Introduction

Advertisement and informing in business has changed to an inseparable part of economic units today as the survival of each business somehow depends on the success or failure of its informing, marketing, market-making, and advertisement activities. Advertisement means planning and its conception. It means any matter at any time with any media and method must be introduced to the addressees to gain the maximum effectiveness.

Today business environment is associated with the increasing complexity, rapid changes, and unexpected developments of the markets. Selecting target marts is the basis of gaining rank for the agency to provide customers’ needs and the agency’s goals. Effective promotion advertising is a set of measures that organizations take to communicate with their target segments in the target market and to influence them to better position their products and services.

Therefore, they play an important role to develop marketing policies of the company such as the relationship with customers, introducing new products, modifying, and changing the customers’ minds about the company and its trademark. Therefore, all promotion-mixed elements must be adjusted and agreed with the other elements of the marketing plan of agency in addition to coordination with each other and varied needs of the selected market goals by the agency.

Customers’ maintenance needs an adaptation of products to their needs and expectations which necessitates the full conception of customers’ needs and decisions to continue the coordination and relationship between the organization and customer. The point to note is that attracting new customers is considered as the middle stage in the marketing process, and marketing makes sense in the form of attracting, retaining, and enhancing customer relationships. Thus, expansion and improvement of relationships with predictor customers and gaining their trust is an important goal of marketing which not to be neglected.

Various studies show that the service-provider organizations pay less attention to the advertisement then the productive organizations due to the unique characteristics of service which is intangibility. Effective promotional advertising in the financial services sector, particularly banking services, is so determinant because these types of services are intangible products and signifying them is so difficult. It is to be noticed that most banks provide similar products.

Banks' services are rarely unique and are easily copied by rivals. Moreover, many people can’t find a difference in different bank services and most of them are unaware of existed financial services. In the country's banking sector, the use of traditional methods and patterns is still widespread in most marketing and advertising activities despite its relatively long history in a way that lack of expertise, lack of use in advertising research, ignorance of the needs of banking network customers, lack of attention to the element of creativity in advertising, and lack of distinction in advertising activities are the most significant weaknesses of state banking advertisement according to the experts’ idea in this field.

Banks of Iran face a big problem to attract customers and their deposits because of the incremental number of banks and providing nearly similar services. Thus, banks must have proper planning to provide their advertisement to maintain their share or increase their share in this competitive space.

Sepah bank, as the first Iranian bank, started its activity in place of several stores in 1925, 4, May with cash of 3,883,950 Rls, and the first branch was established in Rasht in 1925, 14, May. Now, Sepah Bank as one of the most important financial and economic institutions in the country with about 1,700 branches has been able to attract wandering public funds and lead it to productive economic activities in pursuit of economic goals with an effective and desirable corporation over 90 years (nearly a century) of experience. In addition, this bank has a special status in providing banking services at the international level by making banking units in countries such as Germany, Italy, and France similar to England Sepah international bank. The most important activities of Sepah bank in international level include opening all types of deposit account, foreign exchange affairs, opening letters of credit, imparting letters of credit, covering letters of credit, approving letters of credit, Issuing currency guarantees, etc. (Banksepah.ir)

The most important capital of a bank is customers’ trust caused by the bank’s trustworthiness and prudence in the proper and wise use of their funds. One important aspect of trustworthiness is its contagious feature for other people. In other words, when people see their acquaintances as well as their trustees in a particular bank, they also want to trust that bank and join that bank's customer circle. The opposite side of this trust is possible. When acquaintances, as well as trustees of a bank, are deprived of trust, other relatives also have doubts about trusting that bank (Khansari & Ghelich, 2015). Fame, credit, and name of banks make and maintain a positive mentality toward them. Trust is an important factor in user perception from advertisements. Thus, trust is an important factor to study advertisement because there is a permanent tendency for consumers for destroying trust in the advertisement.

