Mi SciELO

Servicios Personalizados

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Cooperativismo y Desarrollo

versión On-line ISSN 2310-340X

Coodes vol.10 no.2 Pinar del Río mayo.-ago. 2022 Epub 30-Ago-2022

Original article

Effects of the Covid-19 Pandemic on saving and credit cooperatives: a case study

1 Universidad San Gregorio de Portoviejo. Ecuador.

The objective of this study is to explore the effects of the Covid-19 pandemic on the portfolio of a saving and credit cooperative in Portoviejo, Ecuador, and to identify factors associated with the probability of reporting slowness. The literature addressing the effects of the pandemic on financial institutions has focused primarily on the rapid digitization of the industry and, geographically, in developed countries. To date, little literature has reported on the effect of the pandemic on saving and credit cooperatives in developing countries. A case study was designed with mixed-methods, combining regulatory content and cooperatives reports with a sample database of credit transactions between January 2019 and December 2021, and the data were analyzed using hypothesis testing and regression analysis. The variables that were best associated with the likelihood of a borrower reporting late payments are the amount of the credit, the time the credit was extended whether before or after the onset of the pandemic, and the sex of the borrowing member. The results can inform new experimental studies that will provide a deeper understanding of what works and what does not work for credit cooperatives during periods of crisis.

Key words: Covid-19; credit portfolio; saving and credit cooperatives; slowness; logistic regression

Introduction

The Covid-19 pandemic transformed the daily practices of the human species around the world and highlighted the intersection between health, finance, socialization and production opportunities. Social confinement led to the paralysis of production in economic sectors with high employment demand and, consequently, to an economic decline on a global scale. The International Monetary Fund (IMF) has referred to this phenomenon as "the great confinement"1 and there seems to be a consensus among academics that this is the greatest global economic crisis since the Great Depression of 19292.

The financial sector has not been immune to the effects of the pandemic. However, the existing literature on this aspect has mostly focused on the transformation of banking operations, with emphasis on digitalization and mainly in developed countries (Darjana et al., 2022; Marcu, 2021). Other studies have focused on the productivity of banking sector workers during the pandemic, relaxation of principal and interest payment schedules for commercial bank debtors, and "remote" customer service alternatives (Umarov & Toshpulatova, 2020; Xie et al., 2021). The impact of the pandemic on the financial system in developing countries, and particularly on saving and credit cooperatives, has received limited attention, which justifies the present study.

To cope with the pandemic, financial institutions have implemented relief measures for their members and customers with credit restructuring policies, extension of terms and lower interest rates. In this way, they have tried to support workers and enterprises affected by the pandemic through policies of flexibility and strengthening of communication channels between financial institutions and users, so that there are timely responses to mitigate risks of non-payment.

According to analyst Kristalina Georgieva (2020), in an IMF publication, the response to this crisis requires the mobilization of resources to help users of financial systems obtain short-term liquidity, in order to help keep basic services running, cushion the economic downturn and protect investments in human capital. The IMF also emphasizes that such financial efforts must be accompanied by government policies to mitigate risks and minimize social impacts.

In Ecuador, the Financial Institutions and Development Network3 has warned about the need for financial institutions to adopt measures to safeguard their assets and perpetuate their operations. In this regard, the Central Bank of Ecuador4 estimates that the financial impact of the Covid-19 pandemic would result in the largest contraction of the Ecuadorian economy in its history. According to its estimates, during 2020, the Gross Domestic Product would fall between 7.3% and 9.6%.

In response to the Covid-19 crisis, Ecuadorian financial institutions implemented a variety of credit policies, accompanied by fiscal and monetary reforms by the central government. Among these measures were the abrupt reduction of public spending, the deferral of payments for obligations to government institutions and users of the financial system, the reduction of taxes, fees and contributions, and the limitation of interest payments in the public sector.

While these measures seem intuitively consistent, the scientific literature has not yet reported evidence on what has and has not worked for credit unions during the Covid-19 pandemic. McKillop et al. (2020) and Omona (2021) have concurred on the need to investigate the impact of the pandemic on this category of credit unions because of the role they play in the quest for poverty reduction in developing countries.

