technical, technological, and innovative lagging;

accumulation of resources in the hands of traders;

lack of proper government support for efficient grain production;

high share of imported resources.

Conclusions

The following factors that may affect the efficiency of grain production should be identified:

Technical and technological - a set consisting of assessing the state of the technical potential of the grain economy, the availability of innovative and resource-saving technologies, the use of the breeding potential of seeds, etc.

Organizational and managerial - associated with the organization of production, the choice of management model, the selection of qualified personnel, specialization and location of production.

Financial and economic - the financial policy of the organization regarding loans, taxation, insurance, the choice of the economic model of production, the level of state support for manufacturers.

The agrarian potential of the territories of Russia requires its rational use in the framework of the spatial development of the grain economy. In addition, attention should be paid to the need to increase the production of processed grain products, i.e. to products of middle and upper processing.

The implementation of the export potential of the grain economy should also take into account the possible risks associated with a permanent shortage of raw materials and an increase in prices on the domestic market. The level of economic affordability of food should be monitored for the population of the country in general and for individual groups. In addition, a significant increase in cereal production exacerbates the problem of maintaining soil fertility in the long term, which requires further research on this topic.