Mi SciELO

Servicios Personalizados

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Cooperativismo y Desarrollo

versión On-line ISSN 2310-340X

Coodes vol.11 no.2 Pinar del Río mayo.-ago. 2023 Epub 30-Ago-2023

Original article

Procedure for the provision of accounting services by non-agricultural cooperatives in Cuba

1 Cooperativa No Agropecuaria "Procura". Santa Clara, Cuba.

2 Universidad de Holguín "Oscar Lucero Moya". Holguín, Cuba.

The cooperative movement in Cuba was characterized until the end of 2012 by its exclusive scope in the agricultural sector. Since the updating of the economic and social model, these forms of management were inserted in other sectors of the economy to diversify it. Thus, professional services cooperatives were approved, including accounting services. At the time of their emergence, these associations did not have an organizational level that would allow them to implement models or procedures aimed at regulating their performance. That is why the objective of this research is to design a procedure for the provision of accounting services by non-agricultural cooperatives in Cuba in order to favor their management. To carry it out, theoretical and empirical research methods were applied to contextualize the scope of the social objects of these cooperatives to the national environment. As a result, a procedure was obtained where the stages to execute the service were defined and integrated in steps and tasks for the establishment of a methodological instrument with documented information. It also allowed the coherent conjugation of methods and techniques that facilitate the work of the acting member and have an impact on the cooperative business management.

Key words: cooperativism; business management; accounting services

Introduction

The development and evolution of the cooperative movement have been in correspondence with the needs of the societies in which they are framed and, in dependence, in addition to the types of cooperatives and the scope to the different sectors of the economy. Odriozola Guitart and Palma Arnaud (2018) considered cooperativism as an entrepreneurial alternative at present for the development of nations, given the principles on which they are based. At present times, there is no doubt about the need for cooperatives to function harmoniously and to relate to the other forms of management in Cuba.

In addition, it is required that their conception is aimed at the improvement of the localities in which they are located in order to contribute to social development. Contemporary authors such as Rodríguez Musa et al. (2016), Piorno Garcell et al. (2017), Odriozola Guitart and Palma Arnaud (2018), Pittman (2018), Piñeiro Harnecker (2020), Núñez Llerena et al. (2021), Garteiz Aurrecoa (2016) and Marín de León et al. (2021) have analyzed the particularities of cooperative business management in specific axes of action such as economic-social impact, the environment and its institutionality.

On the other hand, regardless of the fact that in the world the operation of cooperatives is nothing new, in the case of Cuba, until the end of 2012, the experience that existed was exclusively in agricultural cooperatives such as Credit and Service Cooperatives, Agricultural Production Cooperatives and Basic Units of Cooperative Production. This is why the case of Cuba is particular, because until only a decade ago the term cooperative was synonymous with agriculture. The updating of the economic and social model gave importance to these forms of management, prioritizing those that offered solutions to the development of the country and its territories. In this way, the scope of these associations was expanded to other strategic economic sectors.

In 2014, the first cooperatives of professional accounting services were established. Five cooperatives of this type are currently in operation, grouped in the provinces of Villa Clara and Havana, these are:

Non-agricultural cooperative contadores Doctor Enrique Rodriguez Corominas (Coopsep)

Non-agricultural cooperative Procura

Ambar Cooperative Professional Services

Non-agricultural integrated business management cooperative (Gesin)

Non-agricultural bookkeeping and management cooperative (Acerco)

In these associations, the provision of services is not carried out in a planned manner, but rather empirically, which was confirmed through interviews with members of these cooperatives. Among the causes of this fact, the following stand out:

Partners with proven professional experience, but coming from different sectors of the economy, which leads to the existence of different ways of doing things and the lack of a consolidated organizational culture.

Lack of documented information to evidence the scope of service performance and its influence on customer satisfaction levels.

No alternative methods or guidelines are proposed for the provision of services in the event of deviations.

The accounting system implemented by the client is not taken into account, nor is its redesign or updating conceived.

Poor interrelation of the service with internal control.

This scenario allowed affirming that it is necessary to design a procedure that integrates the phases or stages of the accounting services provided by these cooperatives and, in this way, to establish documented information that facilitates the work of the executing partner. Therefore, the objective of this research is: To design a procedure for the provision of accounting services by non-agricultural cooperatives in Cuba to favor their management.

