Mi SciELO

Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Cooperativismo y Desarrollo

versión On-line ISSN 2310-340X

Coodes vol.9 no.1 Pinar del Río ene.-abr. 2021 Epub 30-Abr-2021

Original article

Analysis of the internal control process in savings and credit cooperatives

1 Universidad Técnica de Cotopaxi Extensión La Maná. Ecuador.

Savings and credit cooperatives are socioeconomic entities with the capacity to meet the economic needs of their members and influence the welfare of the community and society through effective and efficient administrative processes, while respecting the principles and values of the international cooperative movement. In Ecuador, these types of entities are part of the social and solidarious economy sector in the financial sphere and play an important role, since they achieve equity in access to financial resources in an environment where large banking institutions prevail. The objective of the research was to analyze the internal control process of the 14 Savings and Credit Cooperatives of the canton "La Maná", province of Cotopaxi, for which the COSO model questionnaire was adapted, applied as part of the observation method, and finally descriptive statistics were applied for the analysis of the data obtained. It was determined that the Control Environment, Control Activities and Supervision and Monitoring components have a high level of performance, while the Risk Assessment and Information and Communication components showed a lower level of compliance in the cooperatives studied.

Keywords: internal control; popular and solidarious economy; financial institutions

Introduction

Cooperatives are socioeconomic organizations with a double and important function in the current system: to satisfy the needs of their members through efficient and effective productive and economic processes. Much literature has been generated in recent years regarding the role played by these types of organizations in contemporary socioeconomic systems. Specifically, in the financial sector, they are recognized for their function of providing fairer financial and banking systems to the poorest and most limited populations, in an environment where large banks occupy a considerable space in the market.

Management in this type of entities is precisely marked by this duality as a socioeconomic system, which, as expressed by Fernández, Fernández, Rivera and Calero (2016), requires achieving a balance between the social and technical-economic aspects, imposing numerous challenges in the administrative order. Management practice becomes an activity where the modern principles and practices of the Administration must be linked, together with the maintenance of its idiosyncrasy, statutory system, principles and values of the international cooperative movement, which according to Labrador (2020, p. 164) "there is a clear relationship between management, based on principles and values, and CSR; and these entities can become benchmarks in its application".

As indicated by Galarza, García, Ballesteros, Cuenca and Fernández (2017), in Ecuador, financial institutions as part of the social and solidarious economy sector have in recent years increased their importance as part of the national financial sector, having an impact on achieving superior socio-economic results for their members and society in general, in the framework of compliance with enterprise social responsibility and national development goals (Fernández Lorenzo et al., 2017).

In the pursuit of sustainable and comprehensive management, Credit and saving cooperatives in Ecuador must continue to strengthen both social and technical-economic factors, as shown in the work of Fernández, Hernández, Hernández and Chicaiza (2018). In particular, internal control has the potential to provide reasonable security in the flow of internal operations and transactions, through properly structured policies and procedures. This is one of the enterprise tools with the greatest benefit on the quality of internal processes and the verification of requirements and regulations set by external control entities. According to Quinaluisa, Ponce, Muñoz, Ortega and Pérez (2018, pp. 269-270) it is "a process carried out by the board of directors, management and other personnel of an entity, designed with the objective of providing a reasonable degree of assurance as to the achievement of objectives (...) it comprises the structure, policies, organizational plan, set of methods and procedures and the qualities of the enterprise's personnel that it ensures".

Given the nature of financial institutions, these factors are key to develop an adequate and pertinent administrative and accounting management, to be accountable to internal and external control bodies, especially in Credit and saving cooperatives to their members, as well as to efficiently manage common resources to guarantee an adequate economic and social profitability.

Among the different internal control methodologies, the COSO model stands out, which according to Mantilla (2007), is approached as a process executed at all levels of the organization, based on the concerns generated by the limit situations in which organizations find themselves, due to management failures regarding the management of their patrimony. "The COSO model is an effective instrument in the evaluation of internal control, since it includes all aspects to be considered, such as control environment, risk assessment, control activities, information and communication, as well as monitoring" (Santa Cruz Marín, 2014, p. 40). Hence, in the present work, the application of this model has been chosen in order to evaluate the internal control process of the 14 savings and credit cooperatives of the canton "La Maná", province of Cotopaxi.

The selection of the COSO model was based on its high level of applicability worldwide and especially in Ecuador, as it is considered an instrument that provides a reasonable level of assurance of compliance with the objectives, based on the evaluation of its control components.