To address this knowledge gap, this article uses a case study of a savings and credit cooperative in the city of Portoviejo, Ecuador. Portoviejo is the capital of the province of Manabí, on the Ecuadorian coast. It has a population of approximately 325.000, making it the eighth most populated city in Ecuador. The study adopted a mixed methodological approach, using qualitative data such as the contents of official documents of the cooperative under study, as well as press releases, laws and regulations; and quantitative data from the database of transactions of the cooperative's members. For data analysis, the qualitative content was triangulated between different sources, while the quantitative content was analyzed by hypothesis testing using the z-test for median differences and by regression analysis.

The objective of this research is to explore the effects of the Covid-19 pandemic on the debtors' portfolio of a saving and credit cooperatives in Portoviejo, Ecuador. Specifically, the study identifies factors associated with slowness among the cooperative members since the emergence of the pandemic. The results of this work are useful for developing institutional policies aimed at preserving the interests of saving and credit cooperatives and protecting their most vulnerable members during catastrophic events and periods of crisis.

The rest of the article is organized as follows: the subsequent section presents details of the methodological approach and methods of data collection and analysis. This is followed by the results, which are divided into a description of the context, descriptive statistics analysis, hypothesis testing and, finally, regression analysis.

Materials and methods

This research has a mixed methodological approach, i.e., for data collection and analysis, it combined qualitative and quantitative methods. The qualitative data came from official documents of the cooperative under study, as well as from the regulations governing the operations of savings and credit cooperatives in Ecuador. They included the Law of Popular and Solidarity Economy, the General Regulations of the Law of Cooperatives, as well as founding documents and annual accountability reports of the cooperative under study.

The quantitative component is of an analytical cross-sectional type, applied to a sample statistically significant at 95% with respect to the population of the cooperative's debtor-members, of 360 with a cutoff date of December 31, 2021. This type of study consists of examining a population at a cut-off point in time, so that the variables studied are evaluated in a single instance to establish behavioral patterns and test theories. Variables from the cooperative's membership database, which may be associated with instances of slowness during the pandemic, were selected and examined, and hypotheses were posed and tested to analyze differences among users causing delinquency. Finally, a logistic regression model was implemented to identify the variables that may be most influential in delinquency during the pandemic.

For data collection, the available variables were extracted from the cooperative's database to identify factors associated with slowness, including: amount of the credit, whether it is current or late in the payment schedule, economic activity, credit destination, debt balance, type of credit, city, whether it is a rescheduled credit, and the sex of the borrowing member. The data were entered into a spreadsheet for tabulation and analysis using XLSTAT5 version 2022.

First, the descriptive measures of the sample were analyzed. Next, six hypotheses emerged and were analyzed using the z-test for differences in medians: H1: Women receive less credit than men; H2: The pandemic caused more slowness among female borrowers than male borrowers; H3: Restaurants were the most slowness type of business during the pandemic; H4: Credits granted since the onset of the pandemic are more likely to be slowness; H5: Working capital credits were more likely to report slowness; and, H6: Smaller credits are more likely to be slowness. Finally, a logistic regression analysis was implemented to predict whether a member debtor of the cooperative will fall into slowness, i.e., "overdue" status. Logistic regression helps to understand the relationships between a categorical outcome variable and one or more categorical or continuous variables (Peng et al., 2002). This analysis was conducted to identify the variables that were best associated with slowness among the cooperative's debtor members during the pandemic.

Results and discussion

The context of savings and credit cooperatives in Ecuador: the Popular and Solidarity Financial Sector

In Ecuador, the 2009-2013 national development plan recognized the institutional framework of the Popular and Solidarity Economy in the economic system. Previously, there was only a clear institutional framework for the public, private and mixed economy. The promotion of the Social and Solidarity Economy aims to enhance the social inclusion of the vulnerable sectors of our society. The development and growth experienced by this productive segment led the central government to promote the creation of the Superintendence of Popular and Solidarity Economy (SEPS in Spanish). According to the Organic Law of Popular and Solidarity Economy (2011, p. 4), the Popular and Solidarity Financial System is:

"...a form of economic organization in which its members, either individually or collectively, organize and develop processes of production, exchange, commercialization, financing and consumption of goods and services to satisfy needs and generate income, based on relationships of solidarity, cooperation and reciprocity... over appropriation, profit and capital accumulation".