Materials and methods

For the design of the procedure, the following scientific research methods were taken into account.

Among the theoretical methods, the comparative method was applied to establish the effects of the existing regulations in the country and their incidence in the cooperative sector, with a view to including the main regulations of obligatory observation by the executors of accounting services. The analysis-synthesis and inductive-deductive procedures were used to have a better understanding of the nature of the object of study and to establish inadequacies; this allowed arriving at conclusions on the identified problem. The historical-logical method was used to understand the evolution of cooperativism and its behavior in the contemporary Cuban scenario.

As an empirical method, the review of documents was applied by consulting official sources of the governing bodies of the economy in Cuba. In addition, the contracting of accounting services and the monthly reports where the results of the work carried out by the cooperatives' partners are shown were studied. The interview was used to diagnose the current state of the execution of accounting services provided by these organizations.

Results and discussion

Authors such as Rojas (2018), Freeman et al. (2020) and Crespo García et al. (2020) have conceived procedures for internal accounting processes that are the most abundant in the literature, given that every economic entity must have an accounting system where to record the economic facts and, on the basis of these, carry out the decision-making process. In addition, Gelashvili et al. (2020) analyze economically and financially the social enterprises, but in the same way, the study is internal to these entities and not as the outsourcing of a service.

Through interviews with members of the five non-agricultural cooperatives that provide accounting services in Cuba, it is confirmed that only in the case of the Coopsep cooperative in the province of Villa Clara there is a precedent close to this research, since it has a quality management system. In the case of the service provision process, they have defined the objectives, the treatment of non-conforming services and the measurement of customer satisfaction. However, it does not specify how to carry out the provision of accounting services, as it is conceived in a general way.

Consulting firms that provide accounting services in Cuba are characterized by having implemented quality management systems for their service provision processes in general. Accounting services have general procedures that are broken down by as many procedures or specific instructions as necessary. In the case of cooperatives engaged in this activity in Cuba, the scientific treatment in this process is insufficient, so the need to include in their service provision aspects that distinguish them from these consultancies, as main competitors in the country, is introduced.

For the elaboration of the procedure, the theoretical and legal elements related to accounting management were taken as a basis. The general conditions and characteristics of non-agricultural cooperatives that provide accounting services in Cuba were also analyzed.

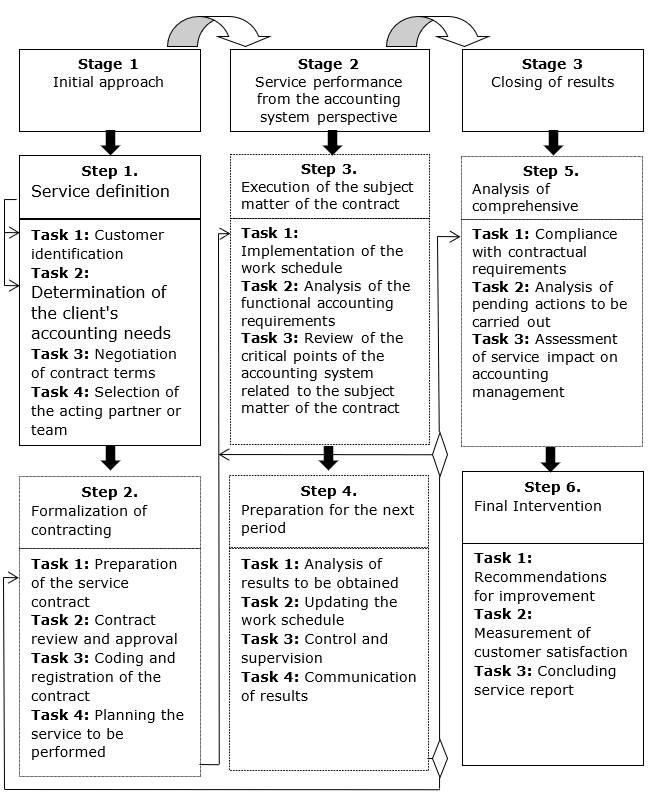

The design of a procedure that could be implemented by these organizations was considered, which consists of three stages, each of which is made up of two steps and these are broken down into tasks. Among the particularities of the procedure, it was emphasized that steps two and five must be carried out entirely at the legal domicile of the non-agricultural cooperative without the intervention of the client. In addition, steps three and four were highlighted as being critical in the service provision process; the satisfaction perceived by the clients will depend to a large extent on their correct execution. Figure 1 shows the logical order and composition of the procedure.