According to records of the Superintendence of Popular and Solidarious economy, in that canton, cooperatives are located as follows: two in segment one; six in segment three; two in segment four and the rest in segment five; take into consideration that according to the Law of Popular and Solidarious economy, "Savings and Credit Cooperatives will be located in segments, in order to generate policies and regulations in a specific and differentiated manner, according to their particular characteristics" (Presidency of the Republic of Ecuador, 2011).

The objective of the research is to analyze the internal control process of the savings and credit cooperatives of La Maná canton, province of Cotopaxi.

Materials and methods

The research was descriptive, based on a survey of a representative manager in the 14 savings and credit cooperatives in the canton of La Maná, with which the internal control components were evaluated according to the COSO model, previously explained (Table 1).

Table 1 Structure of the questionnaire applied

| Internal control component (COSO model) | Number of questions |

|---|---|

| Control environment | 10 |

| Risk assessment | 6 |

| Control activities | 6 |

| Information and communication | 4 |

| Supervision and monitoring | 3 |

| Total | 29 |

Source: Own elaboration based on INEGI (2014)

The response options were 1 (if it complies) and 0 (does not comply). Based on the survey results, absolute frequencies were calculated and graphs were constructed for analysis and discussion, which made it possible to show the status of each of the components of the institutions studied.

Results and discussion

The following are the results of the application of the surveys in the institutions analyzed, in relation to the five control components of the COSO model, based on the proposal of INEGI (2014).

Control Environment Component

The control environment allows organizations to be sure to carry out processes that are free from significant failures, to employ the necessary standards, policies and procedures to ensure compliance with the activities and to avoid risks in financial institutions.

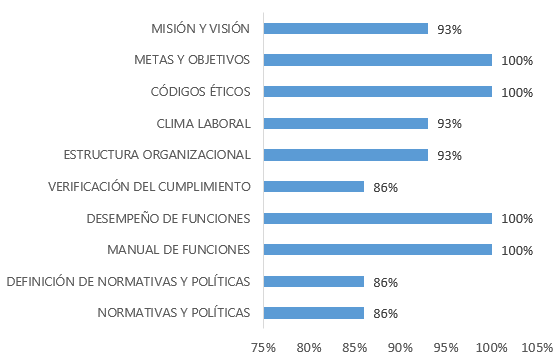

As can be seen in figure 1, in the savings and credit cooperatives of La Maná canton, Cotopaxi province, in terms of the control environment, there is greater compliance in terms of the application of goals and objectives, ethical codes, implementation of the manual of functions and performance of functions. To a lesser extent, there is compliance with the verification of compliance and definition of regulations and policies.

In this component, a high compliance with the standards of the control environment component is evaluated, which is considered a very important aspect for the analyzed organizations, based on what was raised by López, Cañizares and Mayorga (2018, p. 82), who state that this "constitutes the foundation of the internal control pyramid, contributing discipline to the structure that will serve as the basis for the other components".

The positive results observed in general in this component in Savings and Credit Cooperatives are a sign that there is an organizational climate of values and integrity, which makes possible an attitude of commitment to organizational objectives, based on INEGI (2014). This is a fundamental aspect in any organization, especially in social organizations such as cooperatives, where commitment and unity in management are considered one of the basic pillars for business success (Fernández Lorenzo et al., 2016).

Risk Assessment Component

The proper identification of risks has become an indispensable element in financial management, "through this component enterprises can identify, analyze, evaluate, prioritize, control, document and follow up on the various risks that may hinder or prevent the achievement of the organization's objectives and goals" (Serrano Carrión et al., 2018, p. 37).

As shown in figure 2, compliance in the Risk Assessment component is lower, ranging between 71% and 86% in all the items evaluated. The highest compliance is in relation to risk documentation and contingency plans, and the lowest compliance is in disaster recovery plans. This is a component where, according to the results of the research, The Savings and Credit Cooperatives of the canton "La Maná" should strengthen actions to identify and manage the risks they face in the different areas, which is one of the key functions of internal control (López Jara, 2017). In this component, the fraud analysis item stands out, which is fundamental for financial institutions and shows a compliance of 79%, which evidences the need to strengthen activities aimed at reducing the risk of suffering from this type of economic crime, which affects the interests of cooperative members and institutional interests (Barrón Araoz & Ferreyros Morón, 2018).