In addition, in September 2014, the Organic Monetary and Financial Code (2014) was approved, which aims to regulate the monetary-financial, securities and insurance systems of Ecuador. Article 163 determines that "the popular and solidarity financial sector is composed of: savings and credit cooperatives; central savings banks; associative or solidarity entities, communal savings banks and banks, savings banks and auxiliary services of the financial system. The SEPS exercises the function of control and supervision of the entities that make up this sector and is governed by the provisions of the Code and the Organic Law of the Popular and Solidarity Economy.

In turn, the Policy Board for Monetary and Financial Regulation, based on the financial balances reported by the cooperatives, established the mechanism for segmenting the entities of the Popular and Solidarity Financial Sector according to the annual balance of their assets, as shown in table 1.

Table 1 Segmentation of the entities of the Popular and Solidarity Financial Sector

| Segment | Assets (USD) |

|---|---|

| Segment 1 | Greater than 80.000.000.00 |

| Segment 2 | Greater than 20.000.000.00 up to 80.000.000.00 |

| Segment 3 | Greater than 5.000.000.00 up to 20.000.000.00 |

| Segment 4 | Greater than 1.000.000.00 up to 5.000.000.00 |

| Segment 5 | Up to 1.000.000.00 |

| Savings banks, banks and community banks |

Source: Monetary and Financial Regulation Policy Board

The Superintendency of Popular and Solidarity Economy reports that there are currently 3294 cooperatives in Ecuador, of which 584 are savings and credit cooperatives. Among the savings and credit cooperatives, 32 are categorized in segment 1; that is, they report assets of no less than 80 million USD. This segment accounts for 76.63% of total aggregate assets among credit unions. At the other extreme, the 434 cooperatives categorized in segments 4 and 5 account for only 3.69% of the sector's assets. This gives an idea of how the assets of the Popular and Solidarity Economy are distributed.

The case of a Portoviejo savings and credit cooperatives

The savings and credit cooperative that is the subject of this study was founded in Portoviejo in the 1980s. Its founders were inspired by the need to serve the commerce sector, which is the second most important economic activity in Portoviejo after construction. Its main activity is financial intermediation between members with savings capacity and those who demand credit. The cooperative provides the following services: savings and investments; consumer, mortgage, and microenterprise credits; business credits; transfers with other players in the national and international financial sector; ATMs; and collection services.

The study focused on the credits' portfolio. That is, all credits granted by the cooperative to its members, whether commercial, consumer, housing or other. The portfolio can be categorized as "past due" and "to be execute". The Monetary and Financial Policy and Regulation Board (2015) defines the "past due" portfolio as "the portion of the principal balance of the loan portfolio that reports arrears in the fulfillment of its payment obligations". It is understood that it corresponds to those installments that were not paid within the time established by the cooperative, i.e., the member did not pay on time, for which delinquent interest arises. On the other hand, the "to be execute" portfolio is made up of credits that are not in arrears. For the purposes of this study, the "to be execute" portfolio is identified as "current" and the "past due" portfolio as "overdue".

During 2019, the cooperative carried out 11.707 credit operations. Most of the credits were for consumption with 8.123 operations, followed by microenterprise with a total of 3.490, then mortgage with 81, commercial credit with 12 and 1 educational credit. During 2020 and 2021, despite the Covid-19 pandemic, the number of operations grew. However, this increase was driven by consumer credit, while microcredit contracted, due to the massive closure of businesses, including the transportation sector among those affected. Table 2 shows the number of operations granted during the last three years by type of credit portfolio.

Table 2 Number of credit operations

| Portfolio type | 2019 | 2020 | 2021 |

|---|---|---|---|

| Commercial | 12 | 10 | 10 |

| Consumption | 8123 | 8283 | 8730 |

| Real Estate | 81 | 88 | 112 |

| Microenterprise | 3490 | 3661 | 3650 |

| Educational | 1 | 0 | 1 |

| Total | 11707 | 12042 | 12503 |

Source: Own elaboration

Between 2019 and 2020, credits granted in all portfolio types grew in terms of monetary value, as can be seen in table 3. However, while consumer credit grew in terms of number of transactions between 2020 and 2021, the dollar amount contracted. This suggests that loans were approved for lower average amounts during 2021.