The description of the stages included in the procedure is shown below.

Stage 1: Initial approach

This stage constituted the pillar of the procedure and its objective is to lay the foundations for the execution of the service to be carried out in accordance with the regulations in force. It was designed to take place mainly at the legal domicile of the cooperative, since it establishes how to organize and plan the service to be performed.

Step 1. Service definition

Its objective is to define the basic elements and identify the client's initial needs in correspondence with the approved corporate purpose of the cooperative.

Task 1: Customer identification

This is the first approach between the provider and the client and occurs as a result of the marketing management of each member of the cooperative.

This initial evaluation may result in the non-identification of a need for accounting intervention in the entity. In this case, the member who determines it will proceed to socialize it with the rest of the members of the cooperative to avoid initial approaches in the short term with the same entity.

When the request comes directly from a potential or loyal customer, this task is not executed and starts from task two.

Task 2: Determination of the client's accounting needs

Generally, the client has identified the accounting gaps that exist in the entity. Therefore, it must be determined whether this need requires intervention or can be solved by the client itself without the need to enter into a contract with a third party. If deemed necessary, this task constitutes the object of the contract, but it is specified that, once the partner acting in the service intervenes, other accounting needs and barriers that the client itself is unaware of may be identified.

Task 3: Negotiation of contract terms

The typical negotiation and contracting process with a potential client starts from the previous task and the possibility of an offer from the cooperative. After the client analyzes the offer, it is determined if the client agrees with it.

In the event of disagreement, negotiations will be held to assess possible modifications to the aspects included in the offer.

Task 4: Selection of the acting partner or team

If the offer and the contractual terms are accepted, the partners who will perform the service are selected. Two variants are identified: when a potential client requests the service and when a member of the cooperative identifies a possible service.

When a potential client requests the service: In order to provide the service with the required quality, it is necessary to start from the availability of members with the required suitability and the absence of conflicts of interest with respect to the client entity. This may result in the non-acceptance of the service due to the unavailability of members to provide the service with the required quality or because the service is not included in the cooperative's corporate purpose. In this case, the member in charge of the control and inspection activity informs the client of the reasons why he/she is not in a position to provide the service requested. The selection of the partner and other members of the team that will provide the service is made by the member in charge of the control and inspection activity with the approval of the president of the cooperative.

When a member of the cooperative identifies a possible service: For this, it is only required that the member in charge of the control and supervision activity, together with the president of the cooperative, give the approval for the service to be performed by the same member who identified the service. In the event that the presence of more than one member is required for the execution, what is stipulated in the first variant shall be taken into account.

Step 2. Formalization of the contract

It is executed with the objective of formalizing the tasks and actions developed in the previous step and is carried out entirely at the legal domicile of the cooperative. It lays the foundations for the development of the service attached to the legality of Cuban regulations.

Task 1: Preparation of the service contract

To draw up the service contract, the information gathered in the previous stage is taken into account. This task is carried out by the member in charge of the cooperative's control and supervision activities, who takes into account the service contract proforma of each cooperative.

Task 2: Contract review and approval

Once the proforma contract is completed, it is submitted to the president of the cooperative for review.

If any deficiency is observed during the review, the proforma is returned to the partner in charge of the control and inspection activity so that the pertinent corrections can be made. After the necessary adjustments have been made, it is verified that they have been satisfactorily completed.

Task 3: Codification and registration of the contract

Once the proforma contract has been approved, it is coded by the cooperative's accountant, two copies are issued and presented for signature by the president of the cooperative. Due to the volume of contracts, a simple coding is proposed, including a consecutive number followed by the year in question. The format should be as follows: Consecutive Number / Current Year.

The signed copies are delivered to the acting partner(s), after entry in the Control of Service Contracts.