Banks advertisements such as various banking services include facilities and loans, the introduction of new capabilities of the e-banking system, encouragement to deposit such as long-term investment or Qard al-Hasan which cover citizens day and night. According to the central bank announcement, Ansar bank, Ghavamin, Hekmat Iranian, Mehr Eqtesad, and Kosar credit institution will merge into Sepah bank as one more effective and more efficient banking unit to provide better services to police force families and public with aim of centralizing their abilities and capacities.

The heads of the three branches of the High Economic Coordination Council conferred special powers to the head of the central bank to reform the banking system in 2018, October, 13. Therefore, Sepah bank will be the greatest Iranian bank whose marketing and customers’ attraction will be twice important by this act. It is found out by focusing on the background of Sepah bank that this has always tried to influence its addressees through advertisement. However, this question occurs to mind whether this advertisement will always win and cause customers’ trust? Hence, the main question of this research is what role banking advertisement plays in web and traditional space to bring customers’ trust?

The obtained results from this research can help managers and authorities of the bank to obtain an estimation of the effectiveness of each traditional and modern pattern to attract customers’ trust. Furthermore, this research will investigate the opportunities and challenges of advertisement in web and traditional space as well as suggest applied policies to use each media more efficiently.

Development

Most banks have to offer similar services. The only different thing may be the difference in the introduction of attraction and differences in the advertisement. Therefore, awareness of them indicates the specific role and place of advertisement effectiveness evaluation (Sanaei, Mohamamd Shafiei, & Amini Velashani, 2015).

The effective advertisement attracts addressees, makes memories, motivates their buying reaction, and evokes intuition. The results of these evaluations identify the advantages and disadvantages of advertisements. Advertisers and marketers are always interested to determine the effect of their advertisements on their target customers. Actually, they incrementally try to improve the effectiveness of their advertisements. In this way, varied models have been introduced to evaluate the effectiveness of advertisements.

AIDA model identifies the perceptional steps passed by a person during buying or taking a service process. This model provides a purchase path passed by buyers in each step to help them decide the target purchase. Today, it is no longer just a matter of a mere relationship between the buyer and the company, because mass media develops this relationship to obtain the various aspects of AIDA by the added data by the other customers through the associations and social networks. In the media debate, it is very important to consider the differences between international and local media. The used tools and media for both cases are similar but the difference is the user content and objectives in the local and international media which is due to the caused cultural difference from local differences. AIDA model explains the basic and elementary steps of sale which have been permanently applied in history. AIDA is the abbreviation form of the terms: attention, interest, desire, and action that are the logical process for the decision to buy. The problem in each step of sale is caused by a failure in one of these 4 parts.

Empirical background

Sedaghat (2014), studied the effectiveness of TV ads in Mellat bank. The sample volume was determined 380 that increased to 400 people for easiness in selection. The questionnaire of this research was researcher-made whose first and second parts were attributed to TV ads of Mellat bank and 4 steps of AIDA model effectiveness, respectively. The obtained results show that TV ads of Mellat bank were effective on 4 steps of attraction, interest, the desire of using products, and moving them to use the bank products. Moreover, the other findings of this research showed that gender and occupation are not effective for the effectiveness of Mellat bank TV ads. Sedaghat, H. (2014).

Moreover, based on statistical findings, age and education have a reverse relationship with the effectiveness of Mellat bank TV ads. In addition, Sabbar & Hiyan (2015), concluded in research besides investigating the relevant factors to the addressees’ trust in modern and traditional media that there are significant relationships between media, media content, and features of addresses to trust on media.

Based on the type of media, people rely on specialized journals in these areas for medical and economic information rather than their dedicated programs on television or their pages in newspapers and the internet. In addition, results about the content type showed that when it comes to medical matters, people have the least trust on the internet. However, the maximum amount of mistrust was related to television media when it turns to economic issues. In addition, a significant relationship was shown between the addressees’ psychological characteristics and their trust in media. Furthermore, Khurani & Mahdavinia (2015), concluded in a research about the TV advertisement of Sepah bank and attracting banking resources that there is a significant relationship between TV ads and its aspects (including logical-explanatory, emotional-sensational, and logical-emotional ads) and attracting banking resources. The higher the level of television advertising is the greater the tendency to use banking services.