Table 3 Portfolio granted (USD)

| Portfolio type | 2019 | 2020 | 2021 |

|---|---|---|---|

| Commercial | 781.000 | 686.000 | 716.000 |

| Consumption | 65.821.789 | 71.770.773 | 76.933.704 |

| Real Estate | 2.905.471 | 3.408.971 | 4.820.471 |

| Microenterprise | 23.432.437 | 25.529.183 | 26.975.561 |

| Educational | 5.000 | 0 | 5.000 |

| Total | 92.945.699 | 101.394.928 | 109.450.737 |

Source: Own elaboration

During the period under analysis, the average of credits amount was 14.738 USD. However, the median was $8.000, indicating that the majority of credits were granted for less than average amounts. In fact, 68% of the credits were for less than the average amount, while the remaining 32% were for above-average amounts. The minimum credit was 500 USD, while the maximum credit was 150.000 USD. Seventy-two percent of the members in arrears are up to date, while 28% are in arrears. Sixty-four percent of the portfolio corresponds to credits contracted before the pandemic confinement in April 2020, while the remaining 36% of the portfolio was contracted between April 2020 and December 2021. Among past-due credits, the average amount is $7.794 and the median is $4.000. This suggests that the majority of overdue loans are for less than the average amount. Finally, 20% of the portfolio has been granted to female members, while 80% has been granted to male members, suggesting an inequitable distribution of credits based on sex.

Hypothesis testing

Hypothesis 1: women receive less credit than men.

To test this hypothesis, a z-test for the difference in medians was performed between women and men who received credits below the average portfolio amount of $14.738. Eighty-six percent of the credits granted to female members were less than the average, while 55 percent of the loans granted to male members were for a similar amount. The z-test at 95% confidence indicates that the difference in the amount of credit granted to men and women is significant and in favor of male members. This suggests that, in this case, gender may be a predictor of the amount of credit granted, which merits further study in future studies on the role of gender in lending.

Hypothesis 2: During the pandemic, delinquency has been more frequent among female than male debtor-members.

Thirty-seven percent of loans granted to female members during the study period were in arrears, compared to 34 percent for male members. However, at 95% confidence, the z-test suggests that this difference is not significant. It is worth bearing in mind that, as noted above, loans to female members tend to be lower than average and more likely to report arrears.

Hypothesis 3: restaurants were the type of business with most slowness during the study period.

Thirty-three percent of members who applied for credits to start, expand or operate restaurants reported arrears during the study period, versus 17 percent for other economic activities related to credits granted by the cooperative. At 95% confidence, the z-test indicates that this is a significant difference. It was plausible to anticipate that containment measures to curb contagion would affect more services that inevitably require face-to-face interaction.

Hypothesis 4: credits granted since the onset of the pandemic are less likely to report slowness.

Thirty-five percent of credits made before the pandemic reported delinquencies, versus 18 percent of credits made after the pandemic declaration in April 2020. The z-test at 95% confidence indicates that loans extended before the pandemic are more prone to slowness.

Hypothesis 5: working capital credits were more likely to report slowness.

This hypothesis focused on the activities for which the borrowing members would use the credit. Sixty-five percent of credits granted for working capital reported arrears, versus 24% of credits granted for other purposes. The z-test at 95% confidence suggests that the propensity to slowness is higher among working capital credits.

Hypothesis 6: Smaller credits are more likely to report slowness.

The average credits amount was used as a criterion to categorize between larger and smaller credit amounts. Those larger than the average (14.738 USD) are larger credits, while those smaller than the average are smaller. Thirty-three percent of small credits reported arrears versus only 17% of large credits. The z-test at 95% confidence indicates that this difference is significant, suggesting that smaller credits are more likely to report slowness and therefore riskier.