Task 4: Planning the service to be performed

The planning of the service is carried out by the designated partner(s). This planning responds to what is stipulated in the service contract and takes the form of a work schedule for the service. It is therefore proposed that, at the beginning of the service and at the end of each month, this schedule be drawn up with the specific activities to be carried out and validated jointly with the client. This will allow the inclusion of unforeseen events and new needs of the client, as well as to follow up on the actions to be executed, delimit responsibilities and assess the progress and impact of the service.

Stage 2: Service execution from an accounting system perspective

This stage was conceived with the objective of executing the service from the perspective of the accounting system through the use of legal norms. This has a specific impact on the reasonableness of the client's accounting accounts and makes it possible to identify and solve accounting barriers not previously identified. This is the most important stage, since the results and impact of the service and, with these, the client's satisfaction depend to a great extent on its correct development.

Step 3. Execution of the object of the contract

This step constitutes the actual object of the contract and its objective is to link the deficiencies identified with comprehensive solutions from the accounting system point of view.

Task 1: Implementation of the work schedule

The initial work schedule is implemented. At the end of each month, corrections are made for any deviations detected. This action must be reconciled with the client and includes modifications to the accounting system proposed by the partners involved. This task depends, to a great extent, on the preparation and experience of the service performers for the development of the object of the contract.

Task 2: Analysis of the functional accounting requirements

These needs are made up of the necessary organizational and internal control aspects that affect the correct treatment of the object of the contract and its relationship with the other structures of the entity. They include, among others:

Technical-economic plan

Completion of the staff

Risk prevention plan

Labor Fluctuation

Internal customer satisfaction

Human Care System

Workers training

Accounting and cost manual

Internal operating manual

Internal and external information flow chart

Coordination between areas

Control actions

It is specified that, depending on the characteristics of each entity, others that are determined to influence the subject matter of the contract may be included.

The acting partner, together with the employees of the client's Accounting Department or Area, should identify and evaluate as many of these needs as possible, since they are considered to have a direct influence on accounting management. The initial evaluation made should be subject to periodic analysis by the client to determine the variation of the current status in relation to the desired situation. To this end, it is proposed that a plan of action be drawn up to enable it to be monitored.

Task 3: Review of the critical points of the accounting system related to the subject matter of the contract

The critical points of the accounting system are all those technical interventions that affect the reasonableness of the accounts and the accounting organization and discipline and that are related to the object of the contract.

List of critical points:

Documentary support of transactions and events

Mandatory usage data of the models used

The accounting nomenclature and subaccounts of obligatory use

The expenditure object classifier

Offsetting account of the accounting event. Emphasis is placed on the counterpart as a characteristic of accounting, since intervention in one accounting account necessarily requires intervention in another. Therefore, this fact is included in this procedure as an essential distinctive aspect of the services to be rendered by non-agricultural cooperatives

Financial statements

The quality of accounting records

Cross-references

Manipulation of accounting software

Archiving of documents

Results reports

Legal regulations

After the qualitative analysis of each critical point, it is convenient to use the Likert scale to organize the intervention needs according to the diagnosis made. For this purpose, the participation of all the personnel of the Accounting Area or Department and selected managers of the entity's Board of Directors is recommended.

Step 4. Preparation for the next period

This step is carried out with the objective of confirming the partial results of each work period by communicating to the client the actions that have been executed and those to be executed in the near future. It is also characterized by the formal linking of the client entity's managers with the partners performing the service.

Task 1: Analysis of the obtained results

It consists of a comparative analysis of the actions proposed in the work schedule with those that are actually executed. The causes of the non-compliances must be determined, as well as those responsible. It allows it to be taken into account for the planning of the next work period.

Task 2: Updating the work schedule

It is prepared with the actions to be executed in the next accounting period. The novelty is that it includes as executors both the employees of the entity and the partners involved in the execution of the service.

Task 3: Control and supervision

The report to be submitted to the client with the results and analysis carried out in the previous tasks must be delivered to the legal domicile of the cooperative to the partner performing the control and inspection tasks for supervision. The results of this review are communicated to the acting members so that they can take corrective actions if necessary. The following elements are proposed for carrying out the supervision of the service:

Service planning: Includes the use of the work schedule model, issues to be addressed, time of execution.