The prevention of fraud, corruption and other economic crimes is one of the fundamental activities that financial entities of the social and solidarious economy sector in Ecuador must comply with, in order to achieve the equity and transparency enacted in the law (Presidency of the Republic of Ecuador, 2011).

Control Activities Component

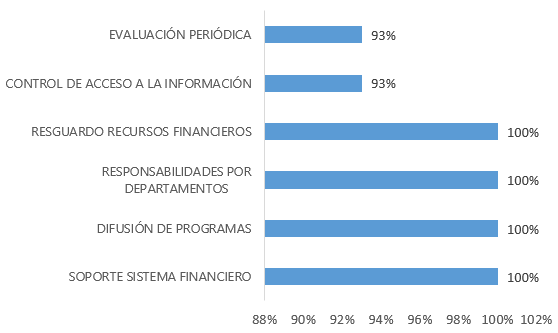

Control activities evidence the procedures and policies that allow compliance with administrative guidelines and business goals, according to Quinaluisa, Ponce, Muñoz, Ortega and Pérez (2018). In the following figure, compliance with the aspects evaluated in this component is evidenced in The Savings and Credit Cooperatives of La Maná canton.

As can be seen, this component achieves 100% compliance in four of the items evaluated and a high percentage in periodic evaluation and control of access to information. These results are very positive for cooperatives, they take into consideration that these policies and procedures allow mitigating risks that may affect the fulfillment of objectives, with emphasis on technological processes that can support organizational development, which is increasingly becoming a managerial trend (Barrón Araoz & Ferreyros Morón, 2018).

Information and Communication Component

According to López, Cañizares and Mayorga (2018, pp. 82-83), this component "consists of the methods for recording, processing, summarizing and reporting on the technical, administrative and financial operations of an entity". According to these authors, communication must be effective and timely and the information shared must have high levels of quality that support an adequate decision-making process.

Figure 4 shows that the Information and Communication component is among the least complied with by the financial institutions of popular and solidarious economy of the canton "La Maná", especially in the factors of communication and information lines, attention to requirements and information within the information. The importance of communication and information in organizations is recognized, especially in cooperatives where the different stakeholders must manage useful information for shared decision making (Fernández Lorenzo et al., 2016).

Supervision and Monitoring Component

Supervision and monitoring as part of the internal control process are key, in the sense that they allow maintaining a "continuous or periodic evaluation of the quality of internal control performance, with the purpose of determining which controls are operating as planned and the need for their modification, according to changes in conditions" (Quinaluisa Morán et al., 2018).

The following figure shows the evaluation of the component in the entities studied.

In this component, a high compliance with the evaluated standards is observed, showing that the cooperatives communicate the deficiencies found and pay attention to the recommendations found, evaluate and monitor the internal control process, with the purpose of ensuring the effectiveness and efficiency of the controls that allow mitigating the risk in management (Manosalvas Gómez et al., 2019). This component is key to evaluate the capacity of financial entities to carry out a correct feedback and continuous improvement of their control processes, in addition, it demonstrates that there is a correct evaluation of each of its constituent parts.

In general, it can be said that Credit and Saving Cooperatives are socioeconomic entities with the capacity to meet the economic needs of their members and other social needs, under the principles and values of the international cooperative movement, in a context where large financial institutions prevail. The analysis of the internal control process of the Savings and Credit Cooperatives of the canton "La Maná", through the COSO model, identified a high level of compliance in the Control Environment, Control Activities and Supervision, as well as Monitoring components, which are related to the organizational climate and other organizational aspects that allow meeting the organizational objectives, application of administrative guidelines and monitoring of activities that allow controlling risks. In the Risk Evaluation and Information and Communication components, there was lower compliance in the cooperatives studied, which demonstrated the need to reinforce actions aimed at documenting risk management through plans and procedures and to better use information as a basis for communication among the different stakeholders.