Regression analysis

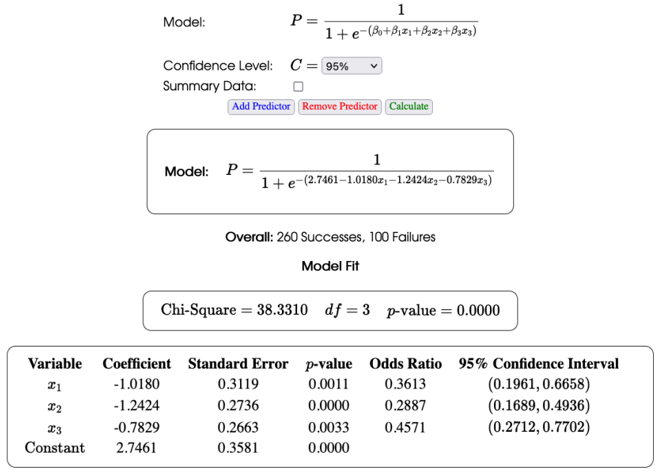

A logistic regression model was implemented to analyze the factors associated with whether the debtor-members are "current" or "late" on the credit repayment schedule. The purpose of this model was to identify the variables that most influence slowness and to complement the analysis of the hypotheses. For the logistic regression analysis, dummy variables were created (Bursac et al., 2008), which reflect the amount of the credit; the date it was granted; whether the economic activity is a restaurant, cab service or bus service for mass transportation; whether the credit was for the purchase of a light vehicle, heavy vehicle or working capital; and the sex of the debtor member. After implementing the logistic regression model with dummy variables (9 independent and 1 dependent), the condition p-value < 0.05 was true for three variables, which are also the ones that best fit the model. Graph 1 illustrates the model and results of the regression analysis.

Where, x1 corresponds to the amount of the credit, x2 the date it was granted and x3 the sex of the debtor member. The resulting variable reflects whether the credit is "current" or "overdue". To interpret the results, assume an above-average credit amount (>$14.738) extended after the pandemic to a male. This observation is more likely to be "current". This pattern was consistent in 95% of the observations. Conversely, a lower than average amount awarded pre-pandemic to a woman is more likely to be "delayed" (67% of the time). However, these results need to be analyzed carefully. The sample contains only 20 women with above-average credits, which are associated with a greater likelihood of being "current" on their obligations; while 125 women have below-average credits, which are associated with a greater likelihood of being "overdue" on their obligations. In fact, none of the women in the sample with larger-than-average credits reported being in arrears.

This research addressed the effects of the Covid-19 pandemic in saving and credit cooperatives in Portoviejo, Ecuador. A mixed study was designed with qualitative and quantitative data that made it possible to describe the context in which saving and credit cooperatives operate, as well as the particularities of the cooperative that was the object of this study. The study made it possible to observe structural aspects of the cooperative portfolio of debtor-members and to identify factors associated with the probability that a debtor will fall behind in the credit repayment schedule.

The variables most associated with the likelihood that a borrowing member will be late in making payments are the amount of the credit, the date it was granted, and the sex of the debtor member. Most credits are clustered around $8.000. Credits around this amount are more likely to report slowness and tend to be for working capital for microenterprise and consumer credits. Credits larger than the average amount of $14.738 are more likely to be for fixed asset purchases and are less likely to report arrears. Another interesting finding is that credits extended prior to the pandemic declaration in April 2020 were more likely to report "arrears," even though the volume of transactions increased from the onset of the pandemic. Finally, the results suggest that women are more likely to report arrears; however, this result may be based since most credits to women are around $8.000, which are also for activities more affected by the pandemic and more frequently associated with arrears.

As for the practical implications of the study, in periods of crisis or social upheaval, it is advisable to address existing credits through rescheduling alternatives that minimize the probability of slowness. Priority should be given to those credits with amounts below the portfolio average and oriented to working capital and the operation of microenterprises. In addition, the study indicates that women debtors are more vulnerable to report slowness in a crisis situation, so it is necessary to design rescheduling alternatives that address the particularities of their challenges.

For future research, it is suggested replicating this study in other saving and credit cooperatives to identify whether portfolio structure is a systemic characteristic. Likewise, it is suggested to conduct studies with metadata and machine learning tools to deepen the identification of saving and credit cooperatives members who are prone to default on their loan payments. Finally, based on this study, experimental research can be designed, such as increasing the proportion of female debtors of above-average amounts, making payment schedules for working capital more flexible, among others. Experimentation would help identify what works and what does not work for saving and credit cooperatives to sustain their operations during periods of crisis such as the Covid-19 pandemic.