Objectivity and results of the work: Includes the depth and objectivity of the work, the work methods, the approach and scope, the relevance of the results and the adequacy of the work to the characteristics of the entity.

Use of and compliance with current accounting standards: Includes references to current regulations, sufficiency and verification of documents, data and information elements captured.

Conduct and professionalism: Includes the client's criteria on the work and conduct of the team (image, conduct, professionalism and ethics).

Customer interaction with the service: Includes the customer's perceived satisfaction with the service, doubts, complaints or suggestions regarding the development of the work, the customer's level of attention and cooperation with the team, and criteria regarding the continuity of the service or the need for others.

It is the responsibility of the partner in charge of the control and inspection activity to raise the need for corrective actions. Acting partners must ensure compliance with the recommendations prior to their presentation to the client.

Task 4: Communication of results

The communication of the results will be made on a monthly basis and must also correspond to the requirements of the contract.

All employees with functions inherent to accounting participate in this act. Members of the Board of Directors of the designated entity may also participate. This action must be carried out on the last working day of each month and must coincide with the delivery of the monthly invoice for the contracted service.

Stage 3: Closing of results

This stage is designed to prepare the closing of the service upon completion of the execution deadline. The steps and tasks included are designed to provide the client with a summary of the accounting interventions performed. In addition, for the cooperative, it constitutes evidence of the client's satisfaction and of the changes that were introduced in the client's accounting process.

Step 5. Analysis of the integral results

This step is executed in its entirety at the legal domicile of the cooperative because it is performed with the objective of determining whether the requirements and expectations of the client were met before executing the final actions defined in step six. It focuses on analyzing whether the contractual aspects were fulfilled, determining the deficiencies that were not solved and assessing the impact of the service.

Task 1: Compliance with contractual requirements

This task is carried out jointly by the acting member, the member in charge of the control and inspection activity and the president of the cooperative. In this meeting, a comparison is made between what is established in the object of the contract and the monthly results that are sent to the client to verify compliance with the requirements that were formally contracted. It is supported by the monthly supervisions developed. This analysis corresponds to the direct impact of the service and includes, in addition to satisfaction regarding compliance with the object of the contract, the methodological resources that were used, the communication style and feedback between both parties and the evaluation of the situation of the critical points of accounting.

Task 2: Analysis of pending actions to be executed

The causes for which at the end of the service there are insufficiencies previously detected pending solution must be determined. The determination of these actions is obtained from the analysis of the compliance with the monthly schedule sent to the client, in addition to the status of the functional needs. In this way, the indirect impact of the service is determined, which is also related to the degree of utilization of the presence of the cooperative's members in the client entity.

Task 3: Assessment of the effect of the service on accounting management

It refers to the effect that the service has had on the labor competencies of the employees and on the organizational functioning related to accounting. It is directly related to the opinion of the other areas of the entity regarding accounting management. This evaluation is carried out by the acting team and is proposed for review by the partner in charge of control and auditing functions.

Step 6. Final intervention

This step was conceived with the objective of preparing the last intervention on the client and providing him/her with the final considerations and recommendations to be observed for the maintenance of the results that are achieved.

Task 1: Recommendations for improvement

The recommendations for improvement are based on the conclusions of the tasks of the previous step and are included on a mandatory basis in the conclusive report of the service. They are focused on proposing actions to the client that could not be solved during the service delivery time. In addition, techniques and tools should be proposed to guide the customer to their subsequent solution.

Task 2: Measuring Customer Satisfaction

The measurement of customer satisfaction with the service received is carried out through a survey by a designated partner. Preferably, a partner is chosen who is not directly involved in the execution of the service.

The member surveyor, after visiting the client and obtaining the survey duly completed by the client, gives it to the member in charge of the control and supervision activity. The latter communicates the results of the survey to the president of the cooperative who, together, if necessary, will carry out a punctual analysis of the rating.

This task is performed before the conclusive report because, if an unfavorable rating is obtained, the elements that respond to the client's dissatisfaction will be included in the report.

Task 3: Concluding service report

The conclusive report is drafted including facts, results, opinions and suggestions based on the monthly evaluations made by the acting partner. Its discussion with the client constitutes the last intervention to be made, which must coincide with the date of termination of the service, according to the service contract.