Hamdi (2016), studied the role of Saderat bank TV ads on Tehran citizens' use of e-banking services. His research was surveying and the tool was a questionnaire. 343 people were selected as a sample by random sampling method among Saderat bank branches in district 4 of Tehran who used e-banking services. The obtained results from this research showed a positive view of the sample about TV ads. The main hypothesis of this research with the issue of the relationship between TV ads and the use of e-banking services was significant.

There is a correlation between knowledge, attitude, behavior, and use of e-banking services by samples. Moreover, Amini & Rahmani (2016), studied the role marketing and advertisement strategy of Sepah bank on customers’ satisfaction. Research findings show that Sepah bank ads influence customers’ satisfaction and attracting customers and their attention (purchase) has the maximum effect on customers’ satisfaction with Sepah bank. Furthermore, the relationship-based marketing strategy of Sepah bank influences customers’ satisfaction with Sepah bank, and supervision on information interaction has the maximum effect on customers’ satisfaction with Sepah bank.

Among the foreign research, Denis et al. research can be cited which studied the effectiveness of banking ads on the internet. In this research, the problem of evaluating banking ads' effectiveness on the internet was studied both theoretically and practically, and the conceptual framework of online advertisement was analyzed using different advertising methods. Particularly, the action focuses on analyzing traditional advertising methods (such as banner, text message, etc.). Particular attention has been paid to the economic and psychological impact of advertising. Various methods and approaches have been considered to evaluate ads effectiveness, their advantages, and disadvantage, in addition, their use in the financial field is definite. Database components serve to determine the economic productivity of advertisements. The applied tool to evaluate the effectiveness of the online ads of baking services and products is examined. The practical recommendations have been developed to improve the effectiveness of the online advertising evaluation mechanism in the bank.

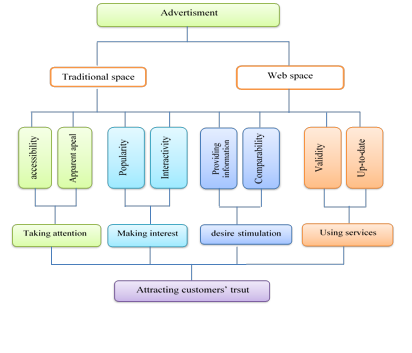

AIDA model was used in this research to evaluate the media advertisement effect in the banking system on customers’ trust which is the most effective scientific model to evaluate the media advertisement which is shown in figure 1, as a conceptual model.

The used methodology in this research is surveying. The questionnaire was used to evaluate the research issue. Therefore, related books and articles to added advertising are first collected, refined, and screened and then translated using reputable scientific resources and foreign scientific and research journals. Furthermore, the essential data about the existed condition of using the traditional and modern media was extracted for advertisement and various items were collected and coded using various resources and relative familiarity with active companies and specialized teams in the advertisement field. These items are directly related to the main questions of research. After that, the items were distributed among several active experts and communication professors in the advertisement field, the problems of items were extracted, and the questionnaire was modified by this feedback, and the essential editions have been made.

The obtained results from studying the credit of research items based on pre-test sample with a volume of 30 members using Cronbach’s alpha coefficient has shown that Cronbach’s alpha coefficient is higher than 0.78 that showed the validity of research items in variables assessment is confirmed. The statistical population of this research is all Sepah bank customers from 220 branches of this bank in 22 districts of Tehran. The essential sample volume for this research was calculated 384 by the Cochran formula. In addition, the essential sample volume for a population with 100000 members is equal or higher than 384. 412 out of 450 distributed questionnaires were finally analyzed to reduce the non-answer error.

The sampling method in this research was mixed (a simple random and a multistage clustering method). The method is that first the branches of Sepah bank in Tehran are divided into five geographical areas from north, south, west, east, and center and then from each region one branch of Sepah Bank is randomly selected and then customers from each branch were selected using systematic sampling. Findings were analyzed using spss software (22) in two descriptive and inferential levels.