REFERENCES

Bursac, Z., Gauss, C. H., Williams, D. K., & Hosmer, D. W. (2008). Purposeful selection of variables in logistic regression. Source Code for Biology and Medicine, 3(17). https://doi.org/10.1186/1751-0473-3-17 [ Links ]

Darjana, D., Wiryono, S. K., & Koesrindartoto, D. P. (2022). The COVID-19 Pandemic Impact on Banking Sector. Asian Economics Letters, 3(3), 29955. https://doi.org/10.46557/001c.29955 [ Links ]

Georgieva, K. (2020). Después de la crisis. Debemos aprovechar esta oportunidad para construir un mundo mejor. Finanzas y Desarrollo, 57(2), 10-12. https://www.imf.org/external/pubs/ft/fandd/spa/2020/06/index.htm [ Links ]

Junta de Política y Regulación Monetaria y Financiera. (2015). Norma para la Gestión del Riesgo de Crédito en las Cooperativas de Ahorro y Crédito (N.o 129-2015-F). Junta de Política y Regulación Monetaria y Financiera. https://www.seps.gob.ec/wp-content/uploads/Resol129.pdf [ Links ]

Marcu, M. R. (2021). The Impact of the COVID-19 Pandemic on the Banking Sector. Management Dynamics in the Knowledge Economy, 9(2), 203-224. https://www.managementdynamics.ro/index.php/journal/article/view/416 [ Links ]

McKillop, D., French, D., Quinn, B., Sobiech, A. L., & Wilson, J. O. S. (2020). Cooperative financial institutions: A review of the literature. International Review of Financial Analysis, 71, 101520. https://doi.org/10.1016/j.irfa.2020.101520 [ Links ]

Omona, J. (2021). Poverty eradication and wealth creation: The role and challenges of savings and credit cooperatives (SACCOs) in Uganda. African Journal of Business Management, 15(8), 198-210. https://doi.org/10.5897/AJBM2021.9234 [ Links ]

Peng, C.-Y. J., Lee, K. L., & Ingersoll, G. M. (2002). An Introduction to Logistic Regression Analysis and Reporting. The Journal of Educational Research, 96(1), 3-14. https://doi.org/10.1080/00220670209598786 [ Links ]

SEPS. (2011). Ley Orgánica de Economía Popular y Solidaria (Registro Oficial No. 444). Superintendencia de Economía Popular y Solidaria. https://www.seps.gob.ec/wp-content/uploads/Ley-Organica-de-Economia-Popular-y-Solidaria.pdf [ Links ]

SEPS. (2014). Código Orgánico Monetario y Financiero (Segundo Suplemento del Registro Oficial No. 332). Superintendencia de Economía Popular y Solidaria. https://www.seps.gob.ec/wp-content/uploads/CODIGO-ORGANICO-MONETARIO-Y-FINANCIERO.pdf [ Links ]

Umarov, Z. A., & Toshpulatova, S. Sh. (2020). Covid-19 and the Banking Industry in Uzbekistan: Impact and Solutions. Austrian Journal of Humanities and Social Sciences, (3-4), 50-56. https://doi.org/10.29013/AJH-20-3.4-50-56 [ Links ]

Xie, H., Chang, H.-L., Hafeez, M., & Saliba, C. (2021). COVID-19 post-implications for sustainable banking sector performance: Evidence from emerging Asian economies. Economic Research-Ekonomska Istraživanja. https://doi.org/10.1080/1331677X.2021.2018619 [ Links ]

1International Monetary Fund blog. https://blog-dialogoafondo.imf.org/?p=13190

2Coronavirus and the economy: 3 possible scenarios for economic recovery after the Covid-19 pandemic. BBC News. https://www.bbc.com/mundo/noticias-internacional-52267326

3Covid-19 and its implications in the National Financial System. http://rfd.org.ec/biblioteca/pdfs/LG-202.pdf

4The Ecuadorian economy decreased 12.4% in the second quarter of 2020. https://www.bce.fin.ec/index.php/boletines-de-prensa-archivo/item/1383-la-economia-ecuatoriana-decrecio-12-4-en-el-segundo-trimestre-de-2020

5Data analysis add-in for Microsoft Excel. https://www.xlstat.com/es/

Received: March 28, 2022; Accepted: July 31, 2022

texto en

texto en