The procedure designed constitutes a useful working tool to perform accounting services for non-agricultural cooperatives from a more comprehensive viewpoint by identifying and addressing the functional needs and critical points of each client's accounting system. The practical application of the procedure will make it possible to identify and intervene in the accounting gaps of the clients and will influence the satisfaction of the entities that receive this type of services.

Referencias bibliográficas

Crespo García, M. K., Carchi Arias, K. L., Zambrano Zambrano, A. A., Orellana Sánchez, D. A., & González Malla, S. E. (2020). Mejora Continua en el proceso contable y su aporte en la competitividad de las MIPYMES en la Provincia de El Oro. Revista ESPACIOS, 41(1). https://www.revistaespacios.com/a20v41n01/20410103.html [ Links ]

Freeman, E., Retolaza, J. L., & San José, L. (2020). Stakeholder Accounting: Hacia un modelo ampliado de contabilidad. CIRIEC-España. Revista de Economía Pública, Social y Cooperativa, (100), 89-114. https://doi.org/10.7203/CIRIEC-E.100.18962 [ Links ]

Garteiz Aurrecoa, J. D. (2016). Breve estudio de la evolución histórica del pensamiento cooperativo. Deusto Estudios Cooperativos, (8), 13-34. https://doi.org/10.18543/dec-8-2016pp13-34 [ Links ]

Gelashvili, V., Camacho Miñano, M. del M., & Segovia Vargas, M. J. (2020). Un estudio sobre el análisis económico-financiero de las empresas sociales: ¿son realmente negocios? Revista de Contabilidad, 23(2), 139-147. https://doi.org/10.6018/rcsar.361531 [ Links ]

Marín de León, I., Labrador Machín, O., Mirabal González, Y., Lorenzo Cabezas, Y., & Torres Paez, C. C. (2021). Institucionalización del sector cooperativo en Cuba: Una propuesta necesaria. Cooperativismo y Desarrollo, 9(2), 572-592. https://coodes.upr.edu.cu/index.php/coodes/article/view/456 [ Links ]

Núñez Llerena, C. R., García Pedraza, L., & Jara Solenzar, D. E. (2021). La participación en la gestión cooperativa. Una experiencia cubana. Estudios del Desarrollo Social: Cuba y América Latina, 9(1), 296-314. https://revistas.uh.cu/revflacso/article/view/4330 [ Links ]

Odriozola Guitart, S., & Palma Arnaud, A. R. (2018). Cooperativas no agropecuarias en el sector de la construcción en La Habana: Un análisis de su gestión. Economía y Desarrollo, 159(1), 80-96. https://revistas.uh.cu/econdesarrollo/article/view/1994 [ Links ]

Piñeiro Harnecker, C. (2020). Las cooperativas no agropecuarias y su contribución al desarrollo local. Propuesta de medidas para materializar sus potencialidades. Economía y Desarrollo, 164(2). https://revistas.uh.cu/econdesarrollo/article/view/1754 [ Links ]

Piorno Garcell, M., Mendoza Pérez, J. C., & Hechavarria Castillo, R. (2017). Dinámica jurídico-constitucional de las cooperativas en Cuba. Revista Jurídica Piélagus, 16(1), 47-64. https://doi.org/10.25054/16576799.1455 [ Links ]

Pittman, L. (2018). History of cooperatives in the United States: An overview. Center for Cooperatives. University of Wisconsin. https://resources.platform.coop/resources/history-of-cooperatives-in-the-united-states-an-overview/ [ Links ]

Rodríguez Musa, O., Hernández Aguilar, O., & Dueñas Bejerano, J. L. (2016). Un acercamiento al régimen tributario de las cooperativas no agropecuarias en Cuba. Propuestas para su perfeccionamiento. Boletín de la Asociación Internacional de Derecho Cooperativo, (50), 177-201. https://doi.org/10.18543/baidc-50-2016pp177-201 [ Links ]

Rojas, S. P. (2018). Contabilidad. Fundación Universitaria del Área Andina. https://digitk.areandina.edu.co/handle/areandina/1266 [ Links ]

Received: October 31, 2022; Accepted: June 19, 2023

texto en

texto en