Findings

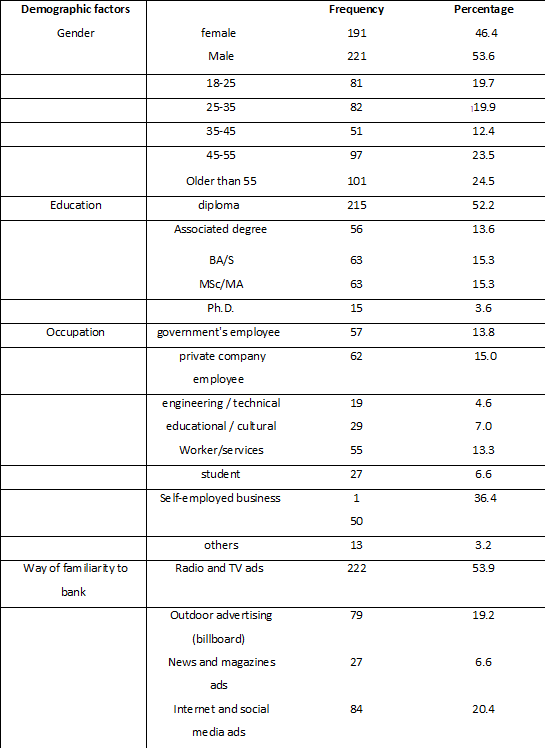

According to demographic data, 53.6% and 46.4% of participants were male and female, respectively. In addition, 24.5% were older than 55, 23.5% were 45-55, 19.9% were 25-35, 19.7% are 18-25, and 12.4% are 35-45 years old. Moreover, the mean age of participants was about 42.

Findings of table 1 show that 52.2% of the participant had a diploma, 15.3% has bachelor, 15.3% had MSc/MA, 13.6% had associated degree, and 3.6% had ph.d. Based on table 1, 36.4% of participants had a self-employed business, 15% were private employees, 13.8% were governmental employees, and 13.3% were workers. It means most participants had the self-employed business. It indicates that most customers of Sepah bank with more interaction had a non-governmental job. In this regard, a triple number of self-employed businesses to governmental job customers show the commercialization of Sepah bank and having more resources in the state banking industry. On the other hand and based on data of table 1, 53.9%, from whole participants got familiar with Sepah bank by TV and radio, 20.4% by internet advertisements and social networks, 19.2% through environmental ads, and 6.6% through newspaper and magazines ads.

Inferential findings

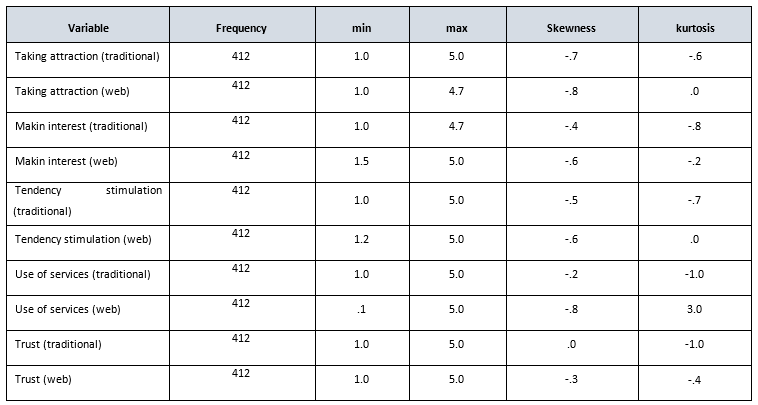

Kurtosis and skewness indexes were used to test the normality of variables before inferential analysis and hypotheses tests. When the absolute value of kurtosis and skewness is in (-3, 3) interval, the researcher can confirm that research variables have a normal distribution. Based on the provided values in table 2, the absolute values of skewness and kurtosis is in (-3, 3) interval. This shows the research variables are normal. Thus, the Pearson correlation coefficient was used to study the significant relationship between research variables.

Testing hypotheses

First hypothesis: there is a significant relationship between attracting customers’ attention by Sepah bank ads in the traditional and web spaces and their trust.