Referencias bibliográficas

Barrón Araoz, A. R., & Ferreyros Morón, J. A. (2018). La necesidad de aplicar la auditoría preventiva en el Perú. Alternativa Financiera, 9(1). https://www.aulavirtualusmp.pe/ojs/index.php/AF/article/view/1765 [ Links ]

Fernández Lorenzo, A., Calero, S., Parra, H., & Fernández, R. (2017). Corporate social responsibility and the transformation of the productive matrix for Ecuador sustainability. Journal of Security and Sustainability Issues, 6(4), 575-584. https://doi.org/10.9770/jssi.2017.6.4(4) [ Links ]

Fernández Lorenzo, A., Fernández, R. R., Rivera, C. A., & Calero, S. (2016). Desafíos en la gestión de las cooperativas de producción agropecuaria tabacaleras de la provincia Pinar del Río, Cuba. Agroalimentaria, 22(42), 119-132. http://erevistas.saber.ula.ve/index.php/agroalimentaria/article/view/7517 [ Links ]

Fernández Lorenzo, A., Hernández Santoyo, A., Hernández Arauz, M. A., & Chicaiza Sánchez, O. L. (2018). Savings and credit cooperatives in Pichincha, Ecuador: A sustainable social management case? Journal of Security and Sustainability Issues, 7(3), 551-560. https://doi.org/doi:10.9770/jssi.2018.7.3(14) [ Links ]

Galarza Torres, S. P., García Aguilar, J. del C., Ballesteros Trujillo, L., Cuenca Caraguay, V. E., & Fernández Lorenzo, A. (2017). Estructura organizacional y estilos de liderazgo en Cooperativas de Ahorro y Crédito de Pichincha. Cooperativismo y Desarrollo, 5(1), 19-31. http://coodes.upr.edu.cu/index.php/coodes/article/view/156 [ Links ]

INEGI. (2014). Cuestionario de autoevaluación del control interno. Instituto Nacional de Estadística y Geografía. [ Links ]

Labrador Machín, O. (2020). Gestión y responsabilidad social cooperativa: Su indisoluble unidad de la actualidad. Cooperativismo y Desarrollo, 8(2), 160-165. http://coodes.upr.edu.cu/index.php/coodes/article/view/342 [ Links ]

López Jara, A. A. (2017). Evaluación comparativa del sistema de control interno del sector comercial y del sector público del Cantón Morona. Killkana Social, 1(1), 31-38. https://doi.org/10.26871/killkana_social.v1i1.12 [ Links ]

López Jara, A. A., Cañizares Roig, M., & Mayorga Díaz, M. P. (2018). La auditoría interna como herramienta de gestión para el control en los gobiernos autónomos descentralizados de la provincia de Morona Santiago. Cuadernos de Contabilidad, 19(47), 80-93. https://doi.org/10.11144/Javeriana.cc19-47.aihg [ Links ]

Manosalvas Gómez, L. R., Cartagena Herrera, M. E., & Baque Villanueva, L. K. (2019). Gestión de control interno para disminuir el riesgo de quiebra en la empresa Capasepri. Dilemas contemporáneos: Educación, Política y Valores, 6(Special Issue). https://www.dilemascontemporaneoseducacionpoliticayvalores.com/index.php/dilemas/article/view/1358 [ Links ]

Mantilla, S. (2007). Control Interno: Informe COSO (4.a ed.). ECOE Ediciones. https://www.ecoeediciones.com/libros/libros-de-auditoria/control-interno-informe-coso-4ta-edicion/ [ Links ]

Presidencia de la República de Ecuador. (2011). Ley Orgánica de la Economía Popular y Solidaria y del sector financiero popular y solidario. Asamblea Nacional del Ecuador. https://www.socioeco.org/bdf_fiche-legislation-14_es.html [ Links ]

Quinaluisa Morán, N. V., Ponce Álava, V. A., Muñoz Macías, S. C., Ortega Haro, X. F., & Pérez Salazar, J. A. (2018). El control interno y sus herramientas de aplicación entre COSO y COCO. Cofin Habana, (1), 268-283. http://www.cofinhab.uh.cu/index.php/RCCF/article/view/291 [ Links ]

Santa Cruz Marín, M. (2014). El control interno basado en el modelo COSO. Revista de Investigación Valor Contable, 1(1), 37-43. https://doi.org/10.17162/rivc.v1i1.832 [ Links ]

Serrano Carrión, P. A., Señalin Morales, L. O., Vera Jaramillo, F. Y., & Herrera Peña, J. N. (2018). El control interno como herramienta indispensable para una gestión financiera y contable eficiente en las empresas bananeras del cantón Machala. Revista ESPACIOS, 39(3), 20-43. https://www.revistaespacios.com//a18v39n03/18390330.html [ Links ]

Received: December 09, 2020; Accepted: April 09, 2021

texto en

texto en