Pearson correlation coefficient test was used to test the relationship between attracting customers’ attention by Sepah bank ads in the traditional and web spaces and their trust. According to the offered results in table 3, the Pearson correlation coefficient between attracting customers’ attention by Sepah bank ads in the traditional and web spaces are 0.57 and 0.31 with sig. level of 0.000 and 0.000, respectively. Since the sig. level is lower than 0.01, the first hypothesis is confirmed with 99% significance and 1% error. The value of the correlation coefficient shows the direct relationship between these two variables. Although attracting customers’ attention by advertisement in the traditional space influence on customers’ trust more than an advertisement in web space, statistical findings show the increasing this attraction in the traditional and web spaces will increase customers’ trust and vice versa. Therefore, the first hypothesis is confirmed.

Table 3 Pearson correlation coefficient test between attracting customers’ attention caused by Sepah bank advertisement in the traditional and web spaces on customers’ trust.

| Trust | ||

|---|---|---|

| Pearson value | Sig. level | |

| Attracting attention in traditional space | 0.57 | 0.000 |

| Attracting attention in web space | 0.31 | 0.000 |

Second hypothesis: there is a significant relationship between making customers’ interest by Sepah bank ads in the traditional and web spaces and their trust.

According to the offered results in table 4, the Pearson correlation coefficient between making customers’ interest by Sepah bank ads in the traditional and web spaces are 0.61 and 0.38 with sig. level of 0.000 and 0.000, respectively. Since the sig. level is lower than 0.01, the second hypothesis is confirmed with 99% significance and 1% error. The value of the correlation coefficient shows the direct relationship between these two variables. Although making customers’ interest by advertisement in the traditional space influence on customers’ trust more than an advertisement in web space, statistical findings show the increasing this interest in the traditional and web spaces will increase customers’ trust and vice versa. Therefore, the second hypothesis is confirmed.

Table 4 Pearson correlation coefficient test between making customers’ interest caused by Sepah bank advertisement in the traditional and web spaces on customers’ trust.

| Trust | ||

|---|---|---|

| Pearson value | Sig. level | |

| Attracting attention in traditional space | 0.61 | 0.000 |

| Attracting attention in web space | 0.38 | 0.000 |

Third hypothesis: there is a significant relationship between stimulating customers’ desire by Sepah bank ads in the traditional and web spaces and their trust.

According to the offered results in table 5, the Pearson correlation coefficient between making customers’ interest by Sepah bank ads in the traditional and web spaces are 0.66 and 0.39 with sig. level of 0.000 and 0.000, respectively. Since the sig. level is lower than 0.01, the third hypothesis is confirmed with 99% significance and 1% error. The value of the correlation coefficient shows the direct relationship between these two variables. Although stimulating customers’ desire by advertisement in the traditional space influence on customers’ trust more than an advertisement in web space, statistical findings show the stimulating customers’ desire in the traditional and web spaces will increase customers’ trust and vice versa. Therefore, the third hypothesis is confirmed.

Table 5 Pearson correlation coefficient test between stimulating customers’ desire caused by Sepah bank advertisement in the traditional and web spaces on customers’ trust.

| Trust | ||

|---|---|---|

| Pearson value | Sig. level | |

| Attracting attention in traditional space | 0.66 | 0.000 |

| Attracting attention in web space | 0.39 | 0.000 |

Fourth hypothesis: there is a significant relationship between moving customers’ to use services of Sepah bank ads in the traditional and web spaces and their trust.

According to the offered results in table 6, the Pearson correlation coefficient between moving customers’ to use services of Sepah bank ads in the traditional and web spaces are 0.51 and 0.35 with sig. level of 0.000 and 0.000, respectively. Since the sig. level is lower than 0.01, the fourth hypothesis is confirmed with 99% significance and 1% error. The value of the correlation coefficient shows the direct relationship between these two variables. Although moving customers’ to use services of advertisement in the traditional space influence customers’ trust more than an advertisement in web space, statistical findings show the moving customers’ to use services in the traditional and web spaces will increase customers’ trust and vice versa. Therefore, the fourth hypothesis is confirmed.

Table 6 Pearson correlation coefficient test between moving customers’ to use services caused by Sepah bank advertisement in the traditional and web spaces on customers’ trust.

| Trust | ||

|---|---|---|

| Pearson value | Sig. level | |

| Attracting attention in traditional space | 0. 51 | 0.000 |

| Attracting attention in web space | 0.35 | 0.000 |

The competitive, dynamic, and sophisticated banking environment in Iran has made banks to intend incrementally to customer-basis in their strategies. As a result, communication, competitiveness, and customer-basis concepts have associated today together. Advertisements play a role as the mixed element of marketing to protect and survive organizational by introducing services and goods. Meanwhile, services have distinctive features than goods by which the advertisements are significantly important to inform the service addresses.

According to the inferential findings, increasing Sepah bank ads in traditional and we space will increase customers’ trust and vice versa. However, advertisement in the traditional space influences customers’ trust more than it in web space. Thus, customers are influenced more by Sepah bank advertisements in traditional media than new media. Moreover, the statistical data showed that attracting customers; attention in the traditional and web spaces will increase customers’ trust and vice versa. However, attracting customers’ attention in the traditional space influences more than the web space on customers’ trust. Therefore, Sepah bank customers pay more attention to the ads in traditional than new media. In addition, the statistical findings show by 99% significance that increasing customers’ interest in ads of the traditional and web spaces will increase customers’ trust and vice versa. Therefore, Sepah bank customers show more interest in the ads in traditional than new media. Furthermore, the statistical findings show by 99% significance that stimulating customers’ desire by ads of the traditional and web spaces will increase customers’ trust and vice versa. However, stimulating customers’ desire in the traditional space influences more than the web space on customers’ trust. Therefore, Sepah bank customers have more desire for ads in traditional than new media.

In addition, the statistical findings show by 99% significance that moving customers’ to use Sepah bank services by ads of the traditional and web spaces will increase customers’ trust and vice versa. However, moving customers’ to use Sepah bank services by ads in the traditional space influences more than the web space on customers’ trust. Therefore, Sepah bank customers use more services in the ads in traditional than new media.

The advertisement has a dual effect including the communicational and sale effects. The first to the third hypotheses in this research studied the communicational effect that Sepah bank ads in the traditional media showed higher rank about attraction, interest, desire, and stimulation than modern media based on the obtained results from statistical analysis. Moreover, the fourth hypothesis studied the sale effect, and statistical analysis showed that Sepah bank ads influence traditional media more than the new ones on attracting customers and their trust. Thus, it can be stated based on research findings that advertisements in traditional media such as TV and radio influence on attracting customers and their trust more than the modern media. Hence, it can be claimed based on findings that Sepah bank ads influence more on customers’ trust through traditional media such as TV, radio, papers, and environmental ads than media based on virtual space, social networks, etc.

Conclusions

First, the traditional media must be focused on a higher share in adjusting the advertising plans than then internet according to priority determination of the effective advertising media based on AIDA model and since the environmental advertisements and radio has the maximum positive effect on Sepah bank customers’ trust. It should be noted that planning executives should not be overlooked in the media with less priority when planning for corporate advertising, because the internet may be less prioritized for lack of investment and proper planning.

In addition, since ads creativity in all media can be an important factor to accept Sepah bank ads, it is suggested to invest and focus in this field, more invention, and creativity to attract the most customers’ attention. Furthermore, since on one hand the proper tie to show ads, persistence and continuity of advertising, create a positive mental image of the bank's service to the target audience and customers, and repeat advertising has a high impact on attracting customers, and on the other hand, traditional media such as TV explains a high proportion of the effectiveness of Sepah Banks ads, it is suggested bank shows its ads at night time or in popular television series or as a subtitle during popular television shows, and popular sports programs to attract most customers’ attention. Moreover, banks should have ads in all periods because not having highlighted advertisements make customers forget their strong mentality about bank services. In other words, customers should have always exposed to advertisements to get familiar with the new products and services. Therefore, banks ads quantity can be increased by a combination of virtual and traditional media.